Food and Beverage, Manufacturing (excludes F&B):

On this page

Prepared by: New Zealand Embassy, Seoul

Summary

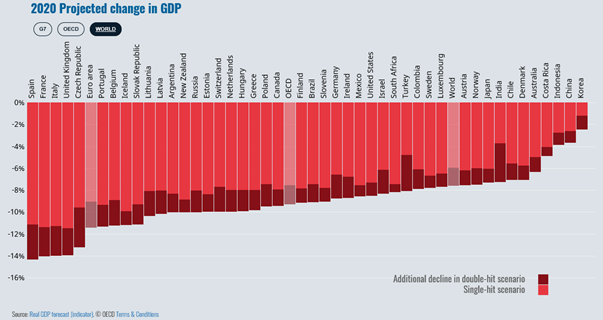

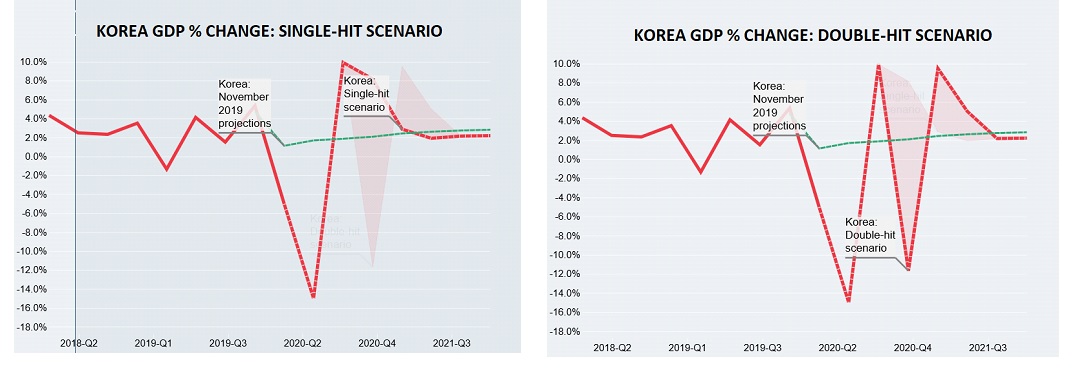

According to latest forecasts, Korea will be the least affected economy in the OECD: Korea’s economy is expected to contract by only 1.2% - 2.5% while the global economy is expected to contract by 6% - 7.6%.

Korea’s GDP growth is expected to bottom out and bounce back in the second quarter of 2020 if a second wave of COVID-19 can be avoided.

A newspaper survey indicates that online demand for food products surged (meat: +233.7%, dairy: +152.5%, fruit: +150.9%) during the first 100 days of COVID-19 in Korea.

COVID-19 has accelerated online demand in Korea for Home Meal Replacements (HMRs), health supplements, and organic/locally grown produce.

Manufacturers of industrial equipment report no negative impact on sales.

Online sales of petfood in the first half of 2020 increased by around 10% whereas offline in-door retail sales decreased 30%.

Education: New Zealand’s successful response to COVID-19 has strengthened perceptions in Korea of it as a favourable study destination but there remain concerns about border restrictions.

Tourism operators in Korea continue to report record losses.

67% of respondents to a survey indicated having plans to travel domestically between now and the end of 2020 whereas only 7.8% of respondents had plans to travel overseas.

Report/findings

We provide a further update on the impact of COVID-19 on New Zealand businesses exporting to and operating in South Korea. We will continue to provide such updates every 2 weeks.

Korea to be least affected economy in the OECD

The OECD’s Economic Outlook(external link) in June 2020 forecasts that Korea will be the OECD economy least affected by COVID-19. In single-hit (where global economic output falls 6%) and double-hit scenarios (i.e. second wave scenario, where global economic output falls 7.6%), the Korean economy is projected to contract by only 1.2% and 2.5% respectively (see graph below, with Korea farthest right):

Online consumption during first 100 days of COVID-19

The Joongang Daily (Korean newspaper) surveyed online consumer spending during the first 100 days after the outbreak of COVID-19 in Korea (1 Feb – 11 May). Compared with the same period last year, the results highlight the following trends:

Korean consumers purchased more of the following products online:

|

|

But the average amount spent per transaction dropped for these items:

- Meat: KRW34,754 (NZD44.40) to KRW16,480 (NZD21)

- Dairy: KW24,293 (NZD31.00) to KW18,156 (NZD23.20)

- Fruit: KW17,195 (NZD21.97) to KW15,721 (NZD20.00)

Korean consumers purchased more of the following products online:

|

|

Food and beverage (F&B) market trends

Natural Week, a company that organizes F&B fairs and expos in Korea, has released a Korean-language report highlighting the following key trends in the F&B sector:

- Rise of the Home Meal Replacement (HMR): The HMR market in Korea has grown by an average of 10-20% over the last five years. The image of HMR products in Korea has evolved over this period from an “instant meal” to “balanced nutritious dining”, considered to be the 4th generation of the HMR market. A large part of this image shift has been due to the increased incorporation of agricultural ingredients into HMR products (rising by 13.4-29.3% over the last five years), such as grains, meats, vegetables and fruits.

