Food and Beverage:

On this page

The story of New Zealand pet food exports to China has been an exciting one of boom and decline over the past 10 years, with a positive outlook for the next chapter as we seek to double exports. New Zealand pet food exports to China grew rapidly from almost nothing in 2016 to NZ$134.3 million by the year ending June 2023, before declining to NZ$64.2 million in the year ending June 2025, with New Zealand’s super premium products hit hard by changing and weak consumption trends post COVID, by rising domestic and international competition, supply disruption, and more recently by trade barriers. Exporters have responded in a variety of ways, including further specialisation into health and nutritional pet food and introducing more affordable value options to broaden demand. With China’s pet sector anticipated to expand, the outlook for New Zealand pet food exports is positive, and monthly trade data from the past six months shows a strong recovery trend not yet reflected in annualised data.

Overview

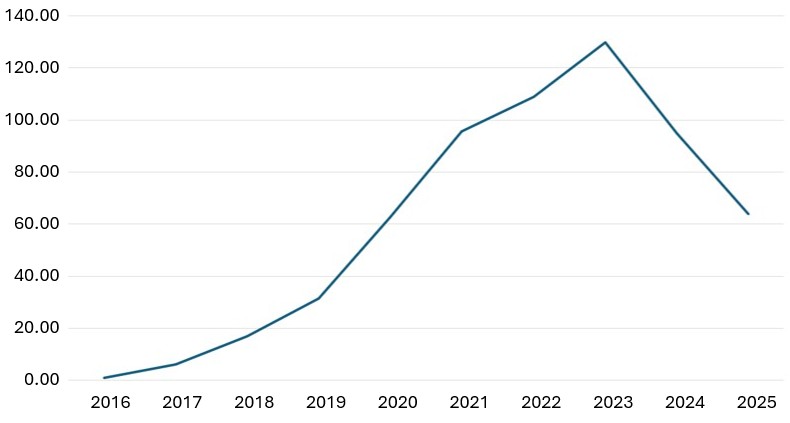

New Zealand’s pet food exports to China have had a dramatic last few years. Growing from almost nothing in 2016 to a peak of NZ$134.3 million in the year ending June 2023, exports fell sharply to NZ$64.2 million in year ending June 2025 (see Figure 1). The past four months have seen pet food exports rise month on month, however, so a recovery appears to be under way (see Figure 5).

Figure 1: New Zealand pet food exports to China 2016–2025,

NZ$ millions, year ending June

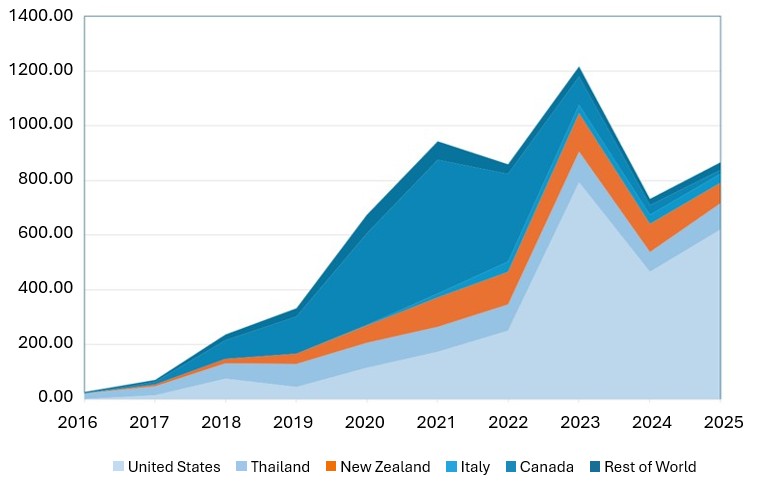

The New Zealand experience largely mirrored China’s overall imports of pet food, which increased from $27.9 million in year ending June 2016 to a peak of $1.2 billion in year ending June 2023, dropped to $732.9 million in 2024, and then recovered to $867.2 million in the past year (see Figures 2 and 3). China is the world’s third largest pet food market globally, behind the United States (US) and Brazil, and has one of the world’s largest pet populations – some 2025 estimates stand at over 100 million cats and 80 million dogs.

