Food and Beverage, Primary Products, Services:

Overview

Saudi Arabia is in the middle of a transformative period of economic and social change. The custodian the two holiest sites in Islam is taking a leading – and convening role – in global affairs and projecting itself internationally. Its G20 economy is increasingly dynamic and a powerhouse within the MENA region. More open and easier to visit than ever before, the Kingdom is also now a global sporting and entertainment hub.

Saudi Arabia is investing hugely in its economic transformation driven by a pipeline of public investment projects known as the Giga projects. That investment – together with a programme of social and regulatory reform, evolving consumer behaviour and the Kingdom’s demographics – is fuelling growth in new industries: tourism, manufacturing, entertainment and Esports.

While oil still looms large (production is forecast to be between 9 and 10 million barrels per day in 2025), Saudi Arabia realised an economic milestone in 2024 during which the non-oil sectors accounted for a majority (52%) of GDP. The Kingdom boasts huge mineral wealth estimated to be valued $2.5 trillion USD. At the same time, it is investing in transport and logistics (including through its new flag carrier, Riyadh Air) with the goal of becoming a bridge between Europe and Asia. Saudi Arabia is concurrently focused on private sector reform, digitalisation and improving ease of doing business, and has set itself the ambitious goal of attracting 100 billion USD in annual foreign direct investment by 2030.

Bilateral Export Profile

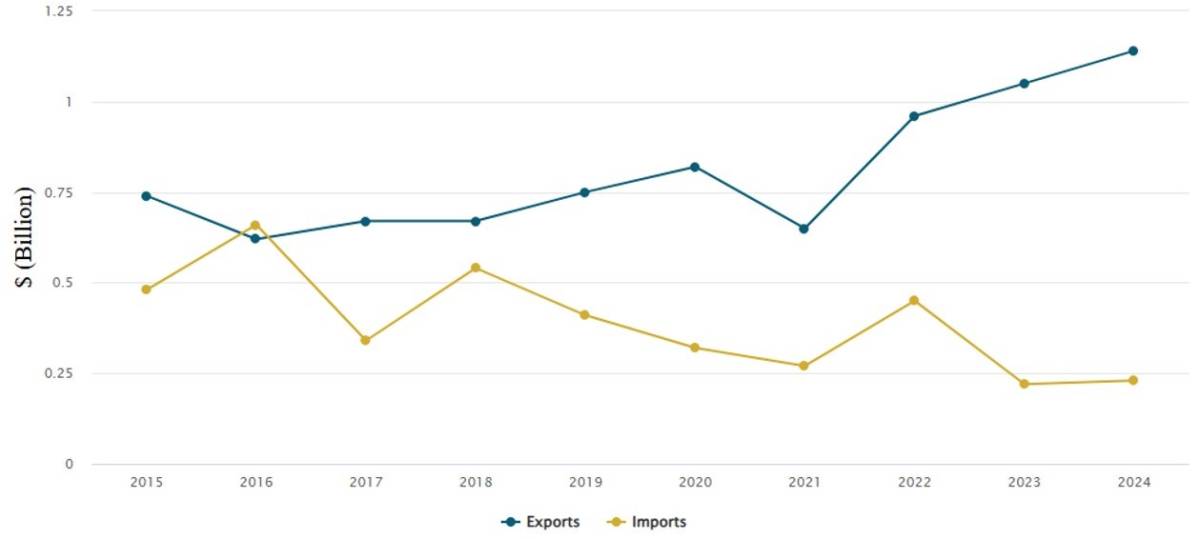

New Zealand’s export profile with Saudi Arabia has grown relatively steadily in the past decade, from $750 million NZD in the year ending 2015 to $1.14 billion NZD in the year ending 2024.

