Food and Beverage, Primary Products, Services, Sustainability:

Summary

The Philippine economy grew by 5.6 percent in 2024, driven by steady household consumption and investment in infrastructure. A similar level of growth is forecast for 2025 and 2026 due to a robust labour market and low inflation. The Philippines is on target to reach upper-middle income status in 2027 and is anticipated to become one of the world’s top 20 economies by 2050.

New Zealand-Philippines trade grew by 18.1 percent to a record high of NZ$1.63 billion in the year ending March 2025. New Zealand exports increased by 19.2 percent to NZ$1.18 billion, with key exports of dairy, tourism and meat all seeing significant growth. NZTE recorded a 25 percent increase in the value of customer contracts in the Philippines, including for dairy, beverages and geothermal energy.

Report

Philippine economic growth remained steady in 2024, but the government has slightly lowered 2025 targets

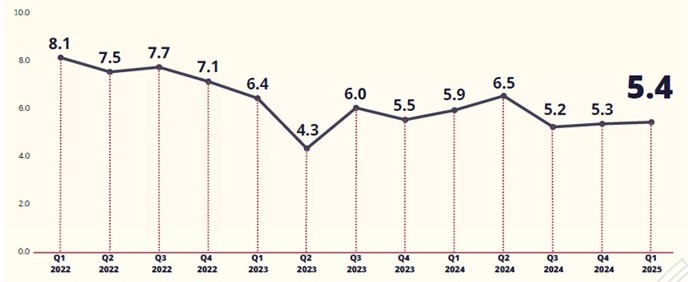

The Philippine economy grew by 5.6 percent in 2024 on the back of steady domestic household consumption and increased public and private investment. This GDP growth was third in Southeast Asia, behind Viet Nam (7.1 percent) and Cambodia (six percent). But growth was lower than the government’s target rate of 8-10 percent (as outlined in the Philippine Development Plan 2023-2028).

Gross Domestic Product, Year-on-Year Percent Change, Q1 2022–Q1 2025

The Philippine government's debt stands at 63.2 percent of GDP, alongside a trade deficit of US$53.4 billion. Goods and service imports outpaced exports, but there was a significant increase in service exports, which make up approximately 60 percent of all exports. This growth was led by tourism (8.7 percent increase; 14.0 percent of GDP) and business process outsourcing sectors (7.7 percent increase; 8.1 percent of GDP). Investment grew by 7.5 percent due to a lift in public and private construction (12.3 and 9.2 percent increases, respectively), including key railway and airport infrastructure projects.

Remittances from overseas Filipinos reached a record high of US$38.3 billion (up 3 percent) in 2024. Remittances continue to play an important role in the economy, representing 8.3 percent of total GDP and driving discretionary household spending and investment into micro, small and medium enterprises (MSMEs). 99.2 percent of businesses are MSMEs. Inflation reduced to 3.2 percent from 6 percent in 2023. Unemployment was 3.8 percent (down from 4.4 percent), with 2.6 million jobs created during the year (mainly in the service, industry and agriculture sectors). However, the underemployment (13.3 percent) and youth unemployment (12 percent) rates remained high, indicating a significant underutilised workforce. (Comment: for survey purposes, a person is considered employed where they worked for at least one hour for pay or in a family business.)

On 26 June, Philippine Budget Secretary Amenah Pangandaman announced a lowering in the 2025 GDP growth target from 6-8 percent to a 5.5-6.5 percent range. She said this reflected “heightened global uncertainties” such as Middle East tensions and the US proposed tariffs. Socioeconomic Planning Secretary Arsenio Balisacan said he expected the Philippines will meet the revised growth targets due to an expected increase in private spending from low inflation and interest rates and a robust labour market. He noted that “at our current growth trajectory—and barring significant external shocks—we anticipate reaching a US$2 trillion economy by 2050” (from current US$392 billion). He said this would place the Philippines within the world’s top 20 economies (currently 33rd).

President Ferdinand Marcos Jr outlined his vision for the economy during his annual State of the Nation Address (SONA) on 28 July. He highlighted his administration’s continued drive to progress large-scale infrastructure projects across the country and to increase agricultural productivity. He called for increased foreign investment to all parts of the Philippine economy, noting the Filipino workforce’s readiness. Marcos also announced substantial investments to the education sector to lift the quality of senior high school graduates so they would be employable into higher paying jobs.

A growing number of Philippine businesses are internationalising. Iconic Philippine fast-food chain Jollibee is now the 10th largest restaurant operating globally. SM Malls have expanded into China and Viet Nam. Hotel operator Double Dragon has ambitious plans for its international Hotel101 chain and listed this year on NASDAQ. There is also increasing air connectivity. Manila’s Ninoy Aquino International Airport saw its highest ever flight and passenger numbers in 2024, with both passengers (10.4 percent) and flights (4.8 percent) up on 2023. Meanwhile, Clark International Airport (100km north of Manila) is also growing quickly, experiencing a 20 percent increase in passenger numbers and a 29 percent increase in flight operations in 2024 (just over half of flights are international routes).

