Supply Chains, Primary Products, Services:

On this page

Rāpopoto: Summary

- New Zealand's two-way trade increased 8% to $163.6 billion for the year ended December 2021, comprising $77.2 billion in exports, and $85.4 billion in imports, leading to a trade deficit of $8.2 billion.

- New Zealand’s total exports declined by 1% for the year ended December 2021, with strong growth in goods exports (up 6% to $63.3 b), offset by a 25% decline in services exports to $13.9 billion. Goods exports are now well above pre-COVID levels in 2019, with increasing export prices (particularly commodities) being the main driver for higher export revenues.

- Goods imports increased by 22% ($12 billion) to $66.1 billion and are now 8% higher than pre-COVID. This strong increase in imports has been driven by solid domestic consumer demand and business investment.

- On-going supply chain issues have also led to rising prices for imports. On top of high global inflation, the cost of transporting goods to New Zealand doubled in the year to December 2021. This has filtered through to annual tradables CPI inflation, which rose to 6.9% in December 2021.

- New Zealand’s international trade in services has been severely impacted by border settings. Services exports fell a further 25% in 2021, and are now 49% lower than pre-COVID 2019 levels. Unsurprisingly, New Zealand’s two largest pre-COVID services exports—tourism and international education—fell a combined 51% in 2021 to $4.2 billion.

- China was the largest source of New Zealand’s export growth in 2021, with goods exports to China growing 21% in the calendar year, driven by dairy, meat, and forestry exports. The global economic recovery and the loosening of COVID-19 restrictions in countries such as the EU, the US, has also contributed to growth in goods exports.

- While the headline figures for good exports are positive, this does mask some significant declines in certain sectors where labour shortages, supply chain issues and the inability to travel to market have had an impact.

Pūrongo: Report

This report looks at New Zealand’s goods and services trade performance for the 2021 calendar year, following the release of international trade data for the December 2021 quarter (released 3 March 2022). As well as examining 2021’s trade data, itprovides comments on the year ahead for New Zealand trade as most countries (including New Zealand) begin to unwind restrictions and open up.

New Zealand's two-way trade rose 8% to $163.6 billion in 2021, comprising $77.2 billion in exports, and $85.4 billion in imports. Despite this growth, two-way trade still remains 6% lower than in 2019, primarily due to ongoing weakness in services trade. Total exports declined by 1% during the year, as services exports (totalling $13.9 billion) fell to almost half their value in 2019. However, goods exports have shown strong growth from pre-COVID levels, up 6% from 2019, to $63.3 billion. In contrast, total imports rose 19% to $85.4 billion, with both goods up 22% (to $66.2 billion) and services up 11% (to $19.3 billion) respectively, compared with 2020. This led to an overall trade deficit of $8.2 billion in 2021.

