Supply Chains, Primary Products, Services:

On this page

Summary

- New Caledonia is a small, island economy in the South Pacific to the northwest of New Zealand. Geographically it is New Zealand’s closest Pacific neighbour. But its Melanesian heritage and status as a French overseas territory make it a very distinct - and complex - market.

- It has a strong industrial base centred around mining and refining nickel. New Caledonia represents 25% of global nickel reserves and its three refineries account for 90,000 tonnes of refined nickel per annum.

- New Zealand trade has historically been concentrated on food and beverage (dairy, meat and fruit) as well as wood products and machinery. New Caledonia is wealthy and developed compared to other Pacific markets with a GDP of US$10 billion and a population of 270,000.

- There is some interest in doing more with New Zealand. But the territory’s high regulatory complexity, strong preference for French products and standards, and language barrier are sizeable challenges, particularly for consumer goods. New Zealand commercial presence in the market is limited. Beca is one of the few New Zealand companies with a physical presence in market.

- Opportunities for New Zealand include continued growth in certain niche food and beverage as well as manufactured goods exports (particularly in the marine sector), as well as partnering through technology and expertise to support a number of New Caledonia’s economic priorities. These include workplace training; developing local indigenous capability (particularly through connections with Māori providers); and capitalising on a major planned programme of investment in new renewable energy generation – including hydrogen.

Report

Population

New Caledonia’s population is approximately 270,000 people. There are three distinct ethnic and cultural communities. The indigenous Melanesian (Kanak) people comprise approximately 40 percent of the population. The local Francophone European community comprises a further 30 percent. This is comprised of a mix of descendants of multigenerational French settlers and more recent expats from metropolitan France. There is also a sizeable Polynesian community from the nearby French territory of Wallis and Futuna, and a small Asian diaspora, notably Vietnamese.

The majority of the population is concentrated in the south of the Island in the greater Noumea area. Noumea is a wealthy and well developed city which is the epicentre of economic activity across all sectors, including the location of New Caledonia’s largest nickel refinery – SLN, which represents approximately 50% of total output.

Outside Noumea, population centres are generally small, dispersed and agricultural, as well as a number of indigenous tribal settlements.

Politics

New Caledonia’s political system is complex, with jurisdiction for different economic policy areas spread between three layers of government. These include:

- France: responsibility for foreign affairs, defence, law and order, the judicial system, as well as currency stability and large scale fiscal subsidisation of industry

- New Caledonian Congress (which forms the executive central government): responsibility for tax, border settings etc

- Provincial governments: responsibility for economic development initiatives.

The current government has placed more focus on regional economic integration with Pacific partners, primarily Melanesia, but to a lesser extent also New Zealand as a way to diversify the local economy.

Economy

New Caledonia’s GDP is approximately US$10 billion. In per capita terms, Noumea is wealthy, and infrastructure is well developed to a level similar to New Zealand.

Nickel refining is the primary industrial sector and source of export revenue. But the territory is also heavily underpinned by large fiscal subsidies from France. The local currency (French Pacific Franc) is underwritten by the Bank of France and effectively pegged to the euro, ensuring price stability and liquidity. The economy is dominated by thirteen mainly local family-owned holding companies as well as some major French companies (Engie, Total, Renault, Vergnet etc). French supermarkets including Casino, Carrefour – all of which are heavily stocked with French brands – are often owned by those holding companies.

Nickel

The nickel industry is a leading New Caledonian economic sector. It is made up of several small mining companies (approximately 30-40 mines) and three large mining-refining companies: SLN (Eramet), KNS (Glencore) and Prony Resources (locally owned).

The oldest and largest is SLN, which accounts for around 50% of New Caledonia’s total output. Based in Noumea, it is owned by a mix of Metropolitan French, New Caledonian, and Japanese interests. Ore is shipped to the refinery from mines around the country.

The other 50% of New Caledonia’s output is divided roughly equally among the two other companies: KNS and Prony. KNS is located in the north of the island adjacent to its own mine and co-owned by the local province as well as Swiss mining company, Glencore. It has significant debt (approximately US$10 billion). Glencore has recently stepped up its oversight with a more assertive management approach to the facility to improve output – but there are challenges with cultural and linguistic application of the new regime.

Prony resources. Located in the south of the island, this was formerly owned by Brazilian mining giant Vale. Vale has now sold out of its stake and the company has been restructured into a new shared ownership model between the local provincial government, Swiss and indigenous community interests. Prony now boasts the best financial position of the industry being entirely debt free.

A fourth player is planning to enter the market: Queensland Pacific Metals is an Australian mining company proposing to establish a new refining facility in Townsville, Queensland. The company hopes to construct its refinery by 2024 and import ore from New Caledonia for refining using a carbon neutral method powered by Australian surplus gas that is currently flared.

