Food and Beverage, Manufacturing (excludes F&B):

On this page

Summary

- Poland is one of the world’s largest markets for dietary supplements, with 89% of Poles using them, driven by increasing health awareness and interest in active lifestyles as well as the power of marketing and innovation. With a population of approximately 38.1 million people in 2025, this widespread usage reflects a significant consumer base.

- The market is rapidly expanding, with online sales and premium-quality products gaining traction alongside traditional pharmacy sales.

- Emerging trends include demand for vegan, gluten-free, and natural supplements, was well as growing interest in superfoods, CBD-based products and personalised products.

- The introduction of new dietary supplements into the Polish market is not a complicated procedure. No permit is required, just a notification to a relevant body.

- Due to New Zealand’s reputation as a clean and green country committed to sustainable production, Kiwi supplements are well-positioned to resonate with Polish consumers.

Report

Polish dietary supplements market dynamics

The dietary supplements market in Poland remains one of the most rapidly expanding segments of the national economy. In 2024, its value was estimated at USD 2.22 billion, with projections indicating a compound annual growth rate (CAGR) of 10.9% between 2025 and 2030 (Grand View Research, Poland Dietary Supplements Market Size, Share & Trends Analysis(external link)).

Poland also leads globally in supplement consumption. According to Statista Consumer Insights, an impressive 89% of Polish consumers reported using dietary supplements between April 2023 and March 2024. Supplements are particularly popular among women (62.6%), though men (46.9%) also contribute significantly to this trend.

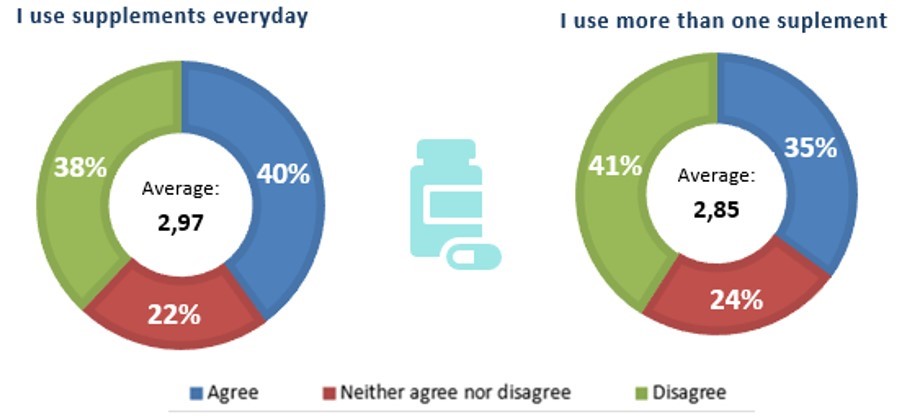

Further insights from a PMR Market Experts study (Dietary Supplements Market in Poland 2024(external link)) reveal that:

- 40% of Poles take supplements daily,

- 18% use them occasionally,

- 35% consume multiple types simultaneously.

Pole's consumption habits when using dietary supplements (%), July 2024

The sector’s sustained popularity is driven by a combination of factors:

- Health consciousness is rising, with many Poles actively seeking preventive solutions to maintain well-being.

- Self-medication is becoming more common in Poland, driven mainly by convenience, immediate availability, and time-saving nature of over-the-counter supplements.

- Dynamic marketing strategies, successfully capturing consumer interest, often drawing on familiar formats used in pharmaceutical advertising.

- The expansion of e-commerce in Poland (see Poland – e-commerce offers real opportunities for Kiwi companies - August 2023) and health-focused digital platforms has made supplements very easily accessible and customisable.

- Demographic changes, particularly the aging population, are increasing demand for products that support long-term vitality. The geriatric segment is anticipated to drive the largest demand for supplements over the 2025-2030 period due to aging trends and chronic disease prevention needs.

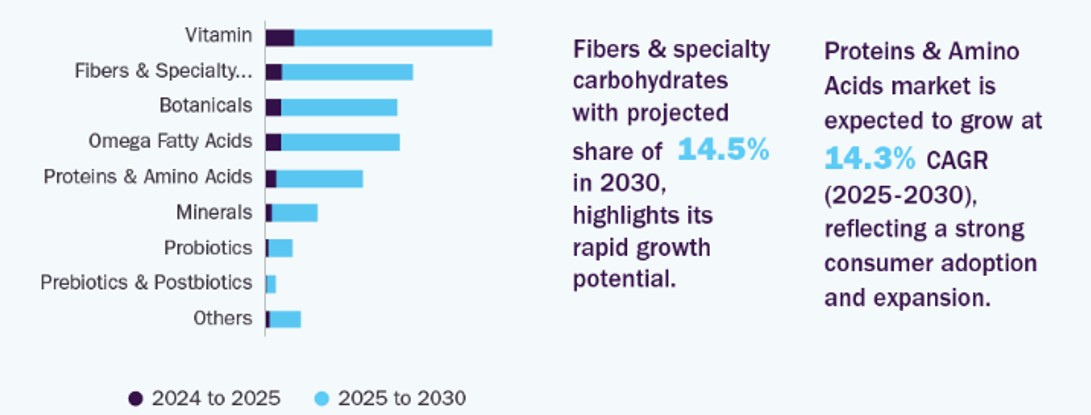

What supplements do Poles buy?