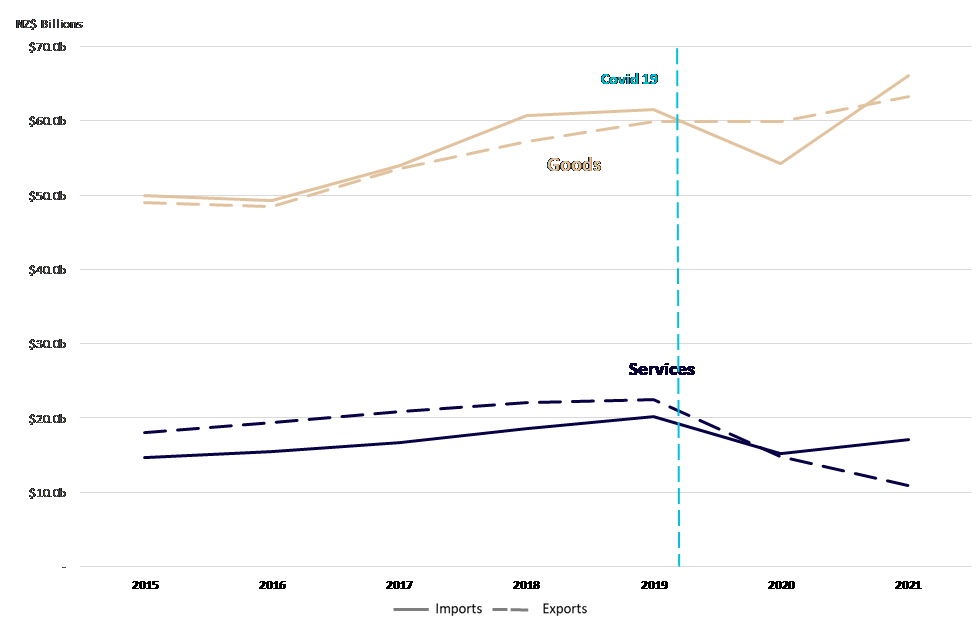

Figure 1: New Zealand’s year end imports and exports

New Zealand’s goods exports grew by 6% in 2021, reaching $63.3 billion. Goods exports are now well above 2019’s pre-COVID levels, with higher export prices for dairy, meat and wood the main drivers, particularly in the second half of this year. Average export prices were up 22% from the same time last year, with aggregate export volumes relatively unchanged.

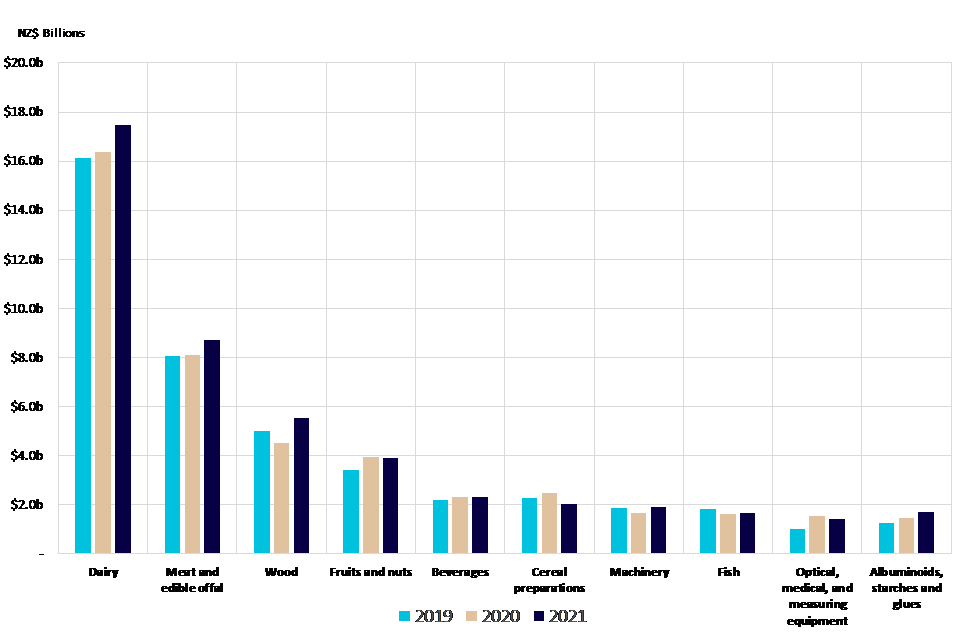

The usual suspects continued to perform well over 2021, with dairy (up 7%), meat (up 8%), wood (up 22%), machinery (up 15%), and fish (up 4%) all experiencing increases in overall trade value over 2021. Alongside generally strong commodity prices (particularly for meat and dairy in the last half of 2021), strengthening global demand and a softening of the NZD delivered strong growth in many key export sectors.

Figure 2: New Zealand's top 10 annual good exports

However, favourable conditions have not been enjoyed by all export sectors. Labour shortages contributed to a challenging year for the horticulture sector with exports down $35 million from 2020 levels to $3.9 billion, particularly for apples, avocadoes, and stone fruits. The wine sector also experienced a $60 million drop in exports compared to 2020 driven by a small harvest. Softening demand from China linked to the slowdown in China’s construction sector contributed to a fall in log exports, with a 9% reduction in the December quarter.

Looking ahead, conditions for goods exporters are more mixed

Dairy prices are exceptionally strong, reflected in the Global Dairy Trade price index now at the highest level since April 2013. This will result in strong export earnings for Dairy processors with farmers set to receive record pay-outs for the current season.

However, costs of production have also continued to go up for all sectors through 2021, with high inflation, competing wage increases, and short-term labour shortages, acting to squeeze business margins. And although goods export revenues are overall up this may reflect differing outcomes at an individual business level, with our feedback form the export community indicating that smaller export businesses are finding the international environment (particularly disruption to supply chains) much more challenging to overcome that New Zealand’s major commodity exporters.

