Supply Chains, Government:

On this page

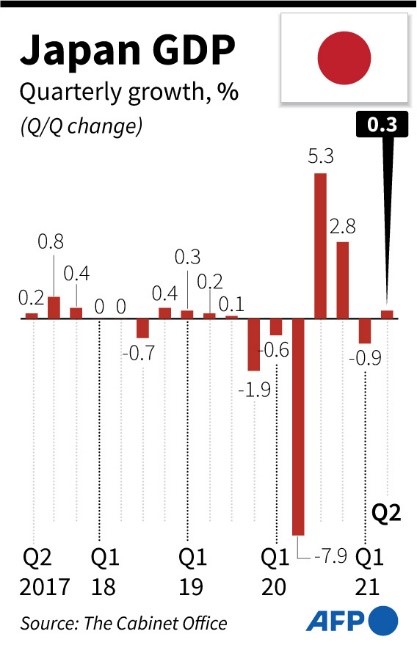

- Japan: Economic Indicators: Japan’s economy returned to modest growth in Q2 2021, 0.3% quarter-on-quarter, following a -0.9% contraction in Q1. While key indicators – goods and services exports; consumer and business spending; and business confidence – were all up in Q2, the recovery was hampered by ongoing restrictions on economic activity due to the COVID related state of emergency in major cities across Japan. The economy in Q2 2021 was still 3.4% smaller in real terms than in Q3 2019. Economists are forecasting Japan’s 2021 GDP growth to be in the +2.2% to +3.0% range.

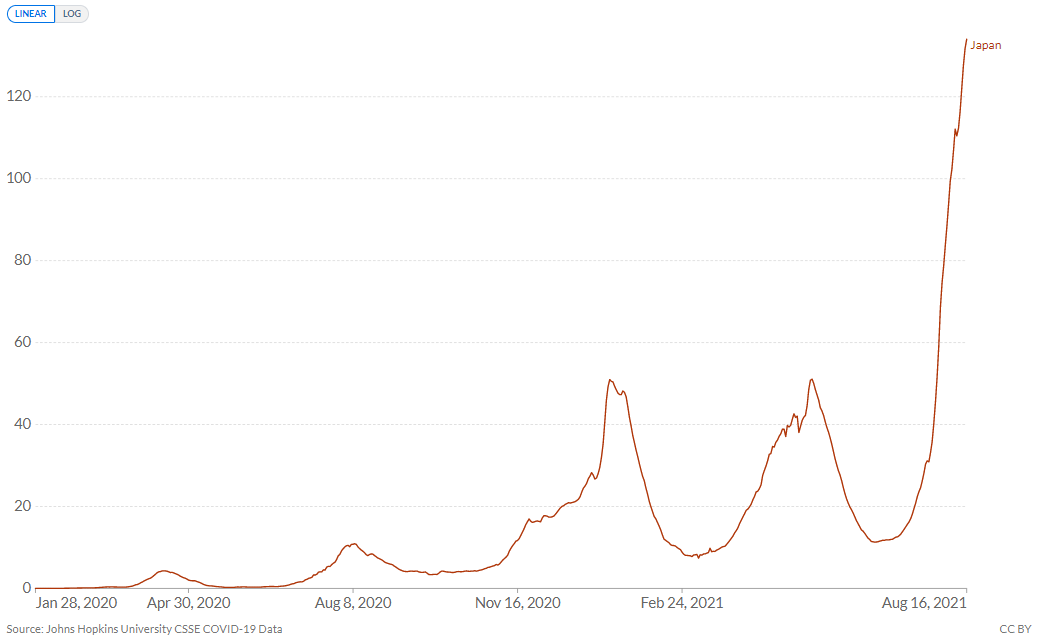

- A fourth COVID-19 state of emergency is in place in Tokyo and Osaka, and in their surrounding metropolitan areas. New COVID infections – driven by the Delta variant – and hospitalisation numbers are at record levels. There is evidence of reduced compliance with the Government’s requests due to “self-restraint” fatigue.

- Despite the fifth wave’s record numbers, Japan was able to host the Olympics safely, with very low numbers of COVID-19 infections among athletes. The Paralympics – which will also be hosted without spectators – kicks off on 24 August, after which a general election needs to be held by November 2021.

