Food and Beverage, Creative and ICT:

On this page

Summary

- Eel meat grown in a lab. Blood-like substance derived from algae grown in a giant test-tube. Cattle herded by drones… Is this the future of farming?

- Israel identifies alternative proteins as the next tech sector to focus on, following successes in fin- and cyber-tech. Government agencies are taking an interdepartmental approach to supporting Israel’s efforts to become a global hub of food tech research & development (R&D) and production, while also helping the world achieve food security and emissions reductions. Opportunities exist for New Zealand to connect with counterparts across the Israeli agri-food innovation ecosystem.

- The New Zealand Embassy in Ankara, Türkiye, which is accredited to Israel, explored the Israeli food and ag-tech ecosystem in November during Israel’s AgriFood Week. Along with venture capitalists (VCs) and representatives of leading kiwi companies from the sector, the Embassy attended the tenth FoodTech IL 2022 and AgriVest 2022 as part of a delegation led by the Trans-Tasman Business Circle. We visited an agri-food incubator, FreshStart, in the North of Israel where we met with VCs, start-ups and government contacts.

Report

We outline below insights into the Israeli agri-food scene, with some background on the enabling environment for start-ups in Israel.

Israel’s integrated ecosystem for supporting start-ups

Earlier this year Tel Aviv/Jerusalem was listed along with Silicon Valley, New York, London and Colorado by the Global Start-up Ecosystem Report (GSER) as one of the top five destinations for its Agtech and New Food ecosystem. The tech economy in Israel is booming. Before COVID, venture capitalists were investing around US$8 billion in Israeli tech p.a. (2019). This figure tripled in 2021. 10% of the world’s “unicorns” are in Israel.

Time and again people we met highlighted the cultural and structural factors that have contributed to Israel’s success: Israelis celebrate success; there’s no stigma around ‘failing’; and theirs is a debating/questioning culture. Connected with that is an open-door approach which means you can reach out to anyone to test your ‘good idea’.

That ability to connect is supported by an integrated ecosystem, which brings together academia, venture capitalists, tech transfer offices, accelerators and incubators, MNCs, corporates, and the companies and start-ups operating in that sector. The Israeli Innovation Institute is a non-governmental organisation with specialist ‘communities’ promoting innovation in Space-tech, Planet-tech, Climate-tech, Agritech, Health-tech and Biotech. The Institute provides a useful interface with each tech sector and is interested in engaging with similar communities abroad.

Israeli government leans in to the riskiest, most ground-breaking ideas

The Israeli Innovation Authority (IIA) leads the government’s engagement in tech. This is one area where political consensus – including on the budget – is apparently easy to reach. The IIA sees its job as being the prime investor in the riskiest, most ground-breaking ideas; developing policy and the enabling environment; and developing regulations that will allow the sector to flourish.

AgTech in the Start-Up Nation

There are currently 650 ag-tech start-ups and companies operating in Israel. (See here(external link) for a detailed list of all start-ups by sector.) This includes 147 in farm robotics, mechanisation and drones; 59 in novel farming systems; 32 developing midstream technologies; 14 in agribusiness and marketplace; 97 in farm management, software, sensing and integration of IT; 87 in ag-biotech; 34 in innovative food (cultured meat, novel ingredients, plant based proteins); and 27 in bio-energy and biomaterials. Over 50 of these have gone through the IIA-supported incubator programme. 70% receive some kind of funding from the IIA.

The IIA has set its sights on Israel becoming the “global hub of food tech R&D and production for local and regional use, helping the world achieve food security and emissions reductions.” It projects a 56% food gap in 2050 based on global population growth reaching 10 billion and the impacts of climate change. The IIA is planning on food-tech being an essential ingredient in finding solutions to that challenge.

FoodTech focuses on scaling up

Priorities in the food-tech sector include alternatives to colouring, reducing sugar, reducing food waste, packaging solutions and alternative proteins. The focus across the industry and the subject of the conference was on how to scale up the innovation. The World Bank was at the AgriVest conference promoting its USD6 billion platform for supporting emerging technology that can strengthen food security in developing nations.

Alternative proteins – hype or really happening?

The alternative proteins sector includes plant-based substitutes for meat, dairy, and egg, cultivated (or ‘cultured’) dairy, meat and seafood made from cells, and various fermentation processes and products. Cultivated protein start-ups and fermentation tech start-ups often overlap.

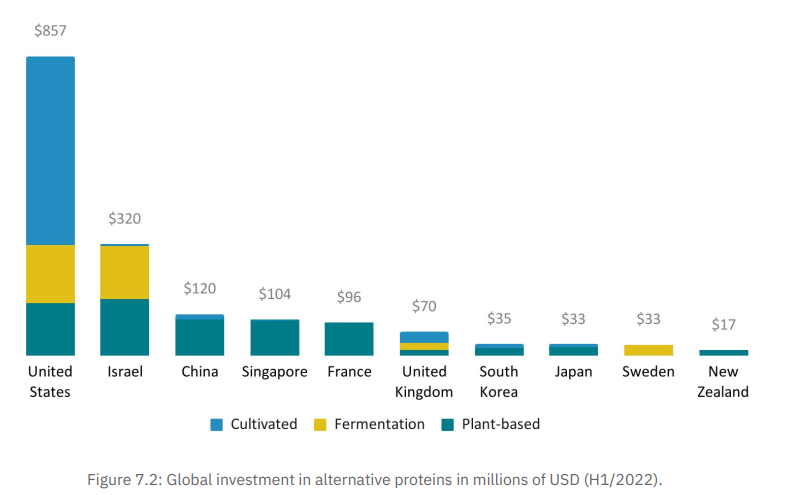

The global alternative protein sector attracted US$1.75 billion of investment in the first half of 2022, with US$320 million (18% of the global total) invested in Israeli start-ups and companies. Israeli companies are leading the world in food-tech investments in the plant-based alternative proteins sector, and come second only to the US in funds invested in the alternative protein industry as a whole.

