Supply Chains, Sustainability:

On this page

Overview

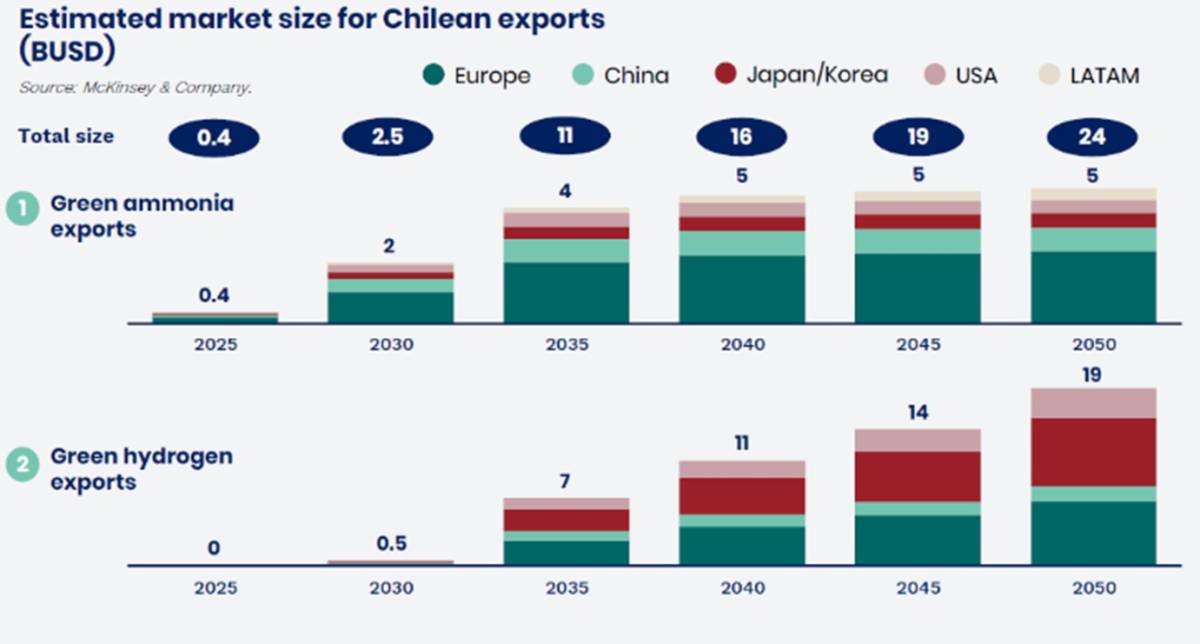

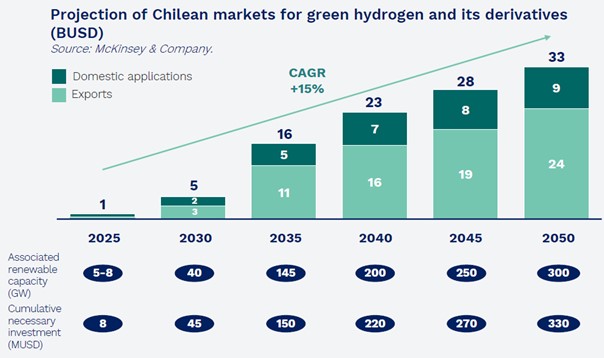

Chile’s enormous renewable energy potential and availability of land in remote regions has seen the country develop high ambitions for becoming a leading producer and exporter of green hydrogen and its derivatives. Chile’s objectives are to install 300GW of renewable energy generation capacity for the production of green hydrogen by 2050, realising a USD 24 billion export market and USD 9 billion domestic market. Chile’s abundant solar and eolic resources are expected to enable Chile to secure by 2030 the world's lowest levelised cost for green hydrogen production at around 1USD/kg H2.

There are approximately 75 green hydrogen projects proposed in Chile across all stages of development, including seven commercially scaled plants currently undergoing an Environmental Impact Assessment representing around USD 40 billion in secured investment. The sector is supported through a comprehensive policy ecosystem, rigorous environmental and permitting standards, and several general and targeted financial incentives. Both the government and project developers are pursuing strategic communication with local communities.

