Supply Chains, Primary Products, Services:

On this page

Rāpopoto – Summary

Austria has a highly developed, diversified and export-oriented, free-market economy. This report examines how Austria is faring heading into a potentially difficult northern winter. COVID-19 and the war in Ukraine will have a significant impact. International supply chains remain disrupted and European sanctions on Russia will have implications for Austria’s energy supply, likely lowering GDP growth. Overall, however, Austria’s economic fundamentals remain sound and the country is well placed to weather the storm. GDP per capita remains above the EU average and the country's infrastructure and openness to trade will continue to make it attractive for both exporters and foreign investors.

Pūrongo – Report

The current situation

As a high-income country with a population of 8.7 million, a per capita GDP of NZ$87,703.20, compared to an EU average of NZ$62,950.73, and relatively even income distribution, Austria is an important consumer market.

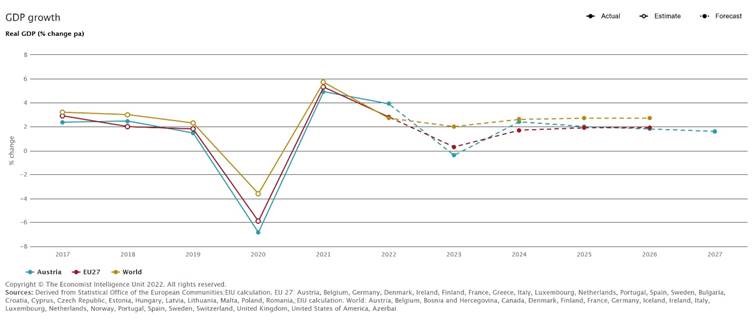

Austria’s GDP growth compared with EU27 and the world:

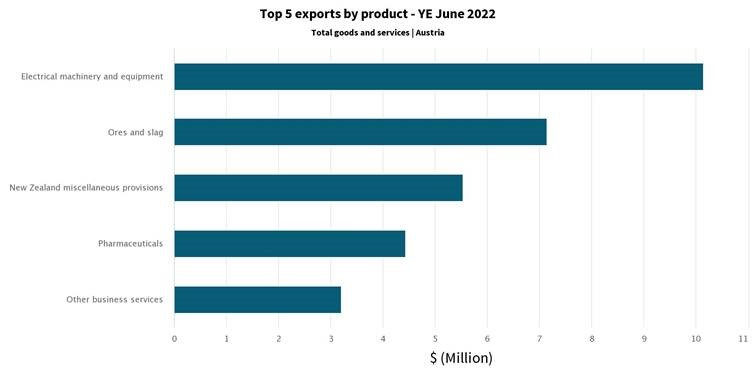

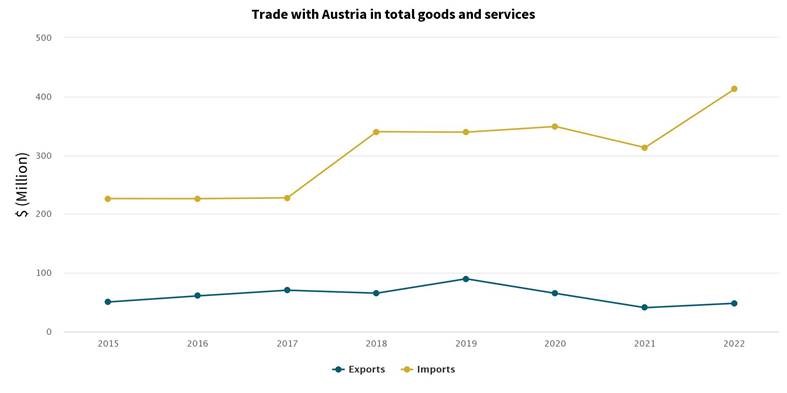

New Zealand – Austrian goods imports/exports in the year ended June 2022:

There may be tougher times ahead…

Pressures on the global economy are likely to affect Austria’s economy in two ways. A weakening of the global economy is dampening the outlook for goods exports and thus for industry, and the increase in prices globally for raw materials and manufactured goods will weigh heavily on household incomes. Economic momentum is likely to slow next year and GDP to decline 0.4%. In line with trends across Europe, inflation in Austria has accelerated sharply in recent months, increasing to 9.3% in August. According to the Austrian Institute of Economic Research, annual inflation will rise to 7.9% this year due to high prices for raw materials, agricultural and intermediary goods. Flattening economic growth will slow inflation to about 5.3% in 2023, still well above the long-term average.