Despite ongoing supply chain issues, imports are well above pre-COVID levels

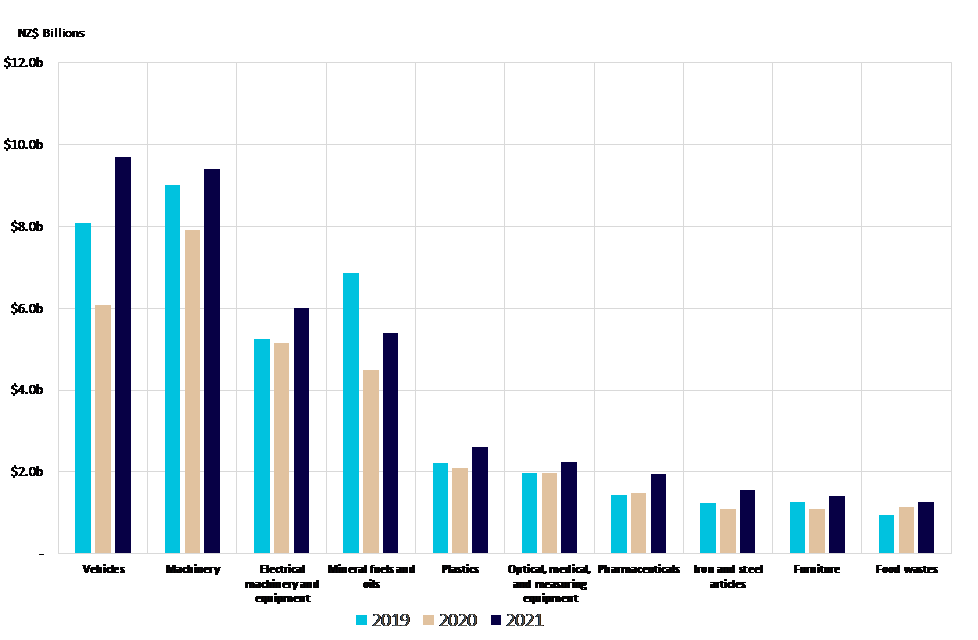

Goods imports increased by 22% in 2021 to $66.1 billion. Despite ongoing supply chain issues, goods imports are 8% higher than pre-COVID levels. This reflects solid domestic consumer demand, with imports such as furniture (up 10%), toys and games (up 27%), and clothing apparel (70%) all increasing.

Figure 3: New Zealand's top 10 annual good imports

A recovery in business investment also supported demand for capital goods, including electrical and mechanical machinery. Anecdotally, as labour shortages have put pressure on production capacity, some businesses have looked to deepen their capital investment by importing technology to ease the burden that has come from lack of staff.

However, there are signs that global inflationary pressures are beginning to weigh on businesses and consumers…

Unprecedented amounts of monetary and fiscal stimulus have been poured into the global economy to buffer the economic impacts of the pandemic and lockdowns. Increased consumer demand combined with international supply chain problems has now seen inflationary pressures appear globally.