Refining nickel is energy intensive. Each refinery uses approximately 100-200MW of power – nearly all from fossil fuels. Replacing these with renewable energy is a common priority. Given nickel’s importance as an input to electric vehicles and other battery technology, all refiners are keen to be able to build the ‘green’ credentials of their product.

NZTE customer Beca works closely with a number of the refineries on their capital projects. There are also a number of New Caledonian businesses that work in the maintenance sector. These are represented by a ‘cluster’ body known as AMD. New Caledonian nickel refining companies have expressed interest in working more closely with New Zealand companies on supplying machinery, equipment and training services – in particular for their planned renewable energy investments. AMD also expressed interest in professional skills training for their workforces.

Energy

New Caledonia’s energy mix is approximately 40% renewable generation (solar, wind, and hydro, see previous reporting on this subject). This is enough to service most of the residential/ public grid. The three nickel refineries however account for around 70% of New Caledonia’s energy use (approximately 500-600MW collectively). The vast majority of this is generated by fossil fuels. The New Caledonian government is expecting a major European Union backed investment (50m euros) in new renewable generation capacity. This will be delivered through a mix of projects, including solar, wind, hydro and hydrogen.

There are a number of French energy companies present in New Caledonia, including Total, Engie and Vergnet, which will be well-placed to deliver most of these projects. But New Caledonia’s current member of government responsible for energy – Christopher Gyges – is keen to work with New Zealand suppliers and partners. His office confirmed they would like to host a Pacific Project Series Webinar on New Caledonia’s renewable energy investment programme.

Trade dynamics and supply chain issues

Prior to COVID, New Zealand trade with New Caledonia had been relatively static. Two way trade was NZ$246m in YT March 2020 – a difference of only -1% compared to 2015. The trade balance has historically been strongly in NZ’s favour, with exports to New Caledonia outweighing imports by a factor of 10 ($209m in export vs $37m in imports) in 2020.

Travel Services (Tourism) have traditionally accounted for a large portion of the trade, so COVID has had a significant impact. Similar to New Zealand’s other Pacific markets, two-way trade has fallen by 46% relative to pre-COVID. Although NZ exports to New Caledonia have fallen by more in absolute terms (dropping by $80m from $209m in March 2020 to $129m in March 2022), this equates a fall of 38%. So, in proportional terms, New Caledonia’s trade to New Zealand has suffered a greater impact, dropping by 89% from $37m in 2020 to only $4m in the year to March 2022.

Like many Pacific economies, New Caledonia’s high import dependency and small market size mean that freight forwarders, shipping agents and distributors play an important role in the economy. As in other Pacific islands these companies are concentrated amongst a small group of large family-owned holding companies with interests spanning a range of sectors.

The smaller scale of the market presents challenges. There are only a few large companies such as Fonterra capable of sending sufficient container-load volumes. In more cases, trade consists of less than container load LCL volumes, meaning that consolidators and import/export houses like Fresha, Tropex or Tara are necessary for the large majority of exporters.

For manufactured goods, supply dynamics have also changed in recent years. Many New Caledonian companies are satellite offices of large French and Asian firms which tend to centralise their procurement from Australian or Asian sources. New Zealand suppliers were well regarded as being good quality and able to service the scale for New Caledonian demand, however there was general lack of awareness of New Zealand capability, and NZ-sourced goods were perceived as being more expensive as those from Australia or Asia. There is a high value marine sector in New Caledonia, which may present opportunities for New Zealand boat and parts suppliers.

Supply chain issues remain a challenge. Despite New Caledonia’s proximity to New Zealand, there are only two shipping lines that operate between the two markets: A-CGM and Neptune. Both apparently synchronise rather than stagger their sailings, so the ships arrive at the same time, meaning that there can be long gaps between vessel arrivals. The Port of Auckland is a major source port. Some New Caledonia-based shipping companies have expressed interest in planning additional sailings across the Pacific region to capitalise on this increased cost.

Airfreight is occasionally used, particularly for high value seafood products around Christmas time. One major food industry retailer charters at least a plane each year to ship over 8 tonnes of New Zealand oysters alone.

Food and Beverage/Consumer goods

New Zealand F&B products are well regarded but relatively underrepresented relative to French products. Fonterra’s dairy products are well-represented – including UHT milk, mainland cheese and milk powders. Most consumer brands on supermarket shelves are French though, due to a combination of consumer taste preferences and the need for Frenchlanguage labels. The larger demand also makes it more economical to source product from mainland France given the ability to send full containers through the existing supermarket supply chains.

Taste preferences are changing but remain very French. For example, the café culture is growing – and there is some demand for alternative milks e.g. soy, almond, oat etc. – but most coffee is drunk in the French/European style: black and short.

New Zealand meat is widely present, particularly lamb and beef. There is not much pre-packaged/labelled meat and very little visible “New Zealand” branding other than a simple word saying “imported”.

New Caledonia has a big local seafood industry. New Caledonian prawns in particular are globally renowned. But niche New Zealand seafood is well regarded and highly sought after, particularly oysters and salmon.

