Food and Beverage, Primary Products, Manufacturing (excludes F&B), Sustainability:

On this page

Summary

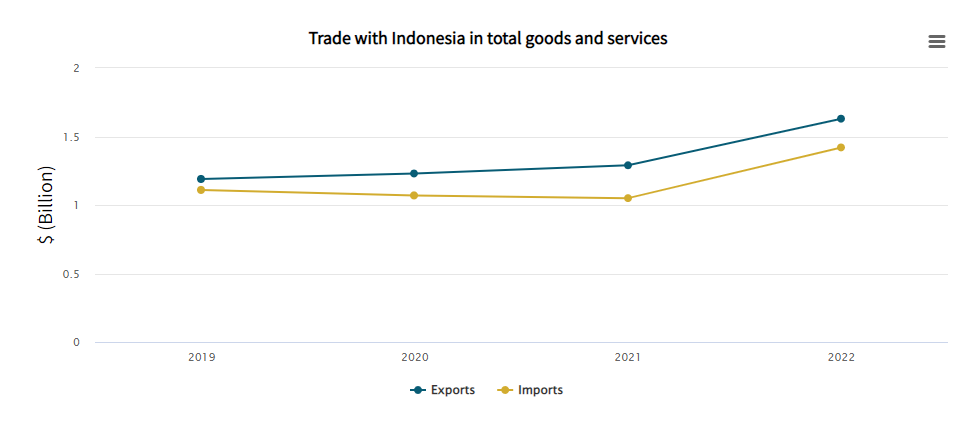

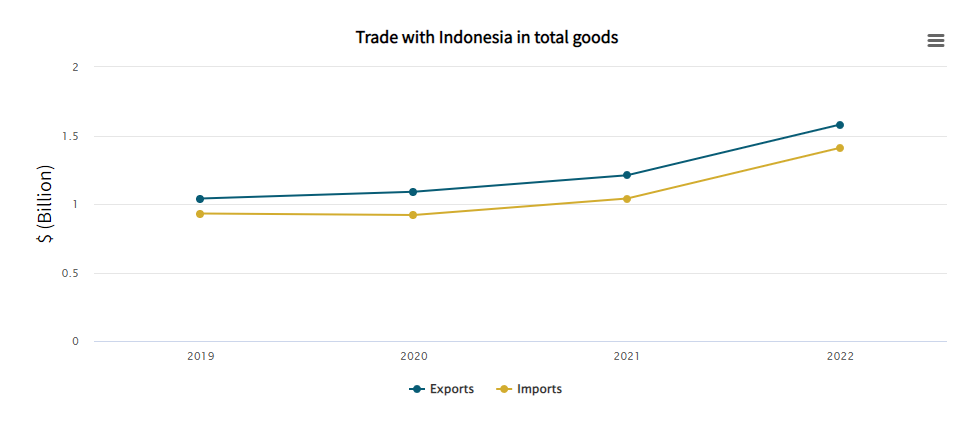

- In the year ended June 2022, New Zealand exported NZ$1.63 billion of total goods and services to Indonesia and imported NZ$1.42 billion, representing a trade surplus of NZ$204.54 million and a total trade value of NZ$3.05 billion. For trade in total goods and services, Indonesia ranked 9th for export value and 12th for total trade value.

- The majority (97%) of New Zealand’s total exports to Indonesia are goods exports. Despite the increase in agricultural goods exports, the regulatory environment in Indonesia remains complex and the exact details of the new Commodity Balance/import license system has yet to be disseminated. Indonesia is New Zealand’s 7th largest goods export destination, but ranked 23rd for trade in services highest export value.

- Some New Zealand businesses in Indonesia are experiencing delays in the delivery of goods caused by the impact of the global supply chain disruption, and price increment of raw materials resulting from the high United States Dollar currency rate compared to the Indonesian Rupiah. New Zealand businesses in the renewable energy sector are securing projects and participating in tenders with existing local geothermal developers.

- Indonesia's trade balance in September 2022 hit a surplus of US$4.99 billion. This means that Indonesia's trade balance has experienced a surplus for 29 consecutive months as Indonesia's economic recovery continues.

- The Regional Comprehensive Economic Partnership (RCEP) Agreement will enter into force for the Republic of Indonesia on 2 January 2023.

Report

Bilateral Trade Statistics

- In the year ended June 2022 New Zealand exported $1.63 billion (up 20.9% from the same period last year) of total goods and services to Indonesia and imported $1.42 billion (up 26.1%), representing a trade surplus of $204.54 million and a total trade value of $3.05 billion (up 23.3%). For trade in total goods and services, Indonesia ranked 9th for highest export value and 12th for highest total trade value.

- This increase was supported by the continued growth of agricultural goods exports and the positive trend in food services in Indonesia. New Zealand exported $1.58 billion (up 23.4% from the year ended June 2021) of total goods to Indonesia and imported $1.41 billion (up 26.2%), representing a trade surplus of $168.22 million and a total trade value of $2.99 billion (up 24.7%). For total trade in goods, Indonesia maintains its position as New Zealand’s 7th largest goods export destination (no change from last year). The top five goods exports to Indonesia by product are: dairy; wood pulp and recovered paper/paperboard; albuminoids, starches and glues; meat and edible offal; and food wastes. The top five goods imports from Indonesia by product are food wastes; miscellaneous provisions; wood; electrical machinery and equipment; and paper products.

