Food and Beverage, Primary Products, Manufacturing (excludes F&B), Services:

On this page

Summary

2025 has been a challenging year for the Japanese economy on several fronts. At the start of the year prospects for Japan were relatively positive, but global economic challenges have undermined some of that optimism. Inflation has been higher than hoped, growth slower than anticipated, and real wages and exports both declined. On the positive side, inbound tourist numbers were up, the stock market reached record highs, and domestic consumption held up well.

Prospects for the remainder of 2025 and into 2026 are mixed. The impact of US tariffs is expected to continue to weigh on Japan’s economy. Inflation is expected to ease and there is hope that real wages will increase.

Overall, exports from New Zealand to Japan grew strongly in the first half of 2025, up 5.3% on an annual basis for the year ending June 2025. Dairy, horticulture, and food and beverages exports grew while aluminium, meat and forestry exports declined. Imports from Japan saw a significant decline, mainly in automobiles and oil (diesel). This helped push New Zealand into a trade surplus with Japan for the first time since 2021. Services trade continues to recover but remains below pre-pandemic levels due to the slow recovery of overall outbound tourism from Japan.

With the Takaichi administration term only recently having assumed office it is too early to assess the economic impact of the new administration. The Nikkei Stock Market reacted positively to Prime Minister Takaichi’s inauguration, reaching record highs.

Report

Economic outlook

In its monthly economic report for October the Cabinet Office assessed that the Japanese economy was recovering at a moderate pace. There was mixed news for Japan regarding economic growth figures. Earlier estimates of a 0.04% contraction of real GDP in Q1 of 2025 were revised upwards to positive growth of 0.1%. Q2 growth estimates were also revised upwards, to 0.4%, driven by stronger than expected business investment and private consumption growth. However, recent Q3 figures showed a fall of 0.4%.

The Consumer Price Index (CPI) has increased 3.8% for the year ending June 2025, driven mainly by increases in food prices (up 6%). The Bank of Japan forecasts core CPI for the 2025/26 fiscal year to sit between 2.5-3.0%. Despite nominal wages continuing to rise, the first nine months of the year saw consecutive declines in real wages.

Corporate profits are under pressure. According to the Bank of Japan Quarterly survey for September 2025, company profits are expected to be down 1.9% for the first half of 2025 and down 7.8% for the second half (compared to the same periods for 2024). The number of corporate bankruptcies has been on the rise.

Inbound tourism is providing a welcome boost for the economy. The year to August 2025 saw 28.4 million visitors, putting Japan on track to beat last year’s record of 36.9 million visitors.

During its October review the Bank of Japan kept interest rates unchanged at 0.5%, with the last increase in January 2025.

US tariffs impact

During the six months since US tariffs were introduced (April to September) Japan’s trade surplus with the US shrank 22.6% to JPY 9.7tn (NZD 111bn) compared to a year prior, with exports falling 10.2% and imports falling 2.0%.

Japanese automobile exports to the US have been significantly impacted by US tariffs. Automobile export volumes to the US for the six-month period from April to September dropped 2.4 percent by volume, while in value terms it dropped 22.7%. This indicates automobile manufacturers have responded to the tariffs by lowering their prices.

Across other sectors there have been mixed responses to US tariffs including passing the cost through to consumers, increasing efforts to reduce costs, and looking to new markets outside the US.

Structural issues worsening

One of the most significant structural issues facing the Japanese economy is its declining and aging population. Labour shortages and increased health and social expenditures are long-standing related issues. The population in Japan at the start of 2025 was 124.3 million, which represented a decline of 0.44% from a year prior. In 2024 deaths of Japanese nationals (1,599,850) were more than double the number of births (687,689). The number of foreign residents in Japan rose by 354,089, a 10.65% increase, to 3,677,463.

Japan continues to maintain extremely high government gross debt to GDP levels, estimated to be 248.7%. This represents a small decline from an estimated 251.2% in 2024. Rising interest rates are increasing Japan’s debt servicing costs, which the Ministry of Finance expects to surpass JPY 30tn (NZD 350bn) for the first time.

International trade snapshot

During the April to September 2025 period Japan’s overall exports rose 0.2% in value compared to a year earlier, while imports fell 3.2%. Import declines were driven by significant declines in the value of oil, coal and LNG imports. Japan’s trade deficit shrank by 61.2% during this period to JPY 1.22tn (NZD 14bn).

Trade with New Zealand

For the year ending June 2025, two-way trade was NZD 8.83bn, compared to NZD 9.59bn the year prior. Japan was New Zealand’s 6th largest trading partner and 4th largest export market during this period.

The main change has been a significant reduction in imports from Japan, which is dominated by vehicle imports. For the year ending June 2025 imports were NZD 4.25bn, compared to NZD 5.24bn a year prior. Vehicle imports decreased 17.7% during this time. Mineral Fuels and Oils (largely diesel) also declined 29.3%. Meanwhile New Zealand exports to Japan grew to NZD 4.58bn, up from NZD 4.35bn (an increase of 5.3%).

| New Zealand Goods Trade with Japan (NZD year to June 2025) | |||

|---|---|---|---|

| Total Goods Trade | $7.69bn | ||

| NZ Exports | $3.86bn | NZ imports | $3.84bn |

| Main exports | Dairy Products; Fruits and Nuts; Aluminium; Meat and Edible Offal; Wood | Main imports | Vehicles; Mechanical Machinery; Mineral Fuels and Oils; Electrical Machinery |