Forecasts from the International Banks – positive but expected timing for Philippine transition to upper-middle income status delayed

The World Bank is forecasting a similar 5.3 percent Philippine GDP growth for 2025, also noting the robust labour market and low inflation levels. It revised its forecast for the Philippines to transition from lower-middle income status to upper-middle income status from 2025 to 2027, in reflection of lower-than-expected economic growth. The Manila-headquartered Asian Development Bank (ADB) expects the Philippines to “remain a bright spot in Southeast Asia” in 2025 and 2026 through stronger domestic demand and sustained public investment. Both banks saw the private sector’s effective utilisation of the recent government economic and trade reforms to boost job creation as a key driver of future growth.

New Zealand–Philippines trade continues to set records

New Zealand-Philippines two-way trade has continued its strong post-pandemic rebound, reaching a record high of NZ$1.63 billion for the year ending March 2025. This represents an 18.1 percent increase on the same period the previous year, when New Zealand Prime Minister Christopher Luxon and Philippine President Ferdinand Marcos Jr. announced a goal in April 2024 to increase two-way trade by 50 percent by 2030. The Philippines is New Zealand’s 21st largest trade partner.

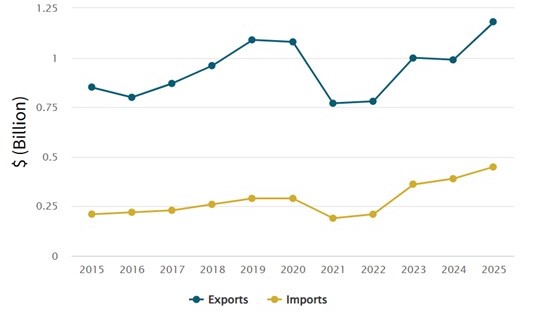

Trade with Philippines in total goods and services

New Zealand exports to the Philippines increased by 19.2 percent to NZ$1.18 billion, with the Philippines rising one place to be our 19th largest export market. Key exports were dairy (NZ$668 million, up 23 percent); travel (NZ$221 million, up 14 percent); meat and offal (NZ$58 million, up 55 percent); wood (NZ$36 million, down one percent); and paper products (NZ$30 million, up 75 percent). This growth was second only to Indonesia, in terms of New Zealand exports to Southeast Asia.

While goods still dominate total New Zealand exports to the Philippines, service exports have seen a remarkable year-on-year recovery from NZ$65 million in 2022 to the current record high of NZ$269 million. Tourism features most prominently, with 31,523 Filipino visitors in the year ending May 2025, New Zealand’s second largest source market in Southeast Asia (behind Singapore)[5]. This growth has been achieved despite the suspension of direct flights since the pandemic.

Philippine imports to New Zealand increased by 15.4 percent to NZ$449.54 million, making the Philippines New Zealand’s 29th largest source of imports. Key imports were travel (NZ$125 million, up 18 percent); other business services such as call centres (NZ$53 million, up five percent); electrical machinery and equipment (NZ$50 million, up 2 percent); fruits and nuts (NZ$35 million, up 45 percent); and mechanical machinery (NZ$15 million, up 21 percent). In 2024, there were a record 47,148 visits by New Zealanders to the Philippines, and in the first four months of 2025, the total already stood at 17,761.[8] New Zealand awareness of the Philippines as a tourism destination has been buoyed by the Philippine government’s “Love the Philippines” tourism promotion and the growing Filipino diaspora in New Zealand (over 108,000 in the March 2023 census).

Opportunities and challenges for New Zealand companies in the Philippines

With a large (113m), young (average age of 27) and largely English-speaking population and having achieved remarkable progress towards middle-income status, the Philippines presents significant opportunities for New Zealand businesses, particularly those that can support the Philippines’ food security, trade diversification and renewable energy priorities. New Zealand’s trade with the Philippines benefits from the ASEAN-Australia-New Zealand Free Trade Agreement (AANZFTA) and the Regional Comprehensive Economic Partnership (RCEP).

Opportunities

Opportunities continue in the traditionally strong food and beverage sectors. The Philippines is a large importer of food, including 99 percent of its dairy needs (New Zealand supplies approximately 24 percent). It is looking to strengthen its agricultural sector and diversify trade relationships to generate income and reduce vulnerability to external shocks. New Zealand businesses are well-placed, as the Philippine government holds in high regard New Zealand agricultural products and technical expertise. There are opportunities to expand New Zealand wine in the growing Philippine consumer market (only NZ$800,000 was exported to the Philippines in 2024).

Renewable energy is another existing focal sector for New Zealand companies, with further potential. The Philippines’ goal is to increase the share of renewable energy in its electricity mix from around 22 percent to 50 percent by 2040. Initial approved projects have been for offshore wind and solar, and the Philippines is also looking to increase geothermal energy generation (home to the world’s 3rd largest geothermal reserves). New Zealand, both government and commercially, has supported the Philippines’ geothermal sector since the 1960s.

There are considerable opportunities in emerging sectors, such as tourism and international education. Participation at all Education NZ’s study seminars and agent workshops in Manila, Bacolod and Cebu in May/June this year was high. Philippine agencies for higher education and technical education have both travelled to New Zealand in the past year to source vocational training.

Two business chambers provide support to New Zealand businesses in the Philippines: the Philippines-New Zealand Business Council, and the Australia New Zealand Chamber of Commerce (ANZCHAM). NZTE’s Trade Commissioner sits on the board of ANZCHAM.

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.

Copyright

Crown copyright ©. Website copyright statement is licensed under the Creative Commons Attribution 4.0 International licence(external link). In essence, you are free to copy, distribute and adapt the work, as long as you attribute the work to the Crown and abide by the other licence terms.