- While the trend has been positive for goods export to Indonesia, trade in services (including tourism, business and education related travels) continued to decline due to border closures. In the year ended June 2022 New Zealand exported $50.06 million of total services to Indonesia (down 48.2%) and imported $13.74 million (up 2.8%) representing a total trade value of $36.32 million. For total trade in services, Indonesia ranked 23rd for highest export value.

- In October 2022, Aotearoa New Zealand Education Minister, Honourable Chris Hipkins, made his first official visit to Indonesia. He was accompanied by a delegation of representatives from New Zealand’s education sector. The official visit reflects how important Indonesia is for New Zealand’s international education sector. In 2021, Indonesia was the 10th largest market for New Zealand with 722 international student enrolments for New Zealand across all subsectors. Minister Hipkins’ visit to Indonesia aims to increase the education links between Indonesia and New Zealand through exploring further cooperation opportunities in the fields of Higher Education and Vocational Training.

Navigating the complex regulatory environment

- Despite the increase in agricultural goods exports, the regulatory environment in Indonesia remains challenging, with Presidential Regulation 32/2022 on Commodity Balances appearing likely to add further complexity. This regulation sets up a new system for importers to gain import licenses and empowers the government to prohibit importation unless domestic supply is calculated to be insufficient to meet projected demand.

- While we have been advised that the new import license system will provide a clearer pathway for exporters, it seems likely in the short run that there may be teething issues around the implementation of the new system. The exact details of the new Commodity Balance/import license system has yet to be disseminated.

- The Indonesian Ministry of Agriculture Regulation 15/2021(external link) on the Business and Product Standards for Risk-based Business Licensing Administration in the Agriculture Sector, which came into force on 1 April 2021, has seen increased enforcement by the Ministry of Agriculture since September 2022. This regulation includes new registration, labelling and traceability provisions for imported fresh animal products. Under this regulation, a Certificate of Analysis (CoA) for these products will be need to be issued by an accredited laboratory every six months.

- Separately, under the ‘Increased Use of Domestic Production’ (P3DN) strategy, there are also regulations that set out the obligation to use domestic products in goods and services procured by government institutions and state-owned, regionally owned, and private enterprises, where the project finance is from the state or regional budgets, if there are domestic products that have a summation value of the Domestic Component Level (TKDN) plus the Company Utilization Point Rating (BMP) of at least 40% (forty percent). The obligation to use domestic products is required during procurement planning, procurement reparation, and providers selection stages. Procurement of imported goods may be conducted where: 1) the goods cannot be produced domestically; or domestic production volume is not able to meet the requirements.

- Recently, the Government has increased the domestic component level for pharmaceutical products and medical devices. The local content requirement for the pharmaceutical sector would differ for each stage of the manufacturing and development process. The overall local content requirement for raw materials is expected to be a minimum 50%, with active ingredients making up 65% of that and additional ingredients 35%. For research and development, the overall local content is expected to be a minimum 30%, consisting of 25% for the research and development stage, 30% for the trial stage, 35% for the formulation stage and 10% for bioavailability/bioequivalence. For the production process, the overall local content is expected to be a minimum 15%, consisting of 60% for the formulation stage and 40% for the dosage formulation stage. And finally, for the packaging process the overall local content is expected to be a minimum 5%, consisting of 50% for batch release, 40% for primary packaging and 10% for secondary packaging.

- Even though the policy of increasing the use of domestic component levels affects only government procurement, this may significantly limit the import of goods such as in the healthcare sector due to the large share of government or state-owned health facilities both in Jakarta (more than half) and elsewhere in Indonesia.

How are businesses in Indonesia faring? – Insights from NZTE

- Food and beverage (F&B) businesses (especially food service) in Indonesia continue to increase market share. However, disruption to global supply chain has resulted in NZTE’s F&B customers experiencing delays in the delivery of goods, with particular impact on fresh produce.

- In the renewable energy sector, the Government of Indonesia (GoI) is encouraging businesses to commit to achieving Net Zero Emission by 2060, which was a focus of the Indonesian G20 Presidency (Transition towards Sustainable Energy). GoI strategies to achieve Net Zero Emission target include gradual retirement of Coal-Fired Power Plants, acceleration of new renewable energy (especially solar and wind power), development of smart grid, and creating electricity demand through encouraging electric vehicle and electric stove usage. For geothermal, the GoI maintains the implementation of programmes to reduce development risks such as government drilling and geothermal funding programs (i.e. geothermal sector infrastructure financing fund (PISP), and Geothermal Resource Risk Mitigation (GREM(external link))). New Zealand businesses are coming back to Indonesia after the COVID-19 lock down to conduct business, including participating in events and market visits. New Zealand businesses are securing projects and participating in tenders with existing local geothermal developers either for existing capacity or for additional capacity.