- COVID-19 mortality in Japan remains low by global standards (6%-7% the rate of the US and EU), and high vaccination coverage (88%) in Japan’s elderly population will assist with managing pressure on the healthcare system. Japan had delivered at least one vaccine dose to 50% of its total population by mid-August.

| Indicator | Latest data | Previous data |

|---|---|---|

| Real GDP growth | +0.3% Q on Q (+1.3% annualised) in Q2 2021 | -0.9% Q on Q (-3.7% annualised) in Q1 2021 |

| Private consumption | +0.8% Q on Q in Q2 2021 | -1.4% Q on Q in Q1 2021 |

| Goods & services exports | +2.9% Q on Q in Q2 2021 | +2.3% Q on Q in Q1 2021 |

| Goods & services imports | +5.1% Q on Q in Q2 2021 | +4.0% Q on Q in Q1 2021 |

| Consumer confidence index | 37.5 points (↑0.1) in July 2021 (below 50 =pessimism) | 34.7 points (↓1.4) in Q1 2021 (below 50 = pessimism) |

| Business confidence index (tankan) | 14 points (↑9) (above zero = optimism) in June 2021 | 5 points (↑15) (above zero = optimism) in Q1 2021 |

| Consumer price Index | -0.2% in June 2021 | -0.2% in March 2021 |

- New Zealand’s goods exports to Japan for Q2 2021 dropped by -11%, compared to the record high in Q2 2020. Anecdotal evidence suggests that labour and skills shortages in New Zealand and logistics challenges constrained the supply of New Zealand products in the Japan market in Q2 2021. On the demand side, the impact of COVID-19 on F&B products – which make up about half of New Zealand’s goods exports – depends on their relative exposure to the retail sector (which is up) versus the food service/restaurant sector (which is down) due to the repeated states of emergency.

COVID-19: fourth state of emergency

- Japan’s fourth state of emergency was declared on 12 July, and is not expected to be lifted until mid-September. The fifth wave of infections has been driven by the Delta variant, and clusters have been identified in locations (e.g. department stores, beauty salons) where they were previously very uncommon.

- There has been evidence of reduced compliance with the Government’s state of emergency “requests”. For example, a survey has revealed that more than 40% of bars in downtown Tokyo remained open after 8 p.m. despite the metropolitan government's request for them to shorten their hours and compensation payments available for businesses that comply. The Government’s chief science adviser on the pandemic, Shigeru Omi, has stated that the effectiveness of calling on individuals to exercise “self-restraint” is diminishing with time.

- COVID-19 mortality in Japan remains low by international standards due to a much lower active caseload throughout the pandemic and a lower case fatality rate. The cumulative total number of COVID-19 deaths in Japan as a proportion of population (122 per million) is 7% of the EU average (1680 per million) and 6% of the US figure (1,880 per million).

Daily new confirmed COVID-19 cases per million people

Shown is the rolling 7-day average. The number of confirmed cases is lower than the number of actual cases; the main reason for that is limited testing.

- Aside from exemptions for the Olympics and Paralympics, Japan’s borders remain closed to most foreign travellers. We do not expect any relaxation of Japan’s border settings until after the general election later this year, by which time Japan will have achieved high rates of vaccination.

Japan’s vaccine rollout progress

- Japan began the roll-out of the Pfizer/BioNTech to healthcare workers from mid-February, and to the elderly from April. The roll-out picked up pace after the Golden Week holiday period in early May, and has consistently averaged over one million doses per day since June. Widespread vaccination of Japan’s elderly population (88% with at least one dose) has contributed to a sharp reduction in infections recorded in the over-65 cohort. This has also reduced the pressure on intensive care units in the early stages of the Delta-driven fifth wave, and will likely lead to a further reduction in Japan’s case fatality rate. By mid-August, 50% of Japan’s total population had received at least one vaccine dose.

New Zealand goods exports to Japan down 11% year-on-year in Q2 2021

- New Zealand’s total goods exports to Japan in Q2 2021 were NZ$1.07 billion – down -11% on Q2 2020 and -6% on Q2 2019, but up slightly on Q2 2018 and Q2 2017.

- The following sectors increased in Q2 2021 compared to Q2 2020:

- Metal and metal products (+21% to $164 million) – both aluminium alloys (+35%) and unalloyed aluminium (+16%) were up. This sector has recovered well after demand for metal and metal products decreased last year due to interruptions to the production of automobiles and laptops.