Trade with Saudi Arabia in total goods and services

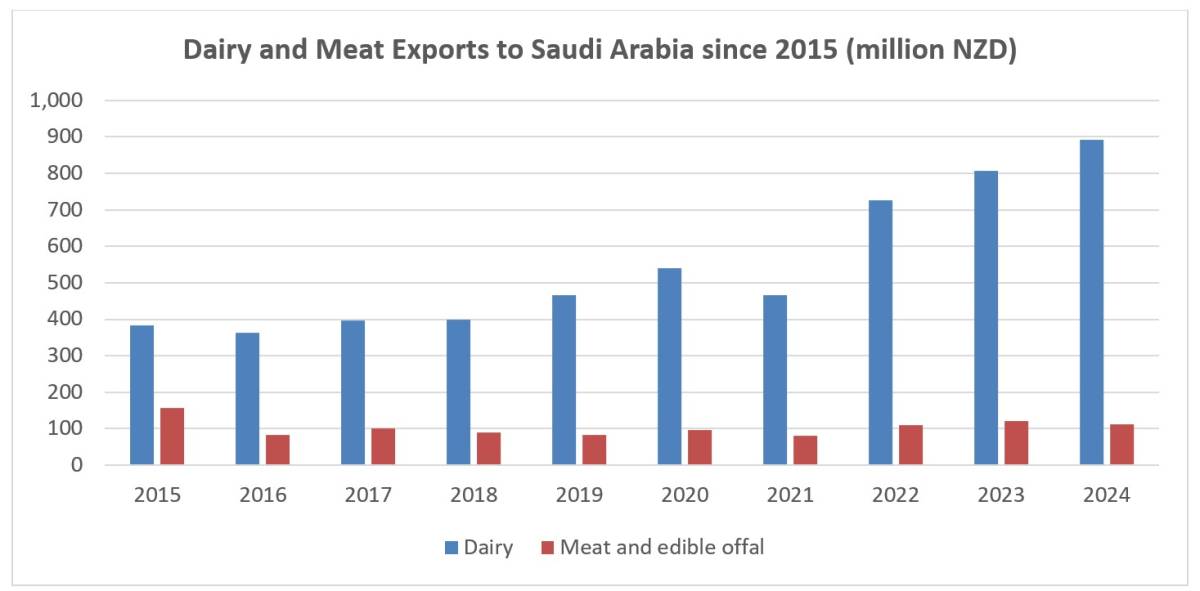

New Zealand’s world class dairy and meat products make up the bulk of our export profile. Growth has predominantly been driven by increasing demand for dairy, while meat exports are marginally down on 2015 figures.

Dairy and meat exports to Saudi Arabia since 2015 (million NZD)