New Zealand Goods Exports to Japan by Industry Year Ending Sept 2025

| Industry | Year Ending September 2025 | ||

|---|---|---|---|

| $ Millions | % Change | % Share | |

| Dairy | 1,031 | 12.2 | 26.6 |

| Horticulture | 850 | 20.1 | 22.0 |

| Aluminium | 491 | -14.9 | 12.7 |

| Meat | 436 | -8.9 | 11.3 |

| Forestry | 306 | -4.7 | 7.9 |

| Miscellaneous food | 257 | 22.4 | 6.6 |

| Fish | 66 | -6.9 | 1.7 |

| Subtotal of leading Industries | 3,437 | N/A | 88.8 |

| Other goods | 434 | N/A | 11.2 |

| Total | 3,871 | 5.42 | 100 |

Source: Global Trade Atlas

Pet food is also worth a mention, as it grew 69.3% for the year ending September 2025 to $32.8m. Wine also grew significantly, up 10.4% to $17.9m (under CPTPP tariffs on wine fell to zero as of April 2025). Both are focus sectors for NZTE in Japan.

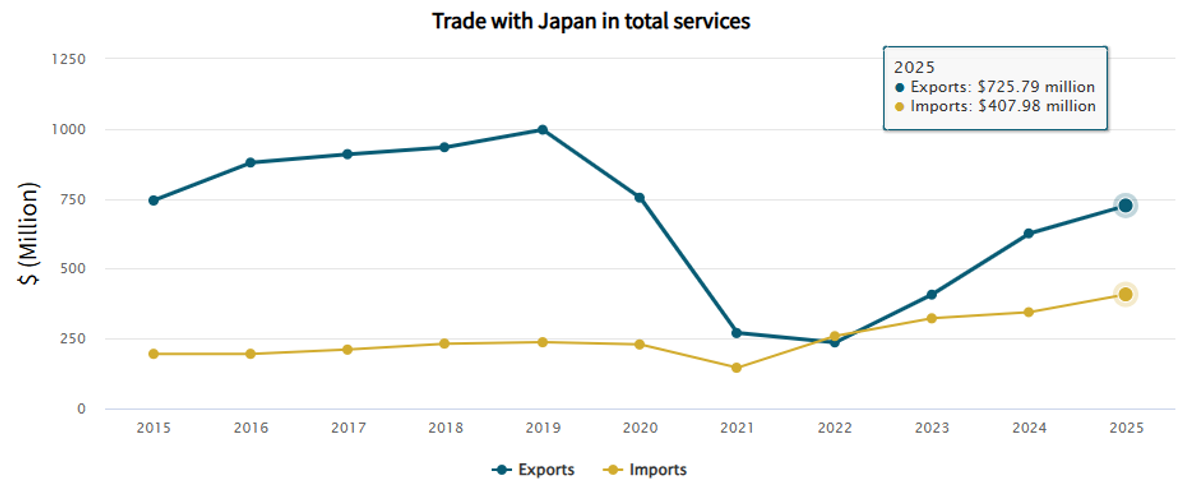

Services trade remains below pre-pandemic levels but has now recovered to around 90% compared to 2019 figures. In the year to June 2025, 72,334 Japanese visitors came to New Zealand. This represents a 72% recovery from pre-pandemic levels. The weak yen continues to dampen demand in Japan for overseas travel, although New Zealand is performing relatively well compared to other long-haul destinations in Japan. Data from the Japan Tourism Board shows that this is changing with 2.44 million Japanese planned to travel overseas during this year’s summer holidays, a 20.8% increase on last year, but still below 2019 figures of 3.03 million. In contrast domestic travel has returned to pre-pandemic levels.

| New Zealand Services Trade with Japan (NZD year to June 2025) | |||

|---|---|---|---|

| Total Services Trade | $1.13bn | ||

| NZ Exports | $725.79m | NZ imports | $407.98m |

| Main exports | Travel; Business Services; Telecommunications and Information Services; Government Services | Main imports | Travel; Business Services; Charges for Intellectual Property; Government Services; Insurance and pension services |

Economic forecasts

Economic forecasts for the remainder of 2025 and into 2026 all come with caveats that considerable economic uncertainty remains, particularly around the impact of US tariffs. The Bank of Japan projected that for the fiscal year 2025/26 (April to March) that the Japanese economy will grow around 0.6%, while the Cabinet Office estimated 0.7%.

Analysts are hopeful that real wage rises are around the corner as continued nominal wage growth could outpace declining inflation. Strong inbound tourist numbers are also expected to continue. Both these factors could help boost consumer spending, which would help support moderate economic growth. In addition, strong inbound tourism and domestic consumption could boost demand for New Zealand exports, particularly in the food and beverage sector.

While it is too early to be able to assess the impact the new Takaichi administration could have on Japan’s economic trajectory, stock markets reacted positively with the Nikkei Stock Average exceeding 50,000 for the first time following her inauguration.

A recent Reuters corporate survey showed 43% of firms expect business conditions to improve under Takaichi’s leadership, compared with just 3% that see deterioration. Political instability and strained relations with China were seen by respondents as key risks.

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.govt.nz

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.

Copyright

Crown copyright ©. Website copyright statement is licensed under the Creative Commons Attribution 4.0 International licence(external link). In essence, you are free to copy, distribute and adapt the work, as long as you attribute the work to the Crown and abide by the other licence terms.