Supply Chains:

Summary

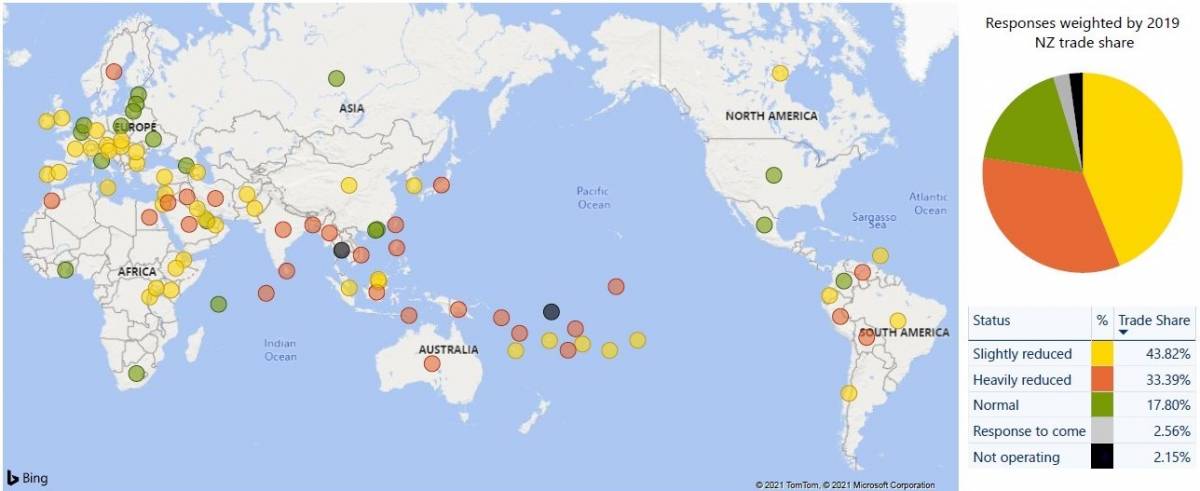

- To ensure New Zealand’s global supply chain connections continue to function during the COVID-19 pandemic, MFAT’s network of Posts and the Trade Recovery Unit are monitoring the operation of New Zealand’s global sea and air freight connectivity. This report provides a snapshot of how global supply chains are functioning offshore, significant international initiatives affecting supply chains, and other issues of interest to New Zealand exporters and importers.

- To provide feedback or information relevant to this report – please contact exports@mfat.net

Report

International Developments: Disruptions and Changes Observed

- China and South East Asia: Our Posts and freight forwarders have reported substantial congestion on shipping routes from China and South East Asia due to the COVID-19 outbreak at Yantian Port in Shenzhen, China. Disruptions are at a level that has surpassed the Suez Canal blockage in March. Although the congestion has eased in recent weeks, Maersk reports that the port’s yard density is at 60%, with vessel omissions continuing and delays of upwards of four days. Singapore and Port Klang in Malaysia are also experiencing prolonged delays in their transhipment services, from 10 to 30 days. These delays have limited the availability of import bookings from Europe to New Zealand, though some carriers are providing alternative routes via the Panama Canal.

- South Asia: Indian Railways reported a 21% decrease in rail freight traffic over the first quarter of 2020-21 due to COVID-19 lockdowns and sluggish economic activity. Trucks were again permitted to cross from India to Bangladesh at the Petrapole land port, subject to compliance with specific health and sanitary standards, after a 75 days’ closure. Meanwhile, the Indian Government has prevented shipping lines and other actors in maritime supply chains from collecting special demurrage charges mandated by specific contractual clauses that come into effect in the event of a lockdown.

- Ireland: The New Zealand Embassy in Dublin has noted that the combined effects of the COVID-19 pandemic and the United Kingdom’s departure from the European Union have strained Irish supply chains, with road and port congestion delaying food imports and the delivery of raw materials to the manufacturing sector.

- Middle East: The New Zealand Embassy in Ankara reports that Türkiye has reopened its land borders with Iraq and Iran, thereby reconnecting the nation to its major overland transit routes to Central Asia.

- Central America: The Central American Integration System (SICA) is seeking to resolve a dispute between Costa Rica, Nicaragua, Honduras and Panama caused by each country’s imposition of COVID-19 testing requirements for all incoming truck drivers.

International Developments: Policy Announcements

International air cargo volumes hit a record high in March with the underlying drivers of air cargo demand remaining strong.

International Air Transport Association (IATA)

- Asia-Pacific Economic Cooperation: At the APEC Ministers Responsible for Trade meeting on 5 June, chaired by New Zealand Minister for Trade and Export Growth Hon. Damien O’Connor, Ministers agreed through a Joint Statement(external link) to ease the movement of COVID-19 vaccines and related medical equipment across the borders of APEC economies, and to prioritise work to identify, and subsequently consider removing, unnecessary barriers to trade in services, particularly those services that expedite and facilitate the flow of essential goods.

