Primary Products:

On this page

Summary

- Singapore’s economic growth is forecast to slow in the 2023 calendar year to between 0.5% to 2.5% (down from approximately 3.5% of GDP growth in 2022).

- While Singapore does not face an imminent threat of a recession, growth could be further dampened in 2023 if the US and EU enter a prolonged economic downturn and China’s re-opening is delayed.

- Singapore’s non-oil exports fell by a surprising 5.6% in October 2022, the first decline in two years. As a result, Singapore’s manufacturing sector is likely to contract during Q1/23.

- Weakness in manufacturing is likely to be offset in 2023 by services, including an ongoing strong recovery in air travel and tourism related sectors. Singapore also continues to see strong inflows of wealthy investors and investments – with the city state cementing its position during 2022 as the third largest global centre for foreign exchange trading.

- Inflation in Singapore remains high (headline was 6.7% in October 2022 / core was 5.1%) and is predicted to remain elevated during 2023 due to structural drivers including labour market tightness.

Report

Export sector struggling: winter comes early

Singapore’s non-oil exports have been falling since February 2022, with weakening demand from China being a key factor. In October, non-oil exports contracted by 5.6% (year on year). The fall was significantly larger than the 1.7% decline forecast by economists in a Bloomberg poll, and also reversed from the previous month's 3.1% growth, according to Enterprise Singapore data.

Weakening external demand is also putting pressure on the global electronics sector. This is being felt sharply in Singapore as the electronics sector represents the bulk of Singapore’s export-driven manufacturing sector. October saw a 45.7% drop in shipments of disk media products, with personal computer parts falling 31.6% and semiconductors or integrated circuits down 11.1%.

Looking forward to 2023, a protracted downturn in major global economies, geopolitical tensions, and delays in China’s re-opening, are downside risks to the order pipeline for Singapore’s manufacturing sector.

Services: bright spots

The aviation and hospitality sectors continue to benefit from the return of overseas visitors – both tourists and travellers attending meetings, incentives, conferences and exhibitions. This is apparent in Q3 growth of 6.8% (year-on-year) in the transport and storage sector. In Q3, the food and beverage sector saw robust growth of 30.5% (year-on-year), from a low base last year. Growth prospects for aviation and tourism related sectors during 2023 remain positive.

Labour market tightness and ongoing property price increases (home prices have increased by about 8% in the first nine months of 2022) mean that private consumption remains solid. The latest Monetary Authority of Singapore (MAS) Financial Stability Review has found that most Singaporean households will be able to fund their ongoing expenditures, including debt payments. However, with rising mortgage interest rates and growing cost pressures, some households are likely to face increasing financial stress and may encounter difficulties in servicing their mortgages.

Private wealth

There has been strong flows of private wealth moving to Singapore. Evidence of this uptick include a rapid growth in family offices - the number doubled from 350 to 700 between December 2020 and 2021. According to data analytics platform Handshakes, about 44% of new family offices have links to Greater China (as at April 2022).

The number of licensed and registered fund management firms in Singapore rose 15% to 1,108 between December 2020 and December 2021. Also of note is that the top five foreign buyers of private apartments in Singapore (Jan – Aug 22) were as follows: China (932), Malaysia (566), India (324), US (203) and Indonesia (194). Sales of luxury cars are also strong – with 87 Bentleys and 78 Rolls Royces registered in Singapore so far in 2022 (up 26% and 90% respectively compared to 2019).

Investment and FX Trading Centre

Other positive news includes Singapore cementing its position in 2022 as the third largest global FX centre. In October, the Monetary Authority of Singapore (MAS) announced that Singapore’s foreign exchange average daily trading volumes rose to US$929 billion in April 2022, up by 45% from April 2019. Singapore’s share of global FX volumes rose to 9.5% in April 2022, from 7.7% in April 2019. MAS also announced in October that total assets under management in Singapore rose 16% in 2021 to S$5.4 trillion, compared with a global increase of 12% to S$112 trillion last year.

Foreign investors in Singapore announced 142 projects worth $8.2 bn in the first half of 2022 (double that of Malaysia, the next best performing ASEAN country). In terms of financial technology related investment (FinTech), Singapore and Indonesia accounted for three-quarters of ASEAN’s total inward investment of US$4.3 billion (which is 7% of total global Fintech investment of US$63.5 billion in 2021, up from 2% in 2018). Out of the US$4.3 billion invested, Singapore secured US$1.8 billion.