- Meat and meat products (+26% to $147 million) – frozen boneless beef (+57%); chilled boneless beef (+12%); chilled boneless sheepmeat (+30%); chilled bone-in sheepmeat (+16%); frozen bone-in sheepmeat (+47%). Frozen boneless sheepmeat was down (-55%).

- Forestry and wood products (+12% to $81 million) – coniferous wood (chips or particles): +161%; Medium Density Fibreboard (MDF) <5mm: +43%, 5-9mm: +54%, >9mm: +30%. New Zealand was in lockdown in Q2 last year – the forestry sector was not deemed essential and production was down. The sector has recovered somewhat this year.

- The following sectors decreased in Q2 2021:

- Horticulture (-27% to $360 million) – while kiwifruit continued to be New Zealand’s largest export to Japan in Q2 (28% of total exports, worth $300 million), it was down -28% on Q2 2020. Kiwifruit arrived to market slightly earlier than usual last year, and slightly later than usual this year, so we expect better Q3 figures this year. Fresh apples – the second largest horticultural export to Japan – was also down by 27% in Q2 2021. This decrease appears to be the result of three factors: (a) shipping delays from New Zealand meant that apple arrivals were late to market this year, and so will fall into Q3 rather than Q2; (b) overall apple consumption seems lower than last year because it is competing with a glut of summer fruit in the market; (c) business decisions of exporters to pack and ship less than they did last year.

- Dairy (-21% to $173 million) – weak performances by butter (-64%), cheddar and Colby cheese (-30%), fresh cheese including whey cheese (-44%). Casein was up (+16%). There is currently a stockpile of butter in Japan, after excess domestically produced milk was converted into butter. Excess butter supplies are affecting the quantity of butter being imported.

- Miscellaneous Food and Beverage Products (-37% to $42 million) – honey was down by -60%. There was a massive increase in the consumption of Mānuka Honey in Japan in Q2 last year, because of the first state of emergency in Japan. Honey sales are returning to pre-COVID levels.

- Fish and seafood products (-33% to $13 million). Bucking the overall trend was Pacific Salmon, which recorded stellar figures in Q2 – chilled salmon (+159% to to $1.3 million) and frozen salmon (+135% compared to 2019 to $1.3 million – no data available for 2020). Also up in Q2 was frozen jack/horse mackerel (+128% to $0.6 million) and frozen fish fillets (+128% to $0.54 million). Overall fish and seafood exports have been affected by decreased restaurant demand due to the multiple states of emergency. The surge in demand for New Zealand frozen jack/horse mackerel is reportedly linked to delays in processing the same product in China, with some Japanese importers switching to buying directly from New Zealand. Increased demand for Pacific salmon from New Zealand has been linked to the Atlantic salmon supply in Chile being affected by red tide algae bloom(external link).

- Services trade: As reported previously, about 20% of New Zealand’s exports to Japan (pre-COVID-19) were tourism and education services which have been severely impacted by the border closures in New Zealand.

In the news…

- Kabochamilk: A unique plant milk made from New Zealand grown kabocha buttercup squash is now hitting supermarket shelves in Japan. Kabochamilk is fully vegan, and free from artificial flavours and colours. Kabochamilk is a collaboration between Shane Newman – one of New Zealand’s largest buttercup squash growers from the Hawke’s Bay, and Sachie Nomura – a Japanese celebrity chef. NewZealand’s Ministry of Primary Industries, MPI, contributed more than $95,000 through its Sustainable Food and Fibre Futures fund (SFF Futures) to help boost Kabocha Milk Co’s efforts to formulate, manufacture, and market a shelf-stable kabocha milk recipe that would appeal to consumers in Japan, Korea, China, and beyond.

- Japanese farmers use app to recoup sales during COVID-19: An increasing number of Japanese farmers are turning to digital technologies such as an app called ‘Pocket Marche’ to grow and sell their products as COVID-19 depresses sales to restaurants. ‘Pocket Marche’ enables farmers, fishermen and consumers to send messages to each other and sell goods. Over 5,000 producers are now using the app to communicate with 300,000 consumers.

- The Japanese Shine Muscat grape illegally taken offshore: The highly prized and priced luxury grape variety has been surreptitiously taken to China and South Korea where it has been cultivated without Japan’s permission and sold in foreign and domestic markets to compete with Japanese products. Shine Muscat grapes are often used for gifts, costing up to hundreds of dollars per cluster.