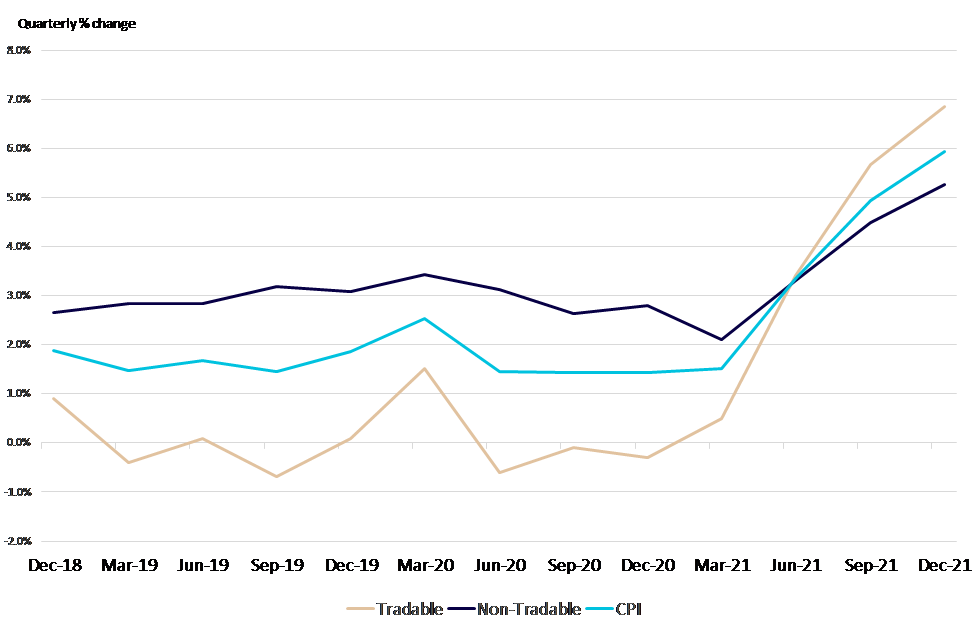

The cost of transporting goods to New Zealand doubled in the year to December 2021. This has also filtered through to annual tradables CPI inflation (Tradables inflation is that part of inflation most determined by international prices), which rose to 6.9% in December 2021.

These pressures are now beginning to impact the domestic economy with New’ Zealand's Consumer Price Index (CPI) rising to 5.9%, well above central bank’s target of 2%. As prices rise at a rapid rate, this may reduce household’s purchasing power and could have a softening effect on future household demand for domestic and imported goods.

Figure 4: New Zealand tradable and non-tradable inflation (annual)

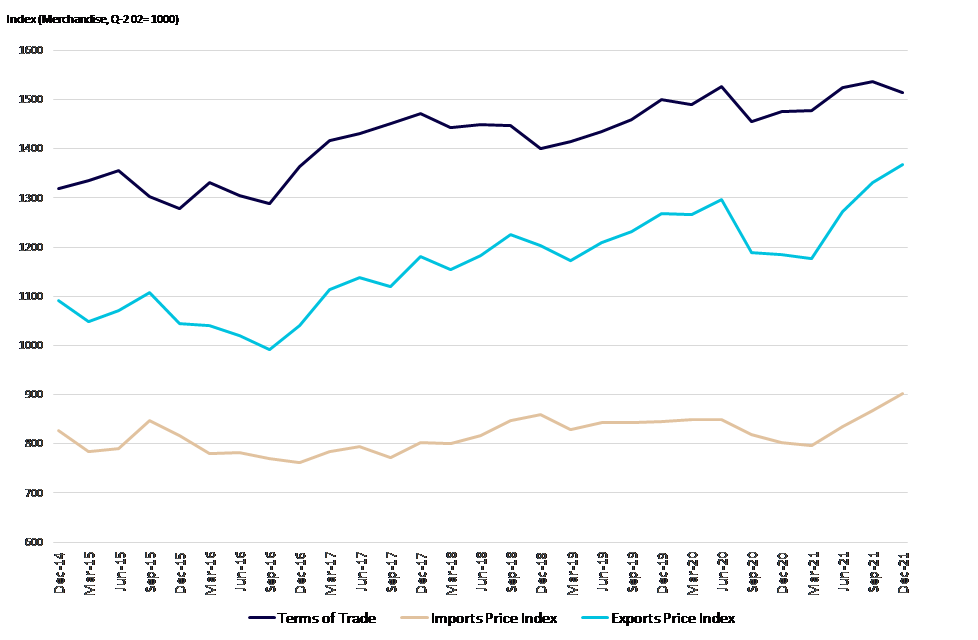

These price affects have resulted in a deterioration in New Zealand’s goods terms of trade. Although New Zealand’s’ export prices have performed well (up 2.7% in the December quarter), import prices (up 3.8%) have increased at a faster rate. This has resulted in a 1% fall in New Zealand’s goods terms of trade.

Figure 5: Terms of Trade, Import and Export price indexes (Quarterly)

New Zealand’s bilateral trade exposure to the Russian economy is relatively low. Russia was New Zealand’s 32nd largest export partner in 2021, with goods exports totalling $240 million (0.4% of New Zealand’s total). Dairy exports (mostly butter) made up almost half of these, with apples, seafood, wine, and medical equipment the only other exports of any significance. Trade with Ukraine is negligible, with exports totalling $24 million (mainly seafood and dairy).

Nevertheless there could be notable indirect effects for New Zealand, driven by Russia’s importance in key global commodity markets, such as oil and wheat. Prices for both commodities have spiked in the aftermath of the conflict – wheat and oil prices have increased by 40% and 52% respectively over the past month. In the short term this will translate through to the New Zealand economy via higher imported fuel and commodity prices. Longer term the pivotal role of energy and food in the global economy and may mean that any extended conflict could also weigh on global economic activity.