New Zealand fruit, including apples, Zespri kiwifruit and pears, are widely present and well regarded. Although more expensive than New Zealand, imported fruit and vegetable prices are still cheaper than Fiji (e.g. $12-14 per kg of gold kiwifruit compared to $25 in Fiji).

Like mainland France, wine dominates the alcohol market. There is some New Zealand wine available, but not common. There is a large local beer industry dominated by two major breweries, though there is a growing craft beer scene with 3-4 craft brewing companies, often familiar with the New Zealand industry and using NZ hops and equipment. Premix drinks are less common, due to taste preferences and high taxes.

Supermarket Sector

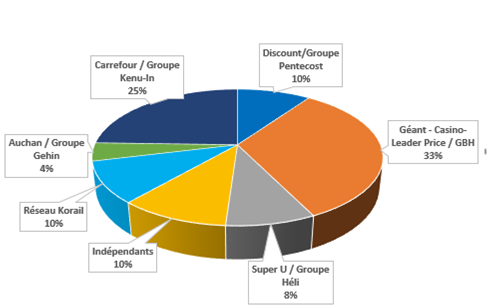

Major supermarket retailers within New Caledonia are dominated by the large French chains (Carrefour and Casino comprise nearly 60% of the market). The breakdown is as follows:

One of the larger “independent” retailers is Johnstons, located in downtown Noumea, which has traditionally featured more imported product. During a visit on 23 August, the store featured a number of NZ products such as Anchor milk powder (CFP845 p 800g); UHT milk; Mainland cheese (grated – CPF975-1195 p/450g); frozen lamb cuts (CFP 2390 / kg); limited Sanitarium soy and almond milk (displayed bottom shelf next to the egg section and next to competitor Alpro); limited Weet bix bites (two packs); as well as Zespri kiwifruit and NZ apples (Gala and Pink Lady).

Another, Les Halles d’Alexandre, is a high-end food retailer similar to Moore Wilsons or Farro, which specialises in premium delicatessen type products. The store features some New Zealand fruit and seafood product.

Where Supermarkets do purchase from New Zealand, they tend to procure either directly from New Zealand producers, via export house/consolidators, and distributors located within New Caledonia itself.

New Caledonian-based F&B distributors are largely concentrated in the alcohol sector given the additional complexities and restrictions in this sector. These include:

- Ballande (with an office in New Zealand)

- Cocoge – owned by a New Caledonian family with significant tourism interests;

- Noumea Gros – another family-owned company whose portfolio is largely dominated by Pernod Ricard products;

- La Vinotheque specialises in wine (and has the distribution contract for Villa Maria)

Tariffs and Regulations

Tariffs and other regulatory barriers are high. Despite being part of France, New Caledonian tariffs and border regulations are set independently and are generally higher than those on the mainland. There is a blanket 10 percent tariff on all products that are not from France plus additional restrictions including quantitative quotas, import licensing and outright bans on some agricultural products (e.g. Potatoes and Onions.) Industry has a generally protectionist outlook and many companies are highly reliant on industry and company-specific subsidies.

New Caledonia is not currently bound by the EU-NZ FTA. Its government is considering whether to sign up to elements of the EU-NZ FTA or PACER Plus.

Relevant Business Community/ Agencies

There are a large number of business associations in New Caledonia including:

- Chamber of Commerce and Industry – a quasi-government agency which plays a strong policy role.

- Federation d’Industry New Caledonia – FINC, which represents larger scale industry players.

- MEDEF – represents medium to large businesses.

- CPME represents the SME sector;

- Syndicat des Distributeurs et Importeurs represents businesses that import from overseas (and is generally pro-trade)

A number of other less formal ‘clusters’ have also been developed, being groups of businesses engaged in similar sectors, to share expertise and lobby government on sector-wide priorities. These include:

- Open – (IT and tech sector)

- AMD – (Industrial Maintenance businesses); they are among the better organised with a dedicated secretariat and particularly interested in growing indigenous business capability and have had some engagement with FOMA. They have also established an online health and safety certification programme for their members.

- Synergie – (renewable energy, mainly focused on the transport sector and electric vehicles)

- Maritime

New Caledonia Trade Invest (NCTI) is an industry-led body that performs a similar role to NZTE helping business (mainly SMEs) to export as well as attracting investment to New Caledonia. They currently have a representative in Suva and are thinking about establishing a similar role in NZ. NCTI is keen to organise a trade mission to NZ in early 2023.

New Caledonia’s three provinces have responsibility for economic policy development and each also has its own investment promotion agency. The most active is the Southern Province, which also accounts for most of New Caledonia’s GDP. They have a detailed online prospectus with information about investment opportunities in New Caledonia, and are able to offer some investment concierge services for companies that are keen to enter and invest in New Caledonia – including to introduce them to potential partners.

More reports

View full list of market reports.

If you would like to request a topic for reporting please email exports@mfat.net

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.