Israeli alternative protein companies raised USD623 million in 2021[1]. The whole industry grew by about 450% in 2021 from the year prior.

[1] Israel State of Innovation Report 2022 - The Good Food Institute (gfi.org)(external link)

Examples of Israeli companies making a mark on food-tech

A range of companies presented their technology and end products at Israel’s AgriFood Week. Some examples of these are detailed below. (See the following for detail on all of Israel’s alternative protein start-ups:

Imagindairy’s dairy proteins are non-GMO, cholesterol-free, and claim to have the same flavour, texture, functionality, and nutritional value as their animal-based counterparts.

The alt-protein company creates animal-free milk proteins from microorganisms through fermentation technology. Their marketing strategy focuses on B2B sales – using their products as novel ingredients.

Ounje is a blood alternative derived from red algae grown in a patented photo-bioreactor. This can be used in cultured meat and restructured meat alternatives to give the look and feel of blood.

Forsea is making cell-cultured eel meat. Consumed in South Korea and Japan, eel meat attracts a high price. Investors in Forsea believe that at the outset it makes sense to work on different cell lines and animals which can attract a higher price point.

Cultured meats – cracking consumer preference, taste, texture and price point

There was much debate at the conference about the future of cultured meats. The IIA has identified cultured meats as the sub-sector with the “highest risk, highest potential and highest reward”. In accordance with its aim to invest in the riskiest tech, it is funding technologies in the early and growth stages, investing in a large-scale fermentation factory and supporting an inter-ministerial effort to keep production in Israel. The IIA is also working with health regulators to support consumer acceptance. The IIA forecasts that cultured meats will make up 40% of the meat market, worth USD 0.5 trillion.

Others consider that cultured meats will remain niche and the focus on alternative proteins will be in dairy alternatives, which will be quick to come to market.

All agreed that there were challenges to overcome in creating consumer acceptance of a processed food, that was expensive and not (yet) on par with animal meat in terms of taste and texture.

Representatives from the marketing community agreed that creating a new habit in a traditional segment was difficult. However, they also agreed there was a demand for change in the food industry, connected with concerns about climate change and linked to health and well-being. Those promoting alternative proteins pointed out that chicken was the most efficient meat, needing ‘nine calories in for one calorie out’. Cows required 40 calories to produce one, and that was without considering the energy needed for the rest of the production cycle.

The investment outlook – funding slowing off 2021, but climate funding on the increase

American alternative protein companies are a long way ahead with US$857 million in total investments so far in 2022. Cultivated protein start-ups are leading the charge.

Following a year of ‘cheap money’ in 2021, company valuations were said at the conference to be coming down to a more realistic level and investment in tech was expected to slow. However, commentators considered that high prices in agriculture brought on by the Ukraine war and associated grain crisis, combined with the close association of food-tech with climate-tech - where money was continuing to flow - would hold up demand for investment in food and agtech.

Opportunities for Aotearoa

New Zealand has already benefited from its links into the Israeli innovation ecosystem, where we have learnt a great deal from Israel’s incubator programme. A three year New Zealand pilot which ended in 2019 resulted in 45 start-ups, attracting investment of over NZD100 million. By the end of 2019, the top 12 of those start-ups had generated NZD7.1 million in sales.

The incubator programme teams up New Zealand innovators and entrepreneurs with international investors, who bring to the table funding, networks and know-how. Some of those also have strong connections with the Israeli ecosystem. Crop X is a good example of how Israeli and New Zealand world-leading scientists and tech experts have worked together on world-leading water conservation technology for efficient farming. Israeli company, BeeFree Agro, is currently looking to pilot drone-supported herd management in New Zealand and will attend Fieldays 2022.

The FreshStart incubator in Israel was keen to connect with international partners. Collaboration would be welcome, either in terms of content, pilots or even co-investment.

Final comment

The jury is arguably still out on where developments on alternative proteins will lead. Some are questioning a number of the assumptions put forward by the proponents of alt-proteins, including the global population reaching 10 billion. Others considered that improving efficiencies in the animal meat market would prevent alt-proteins from growing its market share. On the opposing side, some believed alt-proteins would disrupt the food sector, as EVs had disrupted the car industry.

Regardless of where you stand on the debate, Israel has got it right before and is now going all in with alt-proteins. It will be important that New Zealand understands and follows these trends closely.

Useful information on investment in agtech and foodtech, including on the Asia-Pacific, can be found at Agfunder.com(external link)

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) cover export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.