Chile’s green hydrogen sector is aiming for mutually beneficial development with other sectors including heavy industries, shipping, salmon farming, and agricultural fertilizer production. There is also potential for green hydrogen hubs in Chile to support fuel bunkering and data centre industries. For these ambitions to become reality, significant construction and services provision will be required, in particular for infrastructure upgrades and plant construction in the far south of Chile.

Chile’s ambitions are supported by its open business environment, political stability, extensive free trade agreement network, high education levels, and existing engineering prowess. New Zealand connections in Chile are facilitated through our free trade agreement links, participation in like-minded trade groupings, and enduring people to people exchanges backed by established transport connections including a direct flight.

Chile’s Green Hydrogen ambitions

Chile’s ambition to become a green hydrogen exporter is a ‘flip the script’ scenario. Chile’s energy sector currently accounts for 64% of the country’s greenhouse gas emissions due to low electrification (22% in 2022), low use of renewable and clean energy within the energy matrix (22% in 2022), and the importation of around 98% of fossil fuel consumption.

Chile is firmly committed to a green transition for both domestic consumption (with a goal to be carbon neutral by 2050), and to support global demand and requirements. Chile has enormous potential for renewable energy generation, with potential capacity estimated at 2,000 GW – around 80 times current installed capacity. Chile’s renewable energy sector has seen exponential development in the last decade (from 720MW to 4,509MW of wind capacity, and 225MW to 8,938MW of solar capacity) and ranked 15th globally in EY’s Renewable Energy Country Attractiveness Index (RECAI) 2024 report for attractiveness for renewable energy investment.

An International Energy Agency study found that Chile had the potential to produce up to 160 million tonnes of green hydrogen per year. Chile’s National Green Hydrogen Strategy 2020 sets the ambitions for development of the sector over 2025-2050, from 5GW of renewable energy capacity utilised for the production of green hydrogen by 2025, through to 300GW by 2050. A Chilean Ministry of Energy website(external link), predicts that by 2030, Chile will secure the world's lowest levelised cost (not considering end use) at 0.8 USD per kg of green hydrogen in the north, and 1.0 USD per kg of green hydrogen in the south.

In the 2020 Strategy, Chile foresees its green hydrogen development happening in three waves. Initially, green hydrogen would be used in domestic markets with existing large energy demand, such as replacing imported ammonia, and increasing use of green hydrogen in heavy transportation. Export activities would be expected to start by 2030, followed by a massive scale up as new export markets open and innovation progresses for the transformation of hard-to-electrify industries. If realised, the projected USD24 billion export market by 2050 would be at a similar scale to Chile’s mega-mining industry, which currently provides 60% of Chile’s exports and 12% of GDP.

Institutions and governance

The Chilean government has developed a comprehensive policy ecosystem on the green transition, which will support the development of Chile’s green hydrogen industry. Chile’s National Energy Policy has been developed as a ‘State’ policy, meaning it is not linked to a particular Administration.

| Institutions | Laws | National policies and strategies | Financial incentives |

|---|---|---|---|

| Ministry of Energy Ministry of Environment |

Framework Law on Climate Change Energy Transition Law |

National Energy Policy Energy Agenda |

H2V Facility Programme for Sustainable |

| CORFO – Corporation for the Promotion of Production | Framework Law on Climate Change Energy Transition Law Energy Efficiency Law |

Energy Efficiency Plan Decarbonisation Plan Green Hydrogen Strategy 2020 Green Hydrogen Action Plan 2023-2030 |

H2V Facility Programme for Sustainable Productive Development Concessions of state-owned lands Tax incentive for R&D Tax incentive for remote areas |

Chile’s Green Hydrogen Action Plan details two implementation windows. Over 2023-2026 the focus is on promoting investment signals, rules, regulations, and strengthening relationships with potential buyers. Over 2026-2030 the focus is to materialise productive development and decarbonisation. As Chile’s economic development agency, the Corporation for the Promotion of Production (CORFO) plays a central role as an enabler of the green hydrogen industry in Chile across various workstreams, including: coordination and communication; supporting infrastructure; innovation; human capital; and financing.