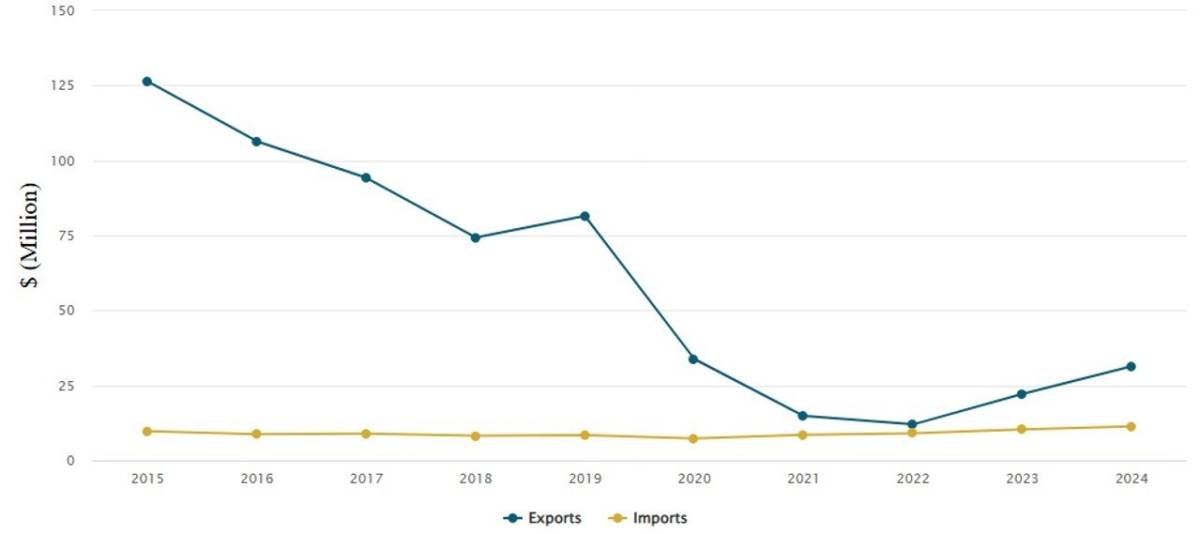

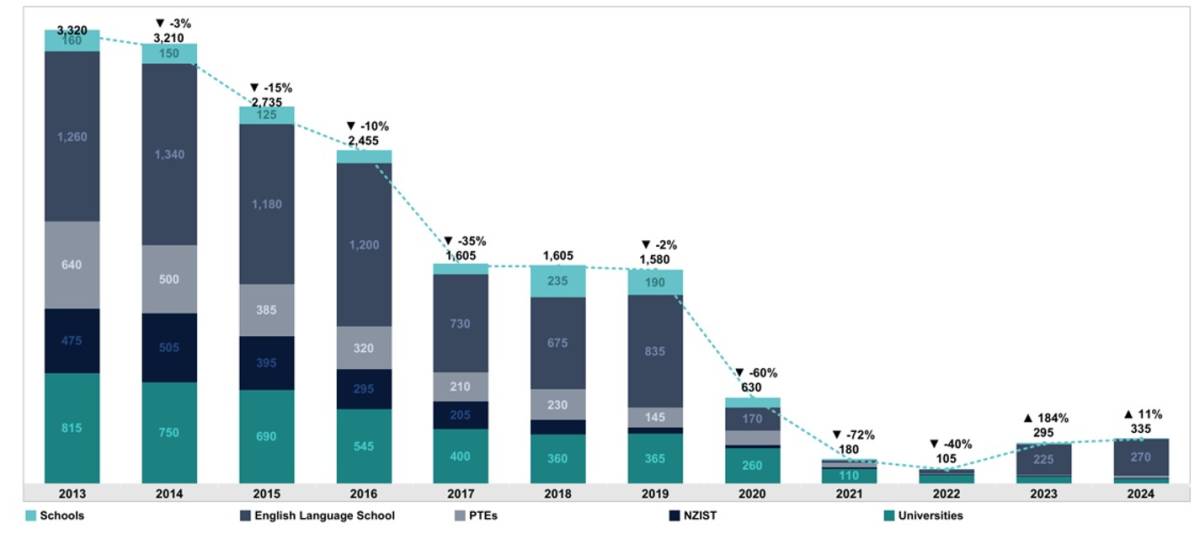

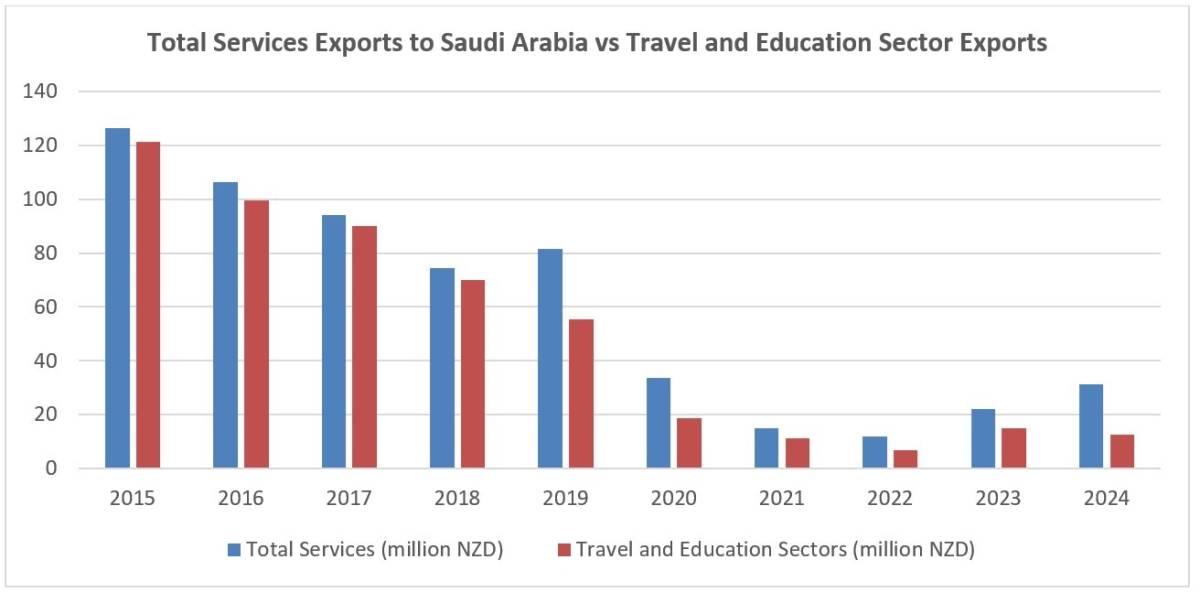

Services exports had been on a downward trajectory from 2015 and fell sharply in 2020-2022. Across the first half of the last decade these were dominated by the travel and international education sectors reflecting the thousands of Saudi students studying in New Zealand under the King Abdullah and Custodian of the Two Holy Mosques scholarship programmes. The downward trend was due to a falling number of students studying in New Zealand owing to an evolution in how Saudi Arabia administered its scholarships programmes, while New Zealand’s COVID-19 border settings accounted for the sharp drop across 2020-2022.

Trade with Saudi Arabia in total services

New Zealand international student enrolments 2013–2024