- Facial recognition technology introduced at Tokyo airports: Tokyo’s two main airports have started using facial recognition to allow international travellers to check in baggage and pass security checkpoints without showing passports or flight tickets. To activate the service, a traveller’s photo is taken at flight check-in and then cameras at security checkpoint entrances and boarding gates automatically verify passengers’ identities and allow them to pass through.

- Toyota remains world’s best-selling automaker: Toyota has sold a record 5.5 million vehicles in the first six months of 2021, outpacing German competitor Volkswagen, off the back of robust sales in its key markets - the United States and China. This is the second year in a row that Toyota has been the world's top automaker in the first half of the year, underscoring its sharp recovery from the initial fallout of COVID-19 and relative resilience despite a global shortage of chips which has forced some automakers to curb production.

- Cars could fly by 2025: The Japanese government has set a goal of realising flying vehicles by 2025, and venture companies are leading the development of the vehicles. The Osaka Kansai Expo in 2025 is targeted as an intermediate goal to introduce the technology with the government planning to use flying cars as a means of transportation between Kansai International Airport and the Expo site, which is nearly 30 kilometres away.

- Zero interest loans for institutions investing in climate change fight: The Bank of Japan announced it will support the fight against climate change by providing zero interest loans to commercial financial institutions making investments and loans in the area. The details of the measures, such as the scale of the loan facility, will be finalised by the end of the year.

- Japan invests in New Zealand’s hydrogen sector: Japan’s Obayashi Corporation has been selected as the equity partner for the Hydrogen Refuelling Station Project being developed by the Ports of Auckland. The project aims to facilitate the development of a green hydrogen production facility and refuelling station at the port site.

- Pushing down price of hydrogen: Japanese energy company Eneos and plant engineer Chiyoda will construct a green hydrogen production plant that will aim to produce hydrogen for approximately NZ$4.30 per kilogram. This is one-third of the current production price and would be a breakthrough in Japan’s push for decarbonisation.

- Scrambled soy eggs on offer: Japanese mayonnaise manufacturer Kewpie has developed a vegetarian version of scrambled eggs made of soy beans, as demand for such products rises. Kewpie started selling what it calls “almost eggs” to hotels, restaurants, and schools initially, with a view to targeting mass consumers later. Kewpie is a key producer of egg-based products, and is the holder of the highest number of egg-related patents in major markets for Japan.

Japan: latest economic indicators

- GDP – Japan’s GDP returned to modest growth in Q2 2021, rising +0.3% quarter-on-quarter (1.3% on an annualized basis), after a downwardly revised -0.9% quarter-on quarter (-3.7% on an annualised basis) in Q1 2020. After a contraction of -4.8% in the 2020 calendar year, economists are now forecasting Japan’s 2021 GDP growth to be in the +2.2% to +3.0% range.

- Private consumption – which accounts for more than half of Japan's GDP – increased +0.8% from the previous quarter, despite the ongoing states of emergency, illustrating that citizens are becoming less responsive to voluntary, repeated requests to stay home.

- Goods and service exports – increased +2.9% quarter-on-quarter in Q2, after rising +2.4% in Q1, with the volume of goods exports surpassing the pre-COVID-19 peak. There has been strong demand for automobiles, chip-making equipment and general machinery with the reopening of the US and some European economies.

- Goods and services imports increased by 5.1% quarter-on-quarter on the back of recovering domestic demand – the third consecutive quarterly increase.

- Business confidence index – The Bank of Japan's index for big manufacturers’ sentiment increased 9 points to 14 in the Q2 2021, from 5 in Q1. This was the fourth consecutive quarter of improvement and the highest reading since the Q4 2018.

- Consumer confidence index - increased by 1 point to 38 in June 2021 month-on-month – the strongest reading since February 2021. Most main sub-indices improved: overall livelihood (up 1 point to 39.0), income growth (up 1 point to 38) and employment perceptions (up 1 point to 35).

- Consumer prices – The "core" CPI – which excludes the cost of fresh food and energy – decreased 0.2% year-on-year, the same rate as in the previous two months.

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.net

To contact our Export Helpdesk

- Email: exports@mfat.net

- Phone: 0800 824 605

- Visit Tradebarriers.govt.nz(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.