Russia's invasion of Ukraine will continue to disrupt supply chains already fragile from COVID-19. Rising concerns about gas supplies will affect business confidence and industrial production, particularly given Austria’s close economic ties with Germany. Increasing prices will put pressure on disposable income and domestic consumption, with lower-income households disproportionally affected. The government has put in place several relief packages, such as an “electricity price brake” in an attempt to cushion soaring energy costs and prevent them from becoming a politically divisive issue.

…but Austria’s fundamentals are sound

Until the 1980s, many of Austria's largest industries remained nationalised. In recent years, privatisation has reduced state holdings to a level comparable to other European economies. Some companies are global competitors including in energy, iron and steel, and chemicals, but many remain small by international standards. Trade unions remain strong and influential.

Since Austria joined the EU in 1995, the agricultural sector has undergone substantial reform through the EU's Common Agricultural Policy (CAP). Although Austrian farmers provide about 80% of domestic food requirements, the contribution to GDP of the agricultural sector has declined since 1950 to less than 3%. Nevertheless, the sector retains significant political influence. The government estimated early this month that Austria produces:

| Percentage of domestic demand | |

| Milk and yoghurt | 178% |

| Beef and veal | 147% |

| Cheese | 118% |

| Pork | 108% |

| Eggs | 92% |

| Poultry | 78% |

| Butter | 72% |

| Fish | 7% |

Foreign investment is generally welcome in Austria, but there is strong opposition to non-EU takeovers, especially in the manufacturing and construction. Because of its close links to the Russian financial system, the financial services sector was badly affected by sanctions imposed on Russian banks but the government has moved quickly to tighten regulatory requirements.

Strong demand for labour has seen unemployment decline year-on-year since March 2021, a trend that is expected to continue. The annual unemployment rate is expected to fall to 6.3% in 2022 and remain steady throughout 2023. Migration flows, particularly from Ukraine, will also increase labour supply. Immigration from Ukraine is expected to amount to 150,000 by the end of 2023, 60% of whom are of working age.

After a sharp decrease in Austrian economic output in 2020 caused by the pandemic, GDP grew 4.8% year-on-year in 2021. Economic activity fluctuated significantly during COVID lockdowns but the domestic economy has continued to grow overall, reaching nearly 6% by mid-2022. Almost all economic sectors have contributed to this growth, especially heavy industry including mining and manufacturing, and the retail and banking sectors. Tourism and restaurants were worst affected by COVID lockdowns but there has been a strong recovery in tourism, accompanied by high growth in services exports. Overall, despite head winds, the Austrian economy is still expected to expand by around 4% this year.

Implications for New Zealand?

In the first quarter of 2022, New Zealand exported NZ$10.43 million worth of goods and services to Austria and imported NZ$91.86 million. While it is too soon to be certain, high inflation and depressed demand in Austria along with supply chain disruptions internationally may well affect these trade flows in the short term. Nevertheless, assuming a more benign international backdrop and steady economic growth in Austria, we would expect demand for imported goods and services to pick up again by 2024.

Tākupu – Comment

Inflation in Austria and the EU zone, as well as uncertainty about energy supplies, will be major preoccupations for the

Austrian government. The government has said that it has enough gas stores to cover domestic heating requirements for the rapidly approaching winter, but restocking stores for the following winter could be a significant challenge. A resurgence of the COVID pandemic this winter could also cause economic disruption, although further lockdowns would be so unpopular as to be unlikely.

Nevertheless, with strong economic fundamentals and a relatively stable political environment lately by Austrian standards, Austria looks well placed to weather the upcoming storm and emerge strongly next year.

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.net

To contact our Export Helpdesk

- Email exports@mfat.net

- Call 0800 824 605

- Visit Tradebarriers.govt.nz(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government.

The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.