Poles prefer traditional forms of supplements like tablets or capsules which are viewed as more convenient to use, simpler and more precise to dose and because their shelf life is longer compared to powders or liquids. Many consumers, especially older adults, see tablets as a more professional or medically-trusted option. Dissolvable tablets rank second. Next, come the “gummies” due to their pleasant taste and chewable form. The gummies segment is anticipated to grow the fastest between 2025 and 2030. The least popular forms are oral sprays, syrups and oils, favoured by only 1% of Polish supplements consumers.

In Poland, the most widely used dietary supplements are vitamins and minerals, followed by products aimed at supporting weight management, improving sleep, strengthening hair, skin, and nails, and reinforcing the immune system.

The products most frequently purchased are:

- Immunity-focused supplements especially ones containing vitamin C, vitamin D, zinc, echinacea, and elderberry. Those held the largest share of the market in 2024.

- Probiotics supporting gut health and aiding digestion.

- Products with adaptogens like ashwagandha and rhodiola as a natural answer to stress and sleep problems.

- Sports supplements like protein powders, amino acids, and performance-enhancing supplements.

- Collagen and nutricosmetics widely used in products belonging to the "beauty from within" segment experiencing a real boom in Poland.

- Tailor-made supplementation for consumers willing to use products customised based on individual genetic testing or gut microbiome analysis.

Polish women appreciate the critical role nutrition plays in maternal and foetal health. Increasing numbers are incorporating targeted supplements—such as folic acid, iron, calcium, and DHA—into their routines, often beginning even before conception. The prenatal health segment is projected to grow at the fastest rate between 2025 and 2030. On the other hand, as more individuals enter the 65+ age bracket, there is a rising demand for supplements that support bone density, joint flexibility, heart health, vision, cognitive function, and overall vitality.

Consumers on restrictive diets are increasingly opting for vegan, gluten-free, or lactose-free versions of supplements. The demand for products that are organic, free from artificial additives, preservatives, allergens, and GMO is growing. The popularity of superfoods (rich in vitamins, minerals, and antioxidants) is also on the rise. Manuka honey is gaining recognition as a superfood in Poland.

Poland Dietary Supplements Incremental Growth Opportunity from 2024 to 2030 (USD Million)

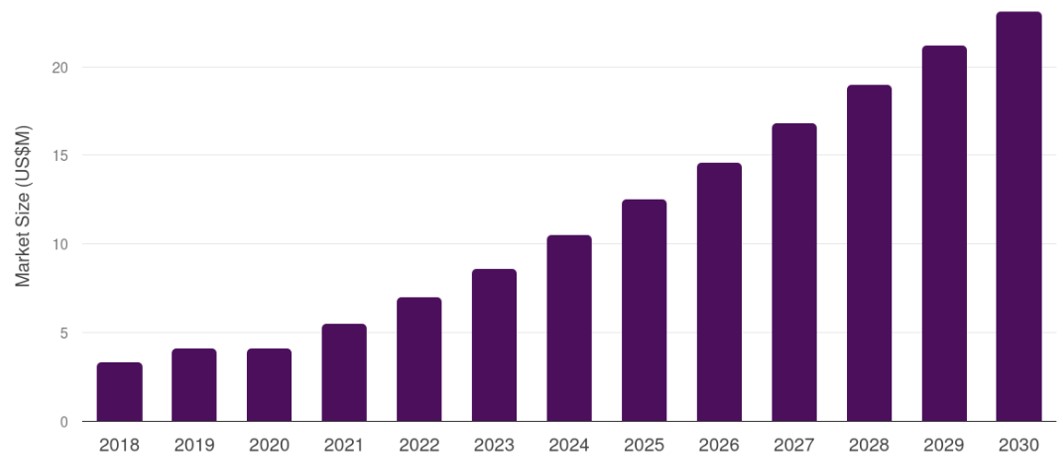

Additionally, Poles more often opt for CBD-based non-medical products such as tablets, oils, hemp flours and teas. They are especially well-regarded by health-conscious individuals who prefer natural ways to support their well-being. Many people are looking for alternatives to traditional medicines and supplements, gravitating towards options perceived as more natural and with fewer side effects. According to Grand View, Polish CBD nutraceuticals market generated a revenue of USD 19.3 million in 2024 and is expected to reach USD 44.2 million by 2030. It is expected to grow at a CAGR of 12.7% from 2025 to 2030.