The Chilean government is working through how it will approach green hydrogen certification, and has joined the voluntary regional scheme CertHiLAC, alongside actively participating in multilateral discussions through the International Partnership for Hydrogen and Fuel Cells in the Economy, APEC, and the International Energy Agency. The German Corporation for International Cooperation (GIZ) has recently concluded a study commissioned by Chile to examine the alignment between current requirements of export markets and Chile’s existing policy ecosystem. The study proposed that Chile’s future system be regulated and voluntary, along with meeting the minimum requirements established by European Union standards. Chile will now work on developing a certification roadmap, in accordance with its Green Hydrogen Action Plan, with a tentative timeframe for implementation from 2028.

International partnerships

International partnerships are key to Chile’s ambitions, across policy, innovation, and investment. Strategic stakeholders with which Chile holds formal arrangements for cooperation include Singapore, United Kingdom, South Korea, the European Union (which includes harmonisation of certification), Germany, France, Netherlands, and Japan, alongside the ports of Rotterdam (Netherlands), Amberes and Zeerbrugge (Belgium), Hamburg (Germany), and the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping (Denmark).

Financial incentives

Chile has several specific financial incentives to improve the development and competitiveness of its green hydrogen sector. These build on the increasing availability of green financing, and existing tax benefits such as tax deductions for research and development (R&D) activities, and VAT and import duty exemptions for remote regions. As an example, in 2021, a CORFO-adjudicated fund of USD 50 million supported the start-up phase of six green hydrogen projects across the country, which now have an installed electrolysis capacity of more than 45 MW in their initial phase. This fund was succeeded by a USD 1 billion financing facility with support from multilateral banks, focused on the development of national green hydrogen production capacity alongside the creation of a market for domestic consumption. In May, the Minister of Finance announced plans to submit a bill to Congress to provide tax incentives for green hydrogen projects, combining fiscal credits with support for demand in the manufacturing, mining, and transport industries.

Chile’s multi-ministerial Programme for Sustainable Productive Development has dedicated significant funds to supporting green hydrogen development including over USD 6 million for a Technological Centre for Green Hydrogen located in the Magallanes region; a Navy-led Centre focused on use of green hydrogen in the maritime industry; a Logistics Development Plan for Magallanes; and several thematic technological programmes promoting industry transition to green hydrogen, and supporting enabling innovations.

Chile’s Ministry of National Assets oversees the “Window to the Future” programme, which facilitates concessions of state-owned land for renewable energy or green hydrogen plants. A first allocation process granted land-use permits to successful projects with a focus on the Antofagasta region; a second allocation process is under development.

Chile’s regional green hydrogen hubs

The variety of Chile’s regional geographies supports a diversified production profile for green hydrogen and its derivatives, through renewable energy sources, local industry, and local infrastructure. Chile has three regional hubs for green hydrogen development: the northern hub centred around the Antofagasta region, the central hub centred on the Biobio, Valparaiso and Metropolitan regions, and the southern hub centred around the Magallanes region. Alongside a national green hydrogen industry association which brings together stakeholders across the entire supply chain, Antofagasta, Biobio, and Magallanes each have regional green hydrogen associations for connecting business, academia, and the public sector, boosting regional profiles and development, and building a sustainable industry for both the economy and community.

Magallanes

The Magallanes region has attracted around a third of the proposed green hydrogen plants, and 80% of existing investment. The far south region has a potential capacity of 200GW of onshore wind energy, where wind turbines can achieve capacity factors of over 60%, in addition to having plentiful available land and access to the ocean.