Figure 2: China pet food imports, percentage share by source country, NZ$ millions, year ending June

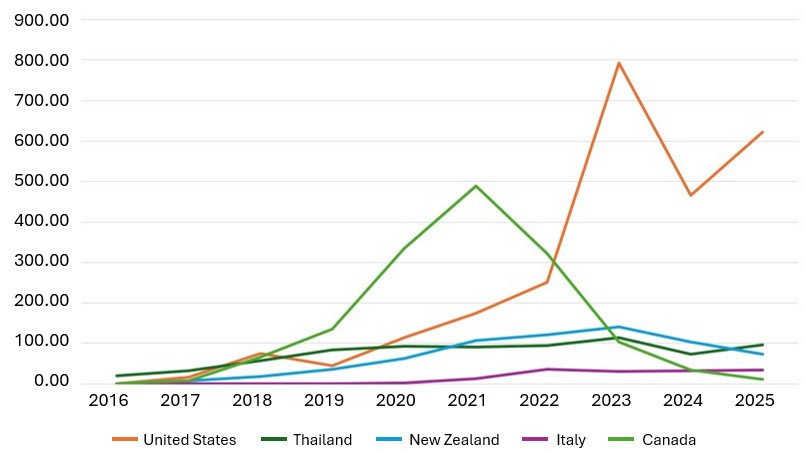

Figure 3: China pet food imports by top five source countries, NZ$ millions, year ending June

There have been massive shifts in where China imports pet food from: most of the 2018–2021 growth came from Canada, reaching nearly 52% market share, before declining rapidly to 8% by 2023 as China banned Canadian pet food containing poultry ingredients in February 2022 due to avian influenza outbreaks (see Figure 3). Pet food from the US then replaced Canadian as part of the 2020 US-China Phase One Economic and Trade Agreement, which saw China lifting restrictions on US pet food containing avian ingredients. As a result, US market share rose rapidly from around 18% in 2021 to over 70% by 2025. During the same period New Zealand pet food made up around 11-14% of total Chinese pet food imports, before easing to 8% by year ending June 2025.

Figure 4: China pet food imports 2021–2025, percentage share by source country, year ending June

| Source Country | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|

| United States | 13.7% | 17.0% | 18.4% | 29.2% | 65.2% | 63.5% | 71.7% |

| Thailand | 25.4% | 13.7% | 9.7% | 11.0% | 9.3% | 10.1% | 11.1% |

| New Zealand | 11.0% | 9.3% | 11.4% | 14.0% | 11.5% | 14.1% | 8.4% |

| Italy | 0.2% | 0.5% | 1.4% | 4.2% | 2.5% | 4.4% | 4.0% |

| Canada | 40.7% | 49.7% | 51.7% | 37.5% | 8.5% | 4.6% | 1.4% |

| Rest of world | 8.9% | 9.9% | 7.3% | 4.1% | 2.9% | 3.3% | 3.5% |

Source: Global Trade Atlas

Why have exports dipped?

China’s total imports of pet food dipped 2023-2024, affecting all major suppliers including New Zealand, driven by:

- Domestic competition: China’s domestic pet food manufacturing increased rapidly, driving down reliance on imports. In 2024 domestic pet food production increased 9.3%, and increasingly shifted into higher value categories (for example, high meat or seafood content product), replacing foreign brands. E-commerce platforms like JD.com and Tmall made domestic brands more accessible; and

- Consumption changes: After the pandemic (China lifted restrictions early 2023), consumption patterns shifted resulting in a temporary consumption decline, especially for imported goods, as households became more cost conscious. This also affected pet food and remains a challenge. New Zealand’s super-premium positioning has made our pet food particularly vulnerable to these changes (New Zealand’s export unit price is much higher than the rest of the world, at US$12.9 per kg, compared to Thailand at US$3.1 and the US at US$2.9 per kg).

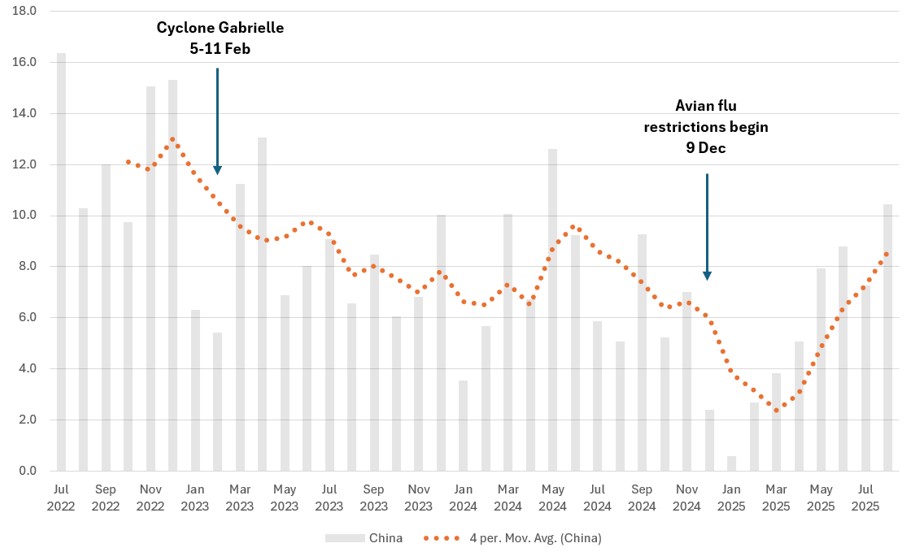

In 2023, some New Zealand petfood exporters also experienced supply-side disruption caused by Cyclone Gabrielle impacting Hawke's Bay production, with effects lasting for months.