- There was considerable interest from New Zealand aviation businesses toward Indonesia’s market prior to the COVID-19 pandemic; however, the majority of them reduced their international market efforts due to the impacts of the pandemic on the global aviation industry. New Zealand aviation businesses that provide services to the New Zealand fast moving consumer goods/services industry have maintained their international market efforts with conscientious business approaches. New Zealand’s flight schools were impacted heavily due to the border closure but following the border reopening, the schools are able to welcome international students back to New Zealand. The flight schools are also working towards re-orientating their international business-to-business (B2B) approaches. The Indonesian aviation sector is still in early stages of recovery from the impacts of the COVID-19 pandemic.

- Indonesia’s manufacturing industries, especially in food, beverage, and pharmaceutical manufacturing are experiencing a reduction in profit margins due to the incremental increase in the price of raw materials. The price of raw materials, which are influenced by the current global economic disruption and the rising cost of fuel prices, significantly affects the manufacturing industry as majority of the raw materials are imported. In addition, Indonesian manufacturing industry buyers are experiencing increased cost on New Zealand products as a result of the low currency exchange rate of the Indonesian Rupiah compared to the United States Dollar. This condition creates a tendency for local businesses to place more consideration on their capital (CapEx) expenditure spending where New Zealand manufacturing products might form a part of the Indonesian business buyers’ CapEx (and possibly leading to reduced spending for international manufacturing products, in general).

- New Zealand businesses in the building sector, which includes engineering and technology services as well as machineries and equipment, are maintaining their business efforts in Indonesia through their channel partners or company presence in Indonesia. Indonesia’s building industry is currently experiencing a building oversupply due to massive building project developments initiated before COVID-19 impacted by the reduction in demand for office space, in part caused by a continuation of hybrid working and online business practices.

Indonesia’s Trade Balance

- Indonesia’s trade balance in September 2022 hit a surplus of US$4.99 billion. This means that Indonesia's trade balance has experienced a surplus for 29 consecutive months as Indonesia's economic recovery continues, and possibly strengthens. Cumulatively, Indonesia's trade balance surplus from January to September 2022 reached US$39.86 billion, which was much higher than the peak of the commodity period in 2011 when it amounted to US$22.2 billion.

- Indonesia’s imports value was recorded at US$19.81 billion in September 2022 (up 22.01% compared with September 2021). Indonesia’s total imports from January to September 2022 increased by US$40.27 billion (28.93%) over the same period last year. The rise was driven by increased imports of oil and gas by US$13.82 billion (80.21%), and non-oil and gas by US$26.45 billion (21.68%). The top three non-oil and gas imports were mechanical machinery/mechanical appliances and parts thereof (15.63%), electrical machinery/equipments and parts thereof (13.47%), and iron and steel (7.15%). The three largest suppliers of imported non-oil and gas goods from January to September 2022 were China with US$50.29 billion (33.88% share), Japan with US$12.65 billion (8.52%), and Thailand with US$8.52 billion (5.74%). From January to September 2022, the share of total imports by broad economy categories are split into intermediate goods (77.14%), capital goods (14.73%) and consumption goods (8.13%).

- Indonesia’s exports in September 2022 grew by 20.28% to USD 24.80 billion compared to September 2021. From January to September 2022, Indonesia’s exports increased by 33.49% to US$ 219.35 billion compared with the same period in 2021. Manufacturing products (71.20%) account for the largest share of Indonesia’s total exports, followed by mining and others products (21.68%), oil and gas (5.54%), and agriculture, forestry and fishery products (1.58%). The top three non-oil and gas exports from January to September by commodities group are mineral fuels (19.25%), animal or vegetable fats and oils (12.65%), and iron and steel (10.07%). During the same period, Indonesia’s main non-oil and gas exports destination were China (21.83% share), United States (10.6%), India (8.64%), and Japan (8.31%).

Indonesia’s Trade Negotiations/Agreements (where New Zealand is also a member of) update

- On 13 November 2022, negotiations have substantially concluded for the ASEAN-Australia-New Zealand FTA Upgrade. The agreement will open doors for our exporters across goods, services and investment, and shows our commitment to our relationship with our regional partners.

- On 4 November, the ASEAN Secretariat transmitted the notification of the deposit of Indonesia’s Instrument of Ratification for the Regional Comprehensive Economic Partnership (RCEP) Agreement. The RCEP Agreement will enter into force for the Republic of Indonesia on 2 January 2023.

- On 12 September 2022, Indonesia’s Coordinating Minister for Economic Affairs, Airlangga Hartarto, announced Indonesia’s participation in all four policy pillars (trade, supply chains, clean economy, and fair economy) of the Indo-Pacific Economic Framework (IPEF) initiative at the IPEF Ministerial Meeting in Los Angeles. The negotiations will be led by the Coordinating Ministry for Economic Affairs, and supported by the Ministry of Foreign Affairs.

External links

- The following links may provide useful information to businesses:

- Omnibus Law on Job Creation Regulations - https://uu-ciptakerja.go.id/(external link)

- Positive Investment List Regulation - https://peraturan.bpk.go.id/Home/Details/161806/perpres-no-10-tahun-2021(external link)

- Online Single Submission (OSS) system - https://oss.go.id/(external link)

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) cover export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.