Poland CBD nutraceuticals market 2018–2030

The ecological aspect of production and supply chain transparency are gaining importance. Younger generations, particularly millennials and Gen Z, increasingly embrace clean-label products.

Interestingly, supplements for pets are also gaining popularity. According to official data from Kantar Public’s study “Animals in Polish Households”, over half of Poles own pets. The most common are dogs (42%), followed by cats (26%). Poles treat their pets as family members. They are becoming increasingly aware of their nutritional needs and are willing to invest in their health as they do in their own.

Where do Poles buy their supplements?

The choice of supplements is mainly influenced by medical or pharmacist recommendations. Supplements are still mainly purchased at traditional stationary pharmacies. However, online pharmacies like DOZ(external link), eZIKO APTEKA(external link) or Cefarm24(external link), are rapidly gaining ground. Convenience, access to a wider range of products, and the ability to compare prices and opinions are the main reasons for this change. The online trend escalated during the COVID-19 pandemic and continues to this day. Very high consumer interest in purchasing supplements online, is also due to their wide availability. They are not only available in online pharmacies or drugstores but can also be purchased in online sports shops, herbal shops or health food outlets. Between 2016 and 2023, the percentage of Poles purchasing supplements online rose from 5% to 36%.

It is worth noting that Polish consumers often prioritise quality over cost. Over half of consumers believe in investing in high-quality supplements, even at higher prices, reflecting a preference for value rather than just affordability.

Entering the Polish supplement market: Legal regulations

In Poland, a dietary supplement is defined as “a food product designed to supplement a regular diet, containing concentrated sources of vitamins, minerals, or other substances with a nutritional or physiological effect, offered in a form that allows for precise dosing”. In short, they are legally treated as food, not medicine.

Introducing new supplements to the Polish market is relatively straightforward. Rather than needing a permit, it only requires notifying the Chief Sanitary Inspectorate (GIS). Sales can start immediately after this notification is submitted. Specific requirements for the composition and labelling of dietary supplements are outlined in the Regulation of the Minister of Health dated October 9, 2007(external link). Experts point to a lack of comprehensive regulations governing the advertising of these products. A draft law addressing this issue has been awaiting parliamentary review for nearly two years.

Superfoods and CBD-based products are subject to separate regulations at the European Union level. Under Regulation (EU) 2015/2283 of the European Parliament and Council(external link), all products containing CBD extracts or derivatives intended for market distribution must be classified as “novel foods” and undergo an approval process. This applies to extracts as well as products that include CBD as an ingredient. Following EU authorisation, novel foods can be introduced to the Polish market through notification to the Chief Sanitary Inspector.

Future prospects for Poland’s supplement market

The value of the Polish dietary supplements market increased from nearly USD 1.68 billion in 2022 to about USD 2.22 billion in 2024, reflecting growth of roughly 32.1% over this period. While the pace of expansion is expected to be more moderate in the coming years, the market remains on a positive trajectory, driven by shifting consumer attitudes, technological innovation, and evolving retail dynamics.

Product innovations, including the personalisation of supplementation based on genetics and biomechanics, are expected to contribute to the market’s development. E-commerce is projected to continue its expansion as the preferred channel for purchasing dietary supplements.

Consumers will be increasingly interested in the origins and production methods of the supplements they purchase. Transparency regarding ingredient sources, production methods, and environmental impact is becoming an essential factor in product selection.

Despite its promise, the Polish dietary supplements sector faces several structural shifts and challenges. The industry is likely to split into two distinct segments: a price-sensitive mass market and a premium segment characterised by innovation, quality, and brand trust. Stricter regulatory oversight should be anticipated, particularly in advertising.

Conclusion

Poles are among the most avid consumers of dietary supplements globally, presenting a unique opportunity for New Zealand producers. New Zealand products, which emphasise quality, purity, and natural ingredients, align well with these preferences, and are particularly appreciated by Polish consumers. Leveraging New Zealand’s reputation for excellence and environmental stewardship, Kiwi dietary products have the potential to gain the trust and loyalty of the Polish market.

Key opportunities include:

- Supplying high-quality products that cater to health-conscious and environmentally aware Polish consumers.

- Introducing innovative formats or ingredients, such as superfoods and CBD-based options.

- Leveraging the growing e-commerce sector to reach Polish customers effectively.

New Zealand businesses entering the Polish market are likely to tap into its dynamic growth and foster a long-term presence in one of Europe’s most promising dietary supplement markets.

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.govt.nz

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.

Copyright

Crown copyright ©. Website copyright statement is licensed under the Creative Commons Attribution 4.0 International licence(external link). In essence, you are free to copy, distribute and adapt the work, as long as you attribute the work to the Crown and abide by the other licence terms.