The region hosts the world’s first operational e-fuels pilot plant Haru Oni (HIF Chile) with plans under way for a commercial plant that would produce 55 million litres of e-fuels annually. A consortium of seven companies planning nine green ammonia projects is poised to attract USD 70 billion in investment, with planned construction over 2028-2032 and an estimated combined installed capacity of around 20 GW of renewable energy generation and production of eleven million tonnes of green ammonia per year.

To support green hydrogen production, the region will need significant infrastructure upgrades (amongst other adjustments) to manage the transformation. Planning and investment for this is being channelled through public sector programmes and a public-private alliance known as the Magallanes Pact, with workstreams focusing on: governance, alliances, and public-private partnerships; social, environmental, and economic development; human capital and innovation; infrastructure; and regulations, permits and standards.

Antofagasta

Around a further third of proposed green hydrogen projects are based in the Antofagasta region, with several pilot projects already in operation. Chile’s northern regions are the source of the most powerful solar radiation on the planet, where approximately 1,700 GW could be installed, and capacity factors are able to reach 35%. Located in the Atacama Desert, land is widely available, and the region’s mining activity means that there is pre-existing infrastructure support. The local mining industry will also be an important partner for Chile’s green hydrogen ecosystem given the sector’s high energy consumption across activities that are difficult to electrify.

Central Regions (Metropolitana, Valparaiso and Biobio)

The Metropolitan and Valparaiso regions, home to approximately 50% of Chile’s population, are projected to have a high share of final internal demand for green hydrogen. There are a number of operational pilots in these regions to support the green transition of international companies, such as Anglo American mining’s collaboration to build Chile’s first green hydrogen-fuelled bus, and Walmart’s use of hydrogen fuel cells for its forklift cranes. Although at a smaller scale to the Antofagasta and Magallanes regions, the Biobio region is projected to be Chile’s green hydrogen hub focused on internal demand, for use in industries such as glass fabrication and the production of hydrogen peroxide.

Project development pipeline

As of September 2024, there are approximately 75 green hydrogen projects registered in Chile, across all stages of development, although the status of some is unknown and it is possible a number of these projects have been paused or discontinued. There are approximately 10 pilot projects already in operation, accounting for around 1,000 MW of renewable energy employed in the production of green hydrogen. On current projections, around 20 projects are pitched at an industrial scale, and 20 at a ‘giga’ scale.

For commercially scaled plants, the approximate timeline for moving from feasibility through to operation of a green hydrogen plant in Chile is estimated to take 10 years:

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Year 10 |

| Secure territory | Local campaigns with communities and authorities | Environmental Impact Assessment and permits | Construction | Operation | |||||

Chile’s rigorous Environmental Impact Assessment process is the main regulatory milestone to test the feasibility of green hydrogen projects, followed by the permitting process. As of early June, the Environmental Evaluation Service lists seven green hydrogen projects with active Environmental Impact Assessment processes under way. These account for approximately USD 40 billion in investment, and the projected future production of over 1.2 million tonnes of green hydrogen per year and around 5.7 million tonnes of green ammonia.

Green hydrogen projects at the stage of submitting their Environmental Impact Assessment are investing approximately USD 20-30 million per year in this process alone, subcontracting out substantial studies and analysis and (in their own words) designing “a lot of new engineering”. Responding to a long-standing request of the private sector, in May Chile’s Minister of Finance announced plans for a Presidential directive to accelerate more than 100 investment projects, alongside entering a bill into Congress to facilitate decarbonisation investments with a focus on green hydrogen projects, including unifying environmental evaluation criteria and avoiding regulatory changes that impact projects under evaluation. In addition, a bill to reduce the timelines for processing sectorial permits (the next step following the Environmental Impact Assessment) by 30-70% has been approved by both chambers of Congress and is now awaiting the final stage in the legislative process before becoming law.

Both the government and green hydrogen investors in Chile are focused on strategic communications and community outreach, including as the Environmental Impact Assessment process allows for community input. In the case of one green hydrogen project’s evaluation process, community consultation identified potential negative impacts on another Chilean sector. This opened a public debate on whether the project should advance, with a decision yet to be made. Questions about the cost-benefit analysis of the green hydrogen sector remain, in particular from environmental NGOs.