- Strong demand for health supplements: Demand for health supplements has remained strong in Korea, and the sector grew by 19.6% in Q1 2020 vis-à-vis the same period last year. “Health supplement” continues to be one of the most searched words in Korea’s web browsers.

- Growing awareness of food safety: Demand for organic/environmentally friendly and locally grown food products in Korea has been strengthened by COVID-19. Research undertaken by McKinsey and Company suggests that 72% of the Korean population is highly concerned about food safety and 63% will continue to purchase environmentally friendly products post-COVID-19.

Manufacturers of industrial equipment

New Zealand manufacturers of industrial equipment report that there has been no negative impact on sales in Korea from COVID-19. Challenges of delivery delays due to the lockdown in New Zealand and subsequent suspension of production April – May have been overcome. Manufacturers expect sales to be stable in 2021, driven by strong demand from existing customers (i.e. government departments and large corporates).

Petfood exporters

New Zealand petfood exporters report that online sales in Korea increased by around 10% whereas offline sales decreased 30% in the first half of 2020. Indoor retail sales of petfood products in Korea have been slow due to reduced foot traffic in pet stores and vet clinics. In-store promotions have also been less effective than normal.

Evolving education landscape

The phased re-opening of schools in Korea, which started on 20 May, was completed on 8 June and almost all students are now attending classes, either physically in classrooms or online, though not every day. Schools began offering online classes in April, and have continued to use them as a way to maintain a reduced number of students in physical classrooms to mitigate the spread of COVID-19.

Having experienced both the advantages and disadvantages of online learning, Korean teachers and education experts seem convinced that online learning cannot entirely replace the effectiveness of traditional education in classrooms. Rather than replacing the traditional classroom, remote learning is expected to accelerate the transition from to hybrid-learning (i.e. offline/online).

Opportunities in the education sector

The New Zealand government’s successful response to COVID-19 has strengthened the perception of New Zealand as a favourable study destination in Korea. There do, however, remain concerns about New Zealand’s prolonged border restrictions.

Despite the uncertainty, New Zealand education providers have been encouraged by Education New Zealand to put their efforts towards maintaining interest from prospective international students through regular contact with local education agency partners and the sharing of positive news stories about New Zealand in Korea. For instance, alumni stories of Korean graduates have been highly sought-after in Korea. Education New Zealand recommend that messages targeting the school sector focus on high quality education and safety while messages targeting tertiary education focus on the benefits of employment in New Zealand.

According to latest Immigration New Zealand statistics, there were 2,846 Korean students in New Zealand in May 2020, compared to 3,539 in June 2019. Currently 269 Korean students outside New Zealand hold a student visa for New Zealand.

International air links

Korean Air has announced the extension of flight suspensions from Seoul to Auckland, Sydney and Brisbane until the end of August.

Announcements in Guam, Vietnam and some European countries (Czech Republic, Greece, and Spain) suggest that the removal of border restrictions against Korea could start as early as this month (i.e. June). Despite this, little movement has been seen in the travel industry that would suggest a resuscitation of international tourism.

Korean Air and Asiana Airlines have extended their unpaid leave schemes for foreign pilots until July, and this could be extended further.

Tourism: More losses and unpaid leave

Tourism operators continue to report record losses. The two largest wholesale travel providers in Korea, Hana Tour and Mode Tour, will record losses of KRW27.5 billion (NZD35.4 million) and KRW15.5 billion (NZD14.8 million) in Q2 2020 respectively. Yellow Balloon Tour, the third largest group of travel agents in Korea, intends to roll out an unpaid leave scheme from July onwards for all employees.

A survey conducted by Korean market research company NICE D&R on consumer travel intentions for the remainder of 2020 showed:

- 75% of respondents plan on travelling between now and the end of 2020;

- 67% of respondents plan to travel domestically; and

- 7.8% of respondents plan to travel overseas;

- 25% of respondents do not plan to travel anywhere due to COVID-19.

A survey conducted by the World Travel and Tourism Council (an international forum for the travel and tourism industry headquartered in London) suggests that, globally, within the next 3 months, 28% of tourism operators face permanent closure, and within the next 6 months, 46% of tourism operators face permanent closure. COVID-19 could result in around 100 million job losses in the international travel and tourism industry.

Tourism New Zealand expects that domestic travel within Korea and New Zealand will continue to play a large role in helping tourism operators weather the storm as they shift operations and marketing strategies to cater to domestic consumers in the short to medium term.

To contact our Export Helpdesk

- Email exports@mfat.net

- Call 0800 824 605

- Visit Tradebarriers.govt.nz(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.