Since 2023 we have seen services exports begin to recover and round out at $31 million NZD in 2024. Ten years ago the travel sector (including international education) made up 95% of our services profile. In 2024 this sector accounted for $12 million – just over a third of our services profile (other services exports are not publicly available owing to confidentiality). While the sum of our services exports is smaller than a decade ago, we are seeing an increasing diversity in their composition, attributable to the growth in non-travel and education services.

Total services exports to Saudi Arabia vs travel and education sector exports

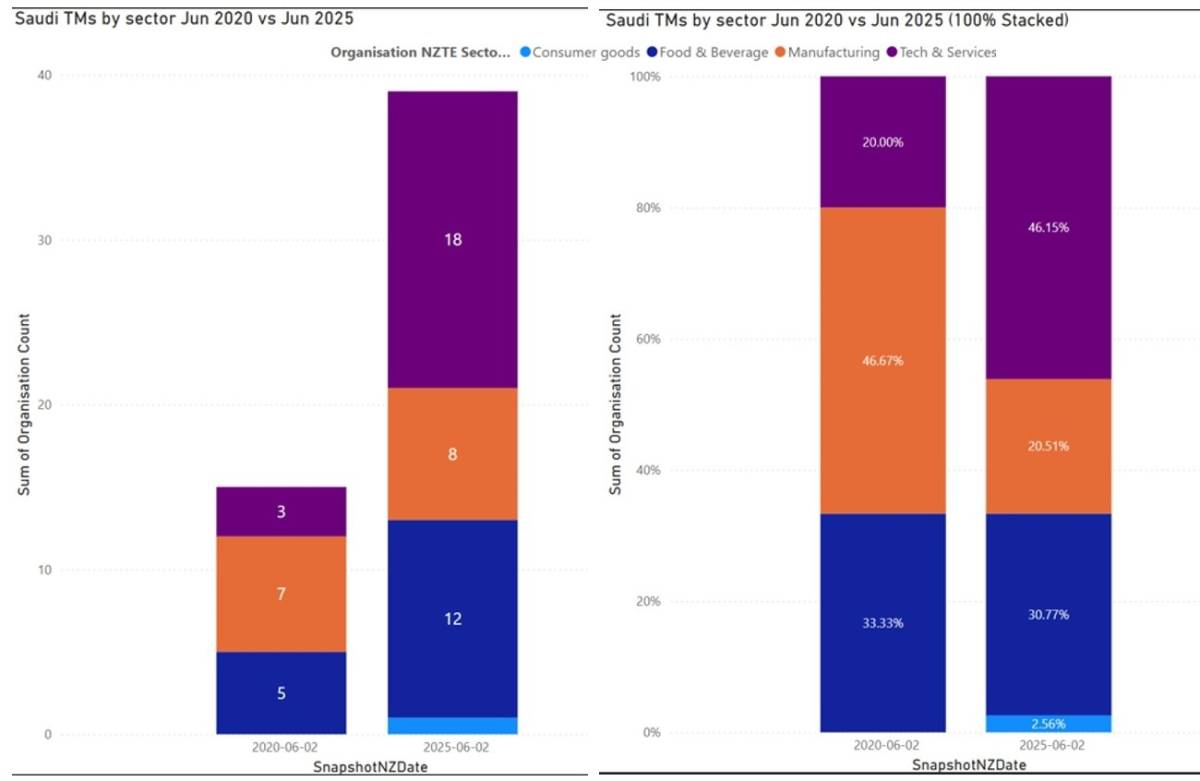

Five years ago NZTE was supporting 15 focus target companies doing business in Saudi Arabia. That figure has increased by 250% and is now 38, with a total of over 100 New Zealand companies indicating interest in the Saudi market (left).