- United States: The United States Congress recently passed the Innovation and Competition Act which establishes a ‘supply chain resilience and crisis response’ programme within the U.S. Department of Commerce tasked with “address(ing) supply chain gaps and vulnerabilities in critical industries”.

- In addition, the White House on June 8 released a ‘Building Resilient Supply Chains, Revitalising American Manufacturing, and Fostering Broad Based Growth’(external link) report, mandated by a February Presidential Executive Order that authorised a review into the United States’ supply chains for semiconductors, large capacity batteries, critical minerals/materials and pharmaceuticals. The report emphasises the need for the United States to strengthen relevant manufacturing and innovation capabilities, and to coordinate with its allies and partners to reduce vulnerabilities in supply chains.

- Australia: The Australian Government has committed A$98.8 million over four years to the establishment of an Office of Supply Chain Resilience in its 2021-22 Budget(external link). The new Office will support the Government’s objective of bolstering Australian supply chain resilience and sovereign capability.

- Singapore: The Emerging Stronger Taskforce (EST), a taskforce of public and private sector representatives created by the Singaporean Government in May 2020, released the findings(external link) of its investigation into the effects of global trends triggered by COVID-19 on Singapore. Among the major international shifts that the EST identified was that a greater emphasis on economic resilience and diversification is causing a reconfiguration of global supply chains and production.

- Germany: The German Bundestag has passed the 'Corporate Due Diligence in Supply Chains Act', a new law that requires German companies and some German subsidiaries of foreign companies to ensure that certain human rights standards are maintained across their supply chains. The law, which comes into effect in 2023, requires German companies to practise effective risk management and due diligence in maintaining these standards across their supply chains, with their compliance being monitored by German government agencies. (More information on this development is available in this report: German supply chain due diligence legislation and New Zealand suppliers).

Availability of Air Freight

Functionality of Air Ports and Availability of Air Freight

- World air freight traffic grew by 4.4% in March 2021 (compared to March 2019) according to the International Civil Aviation Organisation. Although still experiencing growth, the Asia-Pacific region experienced a ‘noticeable slowdown’ in its rate of freight traffic expansion over this period.

- The International Air Transport Association (IATA) reports that international air cargo volumes hit a record high in March. Airlines have sought to minimise the financial toll of the effects of COVID-19 on commercial air travel by converting passenger planes into cargo aircraft. IATA expects this pivot to remain in force for the medium-term, noting that commercial air passenger numbers are not expected to recover until 2024 and that the “underlying drivers of air cargo demand remain strong”.

- Several airlines have announced they will be operating new routes out of Auckland. China Airlines is adding new flights bound for Taipei to its weekly schedule, Air Calin will fly cargo-only flights from Auckland to Noumea, Vanuatu Airlines will operate increased cargo flights to Noumea and Port Vila. Additionally American Airlines will use Auckland and Christchurch as stopovers on its Sydney-Los Angeles route.

- Air freight costs between New Zealand and South Korea have decreased as air connectivity improves between the two countries. Despite this improvement, air freight costs are currently twice as high as pre-COVID-19 levels (though not as high as the same time in 2020, where they were between two and five times higher than pre-pandemic levels). South Korea-New Zealand air freight costs remain lower than costs for transporting air freight between South Korea and the United States of America.

Availability of Sea Freight

- Sea-Intelligence Global has reported that global shipping schedules were 40.4% reliable in March this year, an improvement from 34.9% in January.

- Kotahi and Maersk have collaborated with the Port of Tauranga to expand freight capacity for services connecting Latin America to North Asia via Tauranga. Maersk is increasing its services to the South Island also, primarily to transport empty containers.

- Sea freight rates for routes between Northern Europe and China have trebled or quadrupled in recent months. A scarcity of shipping containers and a strong European demand for Asian goods are driving these increases.

- According to the Panama Canal Administrator, the number of ships that transited through the Canal in May 2021 was 21% lower than projected.

- Ferry traffic originating from France and Spain is being redirected from regular ports of arrival in southern England to other English ports. A backlog in non-essential imports, such as clothing and electronics, is causing logistical log-jams, while warehousing space remains severely limited.

- Low water levels on the Paraná and Paraguay rivers has meant that barges carrying soybeans have been able to transport only 70% of their standard capacity, thereby delaying transhipment from the Paraguayan market to the rest of the world.

More reports

View full list of market reports.

If you would like to request a topic for reporting please email exports@mfat.net

To contact our Export Helpdesk

- Email: exports@mfat.net

- Phone: 0800 824 605

- Visit Tradebarriers.govt.nz(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.