See MFAT’s market intelligence report for a more detailed assessment of the likely economic impacts.

Services export and imports continue to underperform due to border restrictions

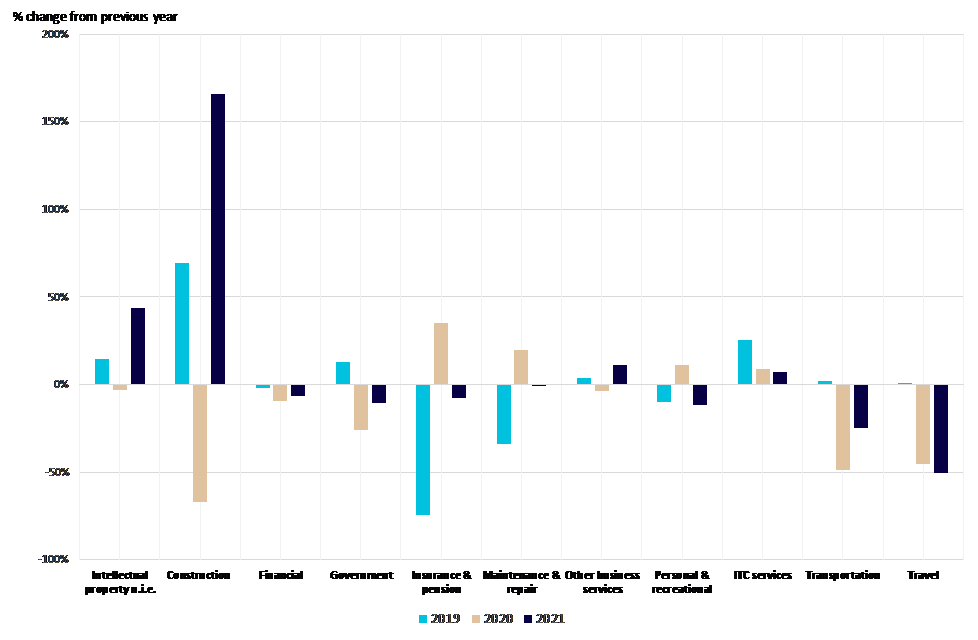

New Zealand’s international trade in services has been severely impacted by border settings. Services exports fell a further 25% in 2021, and are now 49% lower than pre-COVID 2019 levels. By contrast, services imports increased by 11% from 2020 levels to $19.3 billion, driven mainly by higher transportation costs.

Figure 6: New Zealand change in services exports (annual)

Unsurprisingly, New Zealand’s two largest pre-COVID services exports—tourism and international education—fell a combined 51% in 2021 to $4.2 billion. Revenue from international education was down around 30% from pre-COVID levels ($3.1 billion) as some students from abroad continue to reside and study within New Zealand. However, personal travel was still only a fraction of pre-COVID levels, with revenue of $1.0 billion derived mainly from New Zealanders normally resident overseas who returned for visits as well as a limited number of tourists, including those that visited during the short-lived Trans-Tasman travel bubble mid-year.

Other services exports have held up well through the last two years of the pandemic, with computer and information services (up $217 million) and intellectual property (up $377 million), showing more resilience to border and lockdown restrictions given the more digitally integrated nature of these sectors.

… but this year will (hopefully) mark a turning point for services trade with the lifting of border restrictions

The recent announcement of a phased border opening through till October 2022 will likely be a turning point for services exports - particularly for travel services. However, it’s unclear how much global appetite, and how quickly international tourism to New Zealand, will recover. Global inflationary pressures are likely to weigh heavily on household purchasing power and could reduce expenditure on non-essential items such as travel. Furthermore, consumers risk appetites are likely to have changed in light of the pandemic, making long haul tourism potentially less appealing. Finally, it will take some time for passenger air routes to be fully restored (if, indeed, they ever return to pre-COVID capacity).