It is widely accepted that not all commercially scaled proposals will progress through to operation. Chile’s progress has been impacted by the general global slowdown in green hydrogen development, with a few international investments being paused or refocused. Regardless, a 30-50% conversion rate from proposals into reality would constitute a significant boost to Chile’s economy and enable both domestic decarbonisation and the creation of an export market. Steadfast in promoting the country’s green hydrogen potential, the Chilean government has focused on developing public policies and financial tools in close coordination and consultation with the private sector, academia, and the broader community, and has fostered public-private partnerships for sector development initiatives at national and regional levels.

Complementary development

The public and private sectors are working on several partnerships between green hydrogen and other sectors, including piloting uses of green hydrogen in the mining industry, innovation in fuels for heavy industries, the evaluation of four potential green maritime corridors from Chile, provision of excess oxygen for salmon farming, and the feasibility of developing fertilizers or fertilizer compounds for agriculture exports (currently imported into Chile). A study in partnership with the European Union and GIZ proposed that the Magallanes region could be a candidate for green hydrogen-adjacent industries such as the ‘bunkering’ of clean fuels, and data centres.

The development of the green hydrogen sector will draw in parallel on supporting industries, in particular construction and services. The biggest plants anticipate requiring construction workforces of over 5,000 and operation workforces of up to 1,500. The isolation of the areas where green hydrogen plants are proposed will require the plants themselves to be self-sufficient in power and water, during both construction and operation. Structural barriers such as use of land, the upgrade of obsolete or insufficient infrastructure, and water scarcity will need to be addressed. This is particularly the case for the Magallanes region, where public-private partnerships are seeking to resolve infrastructure needs including 120km of new highway, a port upgrade, and an airport upgrade.

Enabling factors

Chile is an externally facing country open to trade, boasting the largest number of free trade agreements in the world (34 agreements with 65 economies). Chile has an open business environment, considered to enable foreign direct investment. The Heritage Foundation’s 2025 report ranked Chile 18th for economic freedom. Chile has an extensive and well-regulated tertiary education sector with high education rates. Over 40% of people aged 25–34 hold a tertiary level qualification, with statistics indicating 30% of these are in fields related to technology, and 20% are in fields relating to administration and business.

With its complex geography and mega-mining industry, Chile has high levels of engineering prowess. Both the established mining and budding green hydrogen industries are backed by overseas investors, with executive teams often comfortably operating across both Spanish and English-language mediums.

Trade flows between Chile and New Zealand are facilitated through trade agreement links, such as through the P4, CPTPP, and DEPA. The two countries are also members of the Inclusive Trade Action Group and the Global Trade and Gender Arrangement. At the time of writing, they are developing a proposed work plan alongside Singapore on a possible ‘Green Economy Partnership’. Chile is New Zealand’s gateway to South America, as host to the only direct flight with the Latin American region (Auckland-Santiago, LATAM Airlines, approximate 12-hour flight time, 4-5 times per week). Due to our enduring trade and people-to-people connections, New Zealand enjoys a very good reputation amongst the business, political and public communities.

Want to explore further?

Public sector: Chile’s Ministry of Energy(external link) is responsible for public policy development, while CORFO(external link) covers implementation and private sector coordination. Examples of regional public-private sector partnerships can be found for the Magallanes(external link) and Biobio(external link) regions.

Private sector: H2Chile(external link) is the nationwide association for the promotion of hydrogen across its entire value chain. There are also regional associations in the Magallanes(external link) and Antofagasta(external link) regions.

Please note, while many of these website links are in Spanish, contacts involved in the strategic or governance development of green hydrogen are often able to comfortably communicate in English.

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.govt.nz

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.

Copyright

Crown copyright ©. Website copyright statement is licensed under the Creative Commons Attribution 4.0 International licence(external link). In essence, you are free to copy, distribute and adapt the work, as long as you attribute the work to the Crown and abide by the other licence terms.