All sectors have experienced growth but their composition as a proportion of total focus target companies has changed markedly over the last 5 years. Tech and services now make up almost 50%, followed by food and beverage at 30% and manufacturing at 20% (right).

Burgeoning Sectors

New Zealand’s primary exports have a very good reputation in Saudi Arabia and we expect these to continue to do well in the future. The following are burgeoning sectors where the Ministry of Foreign Affairs and Trade and New Zealand Trade and Enterprise see opportunities for New Zealand businesses.

Food Security

Saudi Arabia imports some 80% of its food but its Agriculture Ministry is aiming to localise 85% of its food industry by 2030 – an objective which it sees through the lens of food security [2]. A dearth of arable land (estimated to be 1.6%) means Saudi Arabia is innovating in areas like vertical farming – aiming to launch over 600 vertical farms in the next five years – while also investing in the development and implementation of advanced breeding techniques to enhance herd productivity, animal management and control solutions, and research and development. Given the scarcity of natural sources of water, the Kingdom is sharply focused on solutions to long-term water availability like desalination and wastewater reuse, and investing in improving irrigation efficiency [3].

The Kingdom is now recognised as a leader in water sector innovation and the world’s largest water producer, managing a daily production of 15 million cubic metres distributed across 135,000 kilometres of networks. [4]

Sports, Health and Well-being

A combination of social reforms and public policy are leading to an increasing uptake of sport and awareness of health and well-being. The changes – particularly with respect to female sports participation – are impressive: it was only in 2018 that Saudi Arabia permitted women to attend football matches; now the Kingdom has a female football league and reports some 70,000 women and girls participating in football programmes.

Public health surveying indicates that Saudis are becoming more health conscious. In 2019 20% of adults (15 years and over) reported exercising 150 minutes per week, increasing to 29.7% in 2021 [5]. As at 2024 58.5% of Saudi adults (18 and over) report exercising 150 minutes or more [6]. One fitness company active in the Gulf sold 5,000 gym memberships within 24 hours of launching its Riyadh branches in February [7]. The same company has forecast twofold growth in the Saudi fitness sector by 2032 [8].

Supporting this trend are a Ministry of Health campaign to promote 30 minutes walking a day; public sporting events like the Riyadh marathon (the fourth iteration of which earlier this year sold out with participation at 40,000 across various distances); and large-scale infrastructure investment like Sports Boulevard, the first stage of which was unveiled in February and once fully completed will extend 135km across Riyadh, providing green pathways for pedestrians and cyclists. At the same time, there is increasing consumer demand for organic and healthy food products, sports products and supplements. These tend to fare better where they are easy to understand and localised in terms of messaging.

Construction

Saudi Arabia is experiencing a construction boom (as anyone who has visited Riyadh recently and observed its horizon of cranes will attest). This is being driven by a trillion-dollar development pipeline headlined by the giga projects (like NEOM, Diriyah Gate, Jeddah Central and King Salman International Airport) and the Kingdom’s line-up of future hosting rights including the 2029 Asian Winter Games (the first held on the Arabian Peninsula) , Expo 2030 and the 2034 FIFA World Cup (for which it will build 11 new and upgrade four existing stadiums). Saudi Arabia is also building more commercial and residential real estate. Advanced technology like building information modelling, 3D printing and prefabricated construction are being adopted to support construction efficiency and management. Fiscal constraints driven by lower oil revenue mean the Saudi government is concurrently focused on public spending and project delivery.

Entertainment / Creative Sector / Culture & Heritage

One of the pillars of Vision 2030 is to build A Vibrant Society, in doing so making culture and entertainment essential elements of life in the Kingdom. Since the General Authority for Entertainment was established in 2016, Saudi Arabia has hosted some of the most competitive boxing cards in recent history (including New Zealand’s own Joseph Parker), lured Ballon d’Or winners Ronaldo and Benzema to the Saudi Pro League, debuted its own Formula 1 Grand Prix, and established the largest music festival in the Middle East – to list a only a few highlights among many developments in the sports and entertainment industry.