China remains the key growth market for our international trade…

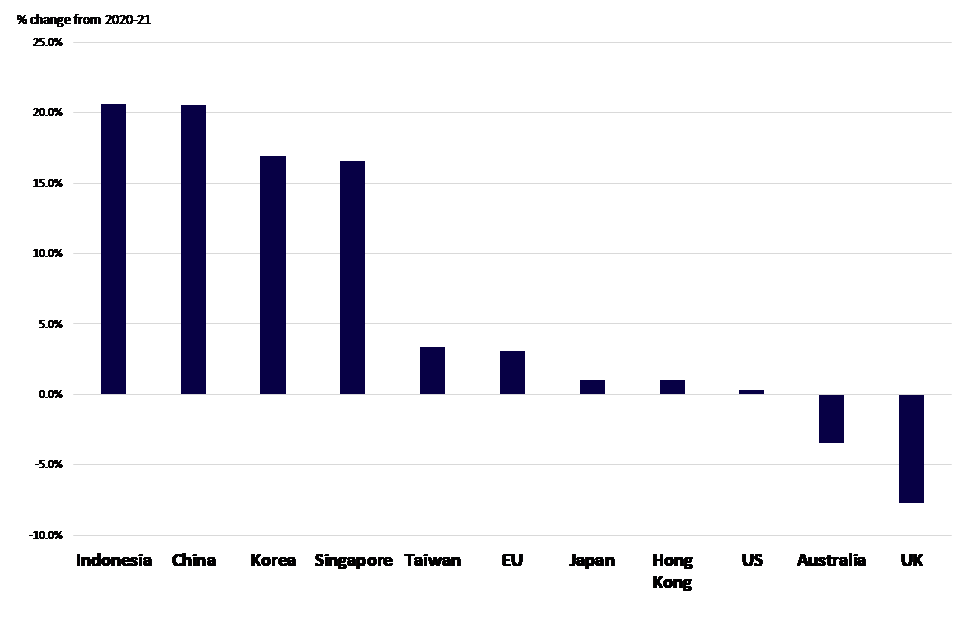

Two way trade across almost all of New Zealand’s top 10 markets grew in 2021. However, China continues to be a vital economic market for New Zealand, with goods exports up 21% ($3.4 billion) from 2020 levels, driven by strong growth in dairy (up 31%), meat (up 25%) and wood (up 35%). China’s increasing importance is also reflected in market share, now taking 32% of all New Zealand goods exports.

Figure 7: New Zealand good exports by market (annual)

However, the momentum to Chinese economic growth is slowing The EIU is forecasting China’s GDP to slow from 8.1% in 2021 to 5.2% in 2022 and further to 5% in 2023. This will likely have downstream implications for New Zealand exporters (already being felt by logs) as softness in demand from the Chinese economy flows through to demand for New Zealand commodities. However, with the economic recovery and the loosening of COVID-19 restrictions occurring in other countries such as the EU, the US, South Korea, and Singapore there may be potential for these markets to pick some of the slack that may result from a slowing Chinese economy.

The signing of the UK-NZ FTA opens up more opportunities for New Zealand businesses

While two-way trade with the United Kingdom is still 8% below pre-COVID 19 levels (largely due to the absence of travel exports), the recent signing of the FTA will further open up access to New Zealand exporters across goods, such as wine, apples, seafood, dairy, and meat. The signing of this agreement brings total New Zealand two-way trade under FTA coverage to 65% with a further 13% still under negotiation (via FTA’s underway with the EU and GCC). The largest remaining market we don’t have a free trade agreement with is the US, making up 11% of two-way trade.

Tākupu - Comment

New Zealand’s goods trade has, by and large, fared relatively well through the pandemic. On the export side, this has been largely the result of strong performance by our larger commodity exports. However, the aggregate story has masked weaker performance in other areas, which have particularly felt the burden of supply chain issues and restricted ability to travel. Imports dipped initially in the pandemic but have since grown strongly, even despite the massive increase in transport costs and the related shipping delays and disruptions.

Services trade was severely hit by travel restrictions through 2020 and 2021. The easing of travel restrictions this year should mark the start of the sector’s recovery.

2022 should have been shaping up as a year of strong recovery across the board, notwithstanding some serious challenges to overcome such as rising inflation, ongoing supply chain issues, and any new surprises COVID brings. Most goods export sectors were in healthy shape at the start of the year, with good prospects ahead. Those in less healthy shape could look forward to easing travel restrictions as an opportunity to start restoring lost overseas business connectivity. Travel services exports are finally in a position to start planning a future.

… But then Russia invaded Ukraine. MFAT’s market intelligence report looks at the economic impacts in more detail. But at the very least, this year will be marked by high commodity prices and even more pressure on inflation, financial market turmoil, and weaker global economic growth. How much this dampens the ongoing economic recovery remains to be seen.

More reports

View full list of market reports.

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page.(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.