Inflation: persistent

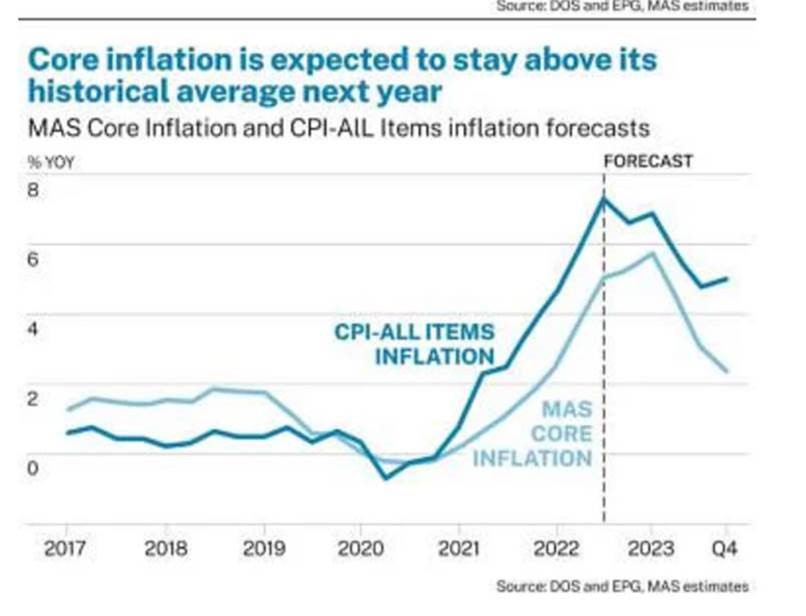

For 2022 as a whole, core inflation will average around 4% and headline inflation around 6%.

For 2023 as a whole, taking into account all factors (including the GST increase due in January), core inflation is forecast to average 3.5% to 4.5%. Headline inflation is projected to average 5.5% to 6.5%. Headline inflation was 6.7% in Oct 22 and core was 5.1%.

To control imported inflation, the Monetary Authority of Singapore (MAS) has tightened monetary policy five times since October 2021, allowing the Singapore dollar to appreciate against a basket of currencies. This makes imports cheaper and in turn limits price rises for goods and services. Nevertheless, inflation remains at its highest level in 14 years. The next scheduled meeting of MAS on monetary policy is April 2023.

A recent report released by the MAS, noted that Singapore’s manufacturing and transport services are heavily affected by sudden jumps in energy prices. For example, a 92% increase in global energy prices will push up costs in the manufacturing sector by 6 percentage points and those in the transport services sector by 13.2 percentage points.

On the impact of rising agriculture prices, the MAS report found that food-related sectors – food and beverage manufacturing, accommodation and food services – take the biggest hit. Another issue for the inflation outlook is the rise GST planned for January (from 7% to 8%). MAS have noted that this will cause core inflation to rise in Q1 2023, but its impact should be temporary.

To help cushion middle and lower income households against cost pressures, the government in mid-October released a S$1.5 billion support package (which included a $500 special cash payment for 2.5 million adult Singaporeans). This takes total government cost of living support during 2022 to S$8 billion.

Recession in Singapore?

Singapore avoided a technical recession (two straight quarters of negative GDP growth) during the third quarter of 2022. Modelling by the Ministry of Trade and Industry (MTI) includes a base-case scenario where the US will avoid a full-year recession, in which case gross domestic product (GDP) growth in Singapore is likely to come in at 3.5% for 2022 as a whole, and moderate in 2023 to 0.5% to 2.5%.

Comment

New Zealand exporters should take note of Singapore’s strong consumption patterns (this includes high end quality food and beverage products) and the ongoing growth of the investment and asset management market, including in areas relating to the digital economy. It is also important to be conscious of the ‘networking’ role that Singapore continues to play in the broader Asian region for people, capital and ideas. Singapore is working hard to deepen this network through amplifying its reputation as a trusted, transparent, and well governed hub for collaboration.

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) cover export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.