A 2024 survey found that visiting malls was the favoured pastime for Saudis, followed closely by desert and beach excursions [9]. As the Kingdom targets its 2030 goal of increasing household spending on recreation spending from 2.9% to 6%, there will likely be an increasing emphasis on promoting Saudi attendance at entertainment centres, events, and shows (Saudis’ attendance among which registered 18.8%, 18.4% and 13.6% respectively per the 2024 survey).

It was only in 2018 that the cinema ban was only lifted; now there are over 630 cinema screens in 60 locations in Saudi Arabia. Saudi Arabia also hosts a burgeoning film sector – having released over 30 Saudi films – and launched a $233 million financing programme to support local and international film productions. Productions highlighting Saudi Arabia’s culture, heritage and contemporary narratives are becoming more prevalent and of increasing popularity.

Tourism is another area where the change has been transformative: the Kingdom used to be closed to non-religious tourists; now it aims to attract 150 million annually by 2030. The development of the giga projects and hosting of global events are integral to this, but so too are smaller scaler investments like museum development and growing the hospitality sector’s offering. Streamlining of processes and expansion of infrastructure around Islamic holy sites are also facilitating a greater number annually of religious tourists undertaking Umrah and Hajj pilgrimages.

Education

There has been an evolution in how Saudi Arabia views education. The approach ten years ago was to send tens of thousands of Saudi students to universities across the world under the then King Abdullah Scholarships Programme. Now the Kingdom wants to bring the world’s institutions to Saudi Arabia and develop King Saud University into one of the top ranked universities globally. Five international universities were recently licensed to establish branches in Saudi Arabia [10]. As the Kingdom aims to establish itself as a global hub for education, efforts are under way to develop academic curricula, train educators and bolster scientific research, potentially generating opportunities in the commercial capacity building space.

Gaming

In its own words Saudi Arabia is “Supercharging the New Golden Age of Gaming” [11]. A passion of Crown Prince Mohammed bin Salman, the Kingdom has committed to investing $38 billion USD in developing a gaming ecosystem and aspires to become the global hub for Esports. A strong government mandate is guided by the National Gaming and Esports Strategy (novel among the global community) setting out KPIs that include establishing 250 gaming companies in Saudi Arabia; producing 30 or more top 300 games by Saudi based studios; and becoming the preeminent host in Esports (Riyadh is already confirmed as host of the inaugural Olympic Esports Games in 2027).

Saudi Arabia reports some 23.5 million gamers with over 90% internet penetration across the country. A recent op-ed in Arab News highlighted the “vast potential for localised content,” noting that “Gulf gamers overwhelmingly prefer Arabic-language content and look for Arab characters and stories in the games they play,” and the ”huge opportunity” to use gaming as a story telling medium for the “ancient lore and heritage of Saudi Arabia” [12].

[1] All trade statistics in this report are sourced from the Stats NZ New Zealand Trade Dashboard(external link). The nature of some services exports is not publicly available owing to commercial confidentiality.

[2] The GCC is increasing food security through innovation | World Economic Forum(external link)

[3] From scarcity to sustainability: a leap toward efficient irrigation in Saudi Arabia(external link)

[4] Saudi Arabia: World's Largest Water Producer, Leader in Water Sector Innovation(external link)

[5] 29.7% Practice Moderate Physical Activity in KSA in 2021(external link)

[6] Physical Activity Statistics Publication 2024(external link)

[7] GymNation sells record-breaking 5,000 memberships within 24 hours of Riyadh launch(external link)

[8] Saudi Fitness Market: $2.28 Billion by 2032 | GymNation(external link)

[9] Household Culture and Entertainment Statistics Publication 2024(external link)

[10] Royal College of Surgeons in Ireland, the University of Strathclyde, the University of Wollongong, IE University and Arizona State University.