Figure 3 shows that, since then, pet food imports from the US increased sharply in the year to June 2025, even as imports from other countries remained flat. This suggests that demand is picking up again in China despite domestic competition remaining strong and consumption subdued.

Despite New Zealand petfood exports also picking up slightly in mid-2024, New Zealand pet food exports experienced a further shock in December 2024 as China banned non-retorted New Zealand pet food products containing avian ingredients. The impact varied by exporter but affected between 30% and 95% of individual exporters’ product to China. Exporters responded by substituting non-avian ingredients, or shifting product to other markets, but pet food exports to China will remain affected until access is restored. MPI is working closely with counterparts in China and with New Zealand industry to achieve this.

Figure 5: New Zealand pet food exports to China, NZ$ millions, monthly

How are companies responding?

New Zealand pet food exporters exhibiting at Pet Fair Asia in August 2025 were subdued but optimistic. The Chinese pet industry remains huge and there is still strong demand for New Zealand’s premium pet food and pet food ingredients.

In the face of rising domestic and foreign competition (as others received market access), New Zealand exporters have responded in a number of ways:

- Premiumisation: Some exporters have moved into even higher premium categories, as Chinese pet owners are paying more attention to pets’ dietary health and seek nutritional and functional foods, especially as the first big wave of Chinese pets age. Various New Zealand exporters are working with New Zealand universities to prove functional claims.

- Broadening appeal: Others have gone the opposite direction and introduced cheaper product offerings to expand downward into value segments. Most exporters are harnessing livestreaming and “Key Opinion Leaders” (KOLs) to reach increasingly savvy customers.

- Focusing on what we’re good at: An increasing number of New Zealand pet food companies are focusing on ‘OEM’-model (Original Equipment Manufacturer) production for Chinese and foreign brands rather than trying to build/maintain their own brands in China (China’s digital marketing landscape is complex and costly). New Zealand’s quality ingredients, trusted processing, and tariff advantage into China makes OEM an especially lucrative proposition.

- Business model optimisation: A number of exporters have rationalised their ways of doing business in China to capture value and increase profitability, including changing distribution models or re-shaping in-market teams.

Outlook

At its core, New Zealand’s pet food value proposition in China remains solid. Chinese customers demand our high-quality ingredients and premium, natural, health-focused pet food, as well as high food safety standards. Even as domestic and foreign brands encroach, the Chinese pet food market is forecast to continue to expand and so opportunity remains strong. New Zealand continues to have a visible and prominent presence at Pet Fair Asia (supported by co-investment from NZTE). The challenge is having the marketing nous to stay ahead of the game in China. As pet food becomes commoditised and competitors are making the same quality and health claims, New Zealand producers have to become even more focused on niche areas, such as functional benefits. They also have to be able to compete with Chinese producers who are really fast at inventing new niches and exploiting these intensely before moving on.

Even though the US overtook China as New Zealand’s largest pet food export market in 2024, at its lowest point since peak China still took 20% of New Zealand’s total pet food exports and will remain an important market. Exporters will be looking to develop both markets at the same time, in fact many New Zealand exhibitors at Pet Fair Asia had arrived into Shanghai from Superzoo Pet Care Expo in Las Vegas. MPI’s June 2025 Situation and Outlook for Primary Industries (SOPI) Report forecasts 10% growth in total New Zealand pet food export revenues in 2025/26, despite lacklustre recent performance.

The past two years have been tough for New Zealand pet food exporters in China and their investors – as profits have been squeezed by demand changes and high production costs. Nevertheless investor interest remains high.

Comment

New Zealand pet food exporters in Shanghai remain generally positive about the state of the Chinese pet food market, particularly the strength of “Brand NZ” and NZTE’s support to the sector over a number of years (NZTE has focused on pet food for a number of years as a promising, value-added growth opportunity for New Zealand’s agriculture sector). Government support has been important given that the pet food sector (like others) sees the China market as complex, challenging, and competitive.

Pet food makes up less than 0.5% of New Zealand’s total goods exports to China, compared with another “hero” category like kiwifruit at 6.7%, and with dairy at almost 50%. It is a small but important value-added component in New Zealand’s China exports. The pet food sector in China is forecast for continued growth and there is a space for premium New Zealand products to grow modestly within that to contribute towards the goal of doubling export value.

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.govt.nz

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.

Copyright

Crown copyright ©. Website copyright statement is licensed under the Creative Commons Attribution 4.0 International licence(external link). In essence, you are free to copy, distribute and adapt the work, as long as you attribute the work to the Crown and abide by the other licence terms.