Supply Chains, Food and Beverage:

On this page

This report was jointly prepared by the New Zealand High Commissions in Singapore and Kuala Lumpur.

Summary

Singapore’s food security issues have once again been brought to the fore, as Malaysia’s export restrictions on chicken take effect this week. There has been a run at supermarkets on fresh chicken, while the food and beverage sector is scrambling to alter menu offerings for the period ahead. The Government has urged consumers to continue to purchase as normal, as they work to ensure continuity of supply from other markets.

Report

Malaysia reacts to rising domestic chicken prices and dwindling supplies

Following an emergency cabinet meeting on Monday 23 May, Malaysian Prime Minister Ismail Sabri Yaakob announced that Malaysia will restrict the export of up to 3.6 million chickens a month from 1 June until domestic prices and production stabilise. The move effectively bans the export of chicken to a number of countries, including Singapore, Thailand, Brunei, Japan and Hong Kong.

The export restrictions are designed to respond to rising prices amongst a range of staple consumer products in Malaysia; and are one of a suite of measures put in place by the Government to address the issue, that include the removal of a form of import permit and strategic stockpiling. It followed reports of Prime Minister Sabri publically chastising Malaysian chicken producers for not fully utilising a domestic subsidy scheme, and for allowing prices to be dictated by the free market. The Prime Minister has also singled out what he considers to be cartel behaviour amongst domestic producers, an issue being investigated by the Malaysian Competition Commission.

Singapore food security shows its cracks

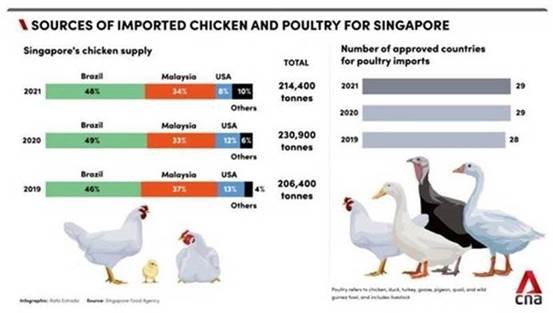

Singapore imports around 34 per cent of its chicken from Malaysia, while nearly half of chicken imports come from Brazil. The United States accounts for 8 per cent of imports, with other countries (including New Zealand) making up the remaining 10 per cent. Almost all imports from Malaysia enter Singapore as live chickens which are then slaughtered and chilled locally. This is to accommodate strong consumer preferences for fresh chicken, with many eateries reluctant to move to using frozen product.

Following the announcement in Malaysia, the price increase in chicken in Singapore was immediate, with suppliers expecting the price will go up by a further $1.20kg this week. Chicken suppliers in Malaysia have been scratching around to send as many chickens as they can across the causeway before the export ban takes effect on 1 June. The Consumers Association of Singapore and the Singapore Food Agency have advised consumers to consider alternative sources of chicken and meat products and frozen options for now and to only buy what they need. Supermarket chain FairPrice announced it has a stockpile of frozen chicken that can last for about four months, with another two months of supply on the way.

34% of Singapore's chicken is exported from Malaysia

$1.20kg expected price increase this week

Inflation comes home to roost

The chicken shortage has exacerbated broader inflation and supply chain issues which have been felt since the start of the pandemic. One of the main issues facing importers is price, rather than lack of supply. Singapore has been working to diversify its sources of food so is well equipped to bring in chicken from other countries, however the price point is much higher than the Malaysian product. The chicken shortage comes on top of problems sourcing palm oil from Indonesia, as well as price escalation of rice in Thailand and Viet Nam.

According to the Monetary Authority of Singapore, inflation is expected to peak in the third quarter of this year, with food inflation a particular concern. As more countries in the region implement protectionist policies to secure their own food supplies, the longer-term effects of Malaysia’s chicken ban will depend on how long the ban will last and how fast Singapore is able to switch sources. Secretary of the Ministry of Trade and Industry Gabriel Lim acknowledged that, as a small and open economy reliant on imports, it would be impossible to “completely shield Singaporeans” from the impact of such disruptions.

Singapore Prime Minister Lee noted it is “regrettable” that countries have started increasing food export controls as these measures have an adverse impact on a consumer country like Singapore. Without naming specific countries, PM Lee said the situation was “not so surprising” given the disruption in the global food supply chains due to the Ukraine war and high inflation. When asked if Singapore would consider taking WTO action, PM Lee noted the process to seek redress is lengthy and securing food supply was the more immediate concern.

Comment

The chicken shortage has landed amid increasing food prices in Singapore and an economy that is already feeling the pinch of inflation. It has been two years since Covid-19 related food shortages saw the creation of the Singapore New Zealand Airfreight Project (SNAP), yet food security and supply chain resilience remain a sharp focus for the city-state. New Zealand has a continuing role to play in providing safe and high quality food to Singapore.

More reports

View full list of market reports.

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.