[11] https://www.pif.gov.sa/en/news-and-insights/news-network/2025/how-pif-is-supercharging-the-new-golden-age-of-gaming/(external link)

[12] Saudi Arabia’s games and esports industry is a story the world should watch | Arab News(external link)

Annex: Giga Projects Overview

NEOM: key projects

- The Line: A 170-kilometer linear city designed to accommodate 9 million residents

- Oxagon: The world's largest floating industrial complex, focusing on advanced manufacturing

- Trojena: A year-round mountain destination offering skiing, adventure sports, and a man-made freshwater lake

- Sindalah: A luxury island resort in the Red Sea, featuring high-end hotels, marinas, and recreational facilities

- Neom Agricultural City: Focused on sustainable agriculture and food production, utilising advanced farming techniques

- Neom Energy City: Dedicated to renewable energy projects, including solar and wind power

- Magna: A luxury coastal destination on the Gulf of Aqaba, featuring twelve premier destinations like Leyja, Epicon, Siranna, Utamo, Norlana, Aquellum, Zardun, Xaynor, Elanan, Gidori, Treyam, and Alsharq

- Topian: The NEOM Food Company, revolutionising global food systems with sustainable and innovative food solutions

- Tonomus: A subsidiary focused on autonomous mobility and smart transportation solutions

- Enowa: NEOM's sustainable energy and water systems company, including the world's largest green hydrogen production plant

Qiddiya: key projects

- Total Area: Qiddiya spans over 360 square kilometres

- Annual Visits: Expected to attract 48 million visitors annually once fully operational with 325,000 new jobs created

- Anticipated to contribute $36 billion to Saudi Arabia's GDP once fully operational

- Six Flags Qiddiya: The largest theme park in the Middle East, featuring the world's fastest, tallest, and longest roller coaster

- Aquarabia: A massive water park, likely to be first offering to open

- Speed Park: An FIA Grade 1 motor racing circuit, expected to host Formula One races

- Jack Nicklaus Championship Golf Course

- Roshn Stadium, FIFA world-cup host stadium

- Gaming and Esports District

- Performing Arts Centre

Red Sea Global: key features

- Ultra Luxury & Wellness Ecotourism Development

- Total Area: Spans over 4,155 square kilometres

- Luxury Resorts: Plans to develop 2,500 hotel rooms and 800 residential villas

- Focus: Emphasises wellness travellers looking for ultra luxurious experiences

- Sustainability: Committed to regenerative tourism and environmental conservation

- LEED Certification: The first development in the Middle East to secure platinum certification under the LEED for Cities standard

- Green Finance: Secured the first-ever Saudi Riyal-denominated Green Finance credit facility

- Environmental Impact: Aims to achieve a 30% net positive increase in conservation value across all projects by 2040

Roshn Group: key features

- Home ownership programme via mid-range housing developments and mixed-use community anchor assets

- Roshn is involved in several large-scale projects, including the Sedra community in Riyadh, the Alarous community in Jeddah, and the Almanar community in Mecca

- One of Roshn's primary objectives is to increase homeownership among Saudi nationals to 70% by 2030

- Emphasis on green spaces, eco-friendly practices, and sustainable development

- Developments include essential and leisure facilities such as schools, retail centres and shopping malls, healthcare centres, sports hubs, and walkable, bike-friendly streets

- Roshn integrates arts, culture, sports, and entertainment into its communities to enrich residents' lives

Diriyah Gate Development Project: key features

- Tourism, culture, dining and high-end living destination in the heart of Riyadh – located around the archaeological remains of the historical capital of Saudi Arabia

- The project encompasses the Al-Turaif UNESCO World Heritage Site, the birthplace of the Saudi state

- Main stages of the project due to be completed by 2027, with expansion plans beyond current blueprint for the next two decades

- Luxury residences are co-branded with the Ritz Carlton group

- Includes 20+ museums and cultural centres to be developed in addition to a world-class opera house

- Upon completion, will have 38 hotels ranging from heritage revival to golf clubs

New Murabba: key features

- New downtown iconic district with a covered tower set inside a box-shape building with futuristic, changing facades covered with immersive media screens

- The project spans 19 square kilometres

- Will include over 104,000 residential units and 620,000 square meters of leisure facilities

- The project is projected to add SAR 180 billion (approximately $48 billion) to Saudi Arabia's non-oil GDP

- The Mukaab: A 400-meter tall cuboid skyscraper, large enough to fit 20 Empire State Buildings

- In tune with other projects, New Murabba emphasizes sustainable urban growth with green spaces, walking and cycling paths, and advanced technology integration

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.

Copyright

Crown copyright ©. Website copyright statement is licensed under the Creative Commons Attribution 4.0 International licence(external link). In essence, you are free to copy, distribute and adapt the work, as long as you attribute the work to the Crown and abide by the other licence terms.