Primary Products, Sustainability:

On this page

Summary

- In 2023, Spain’s mining industry totalled €3.57 billion in output value and directly employed 30,000 workers. While not a large global player by volume, Spain leads the EU in production of various critical minerals such as strontium, sepiolite, fluorspar, and gypsum. It is also a key EU supplier of critical raw materials, including copper, tungsten, and fluorspar.

- Spain hosts seven EU-designated Strategic Projects—the highest number alongside France—under the Critical Raw Materials Act. These benefit from streamlined permitting processes and expanded EU funding opportunities.

- The dynamic and evolving mining sector in Spain and in the EU present strong opportunities for New Zealand companies to invest or offer specialised services—particularly in supporting the Strategic Projects seeking clean-tech solutions and partnerships.

Report

Spain hosts a diverse and abundant range of rock and mineral resources, supporting a mining industry with 2,604 active sites. In 2023, Spain’s mining production value totalled €3.57 billion, led by quarry products (€1.23 billion), followed by metal mining (€976 million), industrial minerals (€906 million), and ornamental rocks (€452 million), according to the Spanish Ministry for the Ecological Transition(external link).

Spain holds a strategic position within the EU as the sole producer of strontium and sepiolite, and as the leading producer of fluorspar and gypsum. It ranks second in the EU for the production of copper ore, magnesite, and potassium salts, and is the sixth-largest producer of bentonite. Spain is also one of the few EU producers of tungsten. Globally, it is the largest producer of roofing slate, the second-largest producer of ornamental stones and marble, and the fourth-largest producer of granite.

Critical raw materials are vital to the energy transition and the pursuit of strategic autonomy. As global demand rises, Spain’s mining sector is experiencing a resurgence. This renewed momentum is unlocking new opportunities for international businesses and investors.

Market Overview

In Spain, all mineral resources are classified as ‘‘public domain’’, and their exploration or exploitation requires prior authorisation from relevant regional and/or national authorities. Mining in Spain is highly regulated, requiring numerous administrative procedures—including technical studies, environmental assessments, landfill and restoration plans, and planning permission. Permitting processes typically take six to eight years before operations can begin. However, designation as a ‘Strategic Project’ under the European Critical Raw Materials Act(external link) can substantially reduce the time required for this process.

Mining projects typically involve many companies due to their complexity, scale, and duration. Each phase—exploration, feasibility, construction, operation, and closure—requires different expertise, from geology and engineering to environmental restoration. Projects also depend on services like logistics, safety, and tech support. Mining firms often outsource tasks, creating a network of contractors and specialists.

Mining companies

Major international companies in the sector are directly or indirectly present in Spain, including Australia’s Sandfire and explosives provider Orica, as well as Grupo Mexico, Atalaya Mining and Imerys. The New Zealand company Sequeent is also active in the Spanish market, providing software solutions for earth modelling and geographic data management.

Spanish firms are globally recognised for their expertise in bespoke mining support services. Notable examples include MTG, specializing in construction, mining, and dredging machinery; Maxam, known for explosives; and ULMA, focused on conveyor systems. All three companies are active in mining projects in New Zealand. Leading Spanish infrastructure firms such as Sacyr, Acciona, ACS, and FCC also offer specialised services that support mining projects globally.

Spain hosts Europe’s largest mining trade fair, the Mining and Minerals Hall(external link) (MMH), every two years in Seville. It is next scheduled for 2026. As the only event of its kind in Europe, MMH brings together global industry leaders, innovators, and policymakers.

Trends & Opportunities in Spain

In 2024 the EU adopted the Critical Raw Materials Act(external link) (CRMA) that provides an updated regulatory framework and new financing opportunities. The EU is looking to strengthen the security of supply of strategic raw materials—positively impacting Spain’s mining sector. The CRMA sets ambitious targets: by 2030, at least 10% of critical raw materials must come from domestic extraction, 40% from domestic processing, and 25% from recycling. To achieve this, Spain approved the Road Map for the sustainable management of mineral raw materials(external link). In addition, the Spanish government has drafted a National Subsurface Exploration Program 2025-2029(external link) aimed at identifying mineral deposits—marking the country’s first campaign of this kind since 1970.

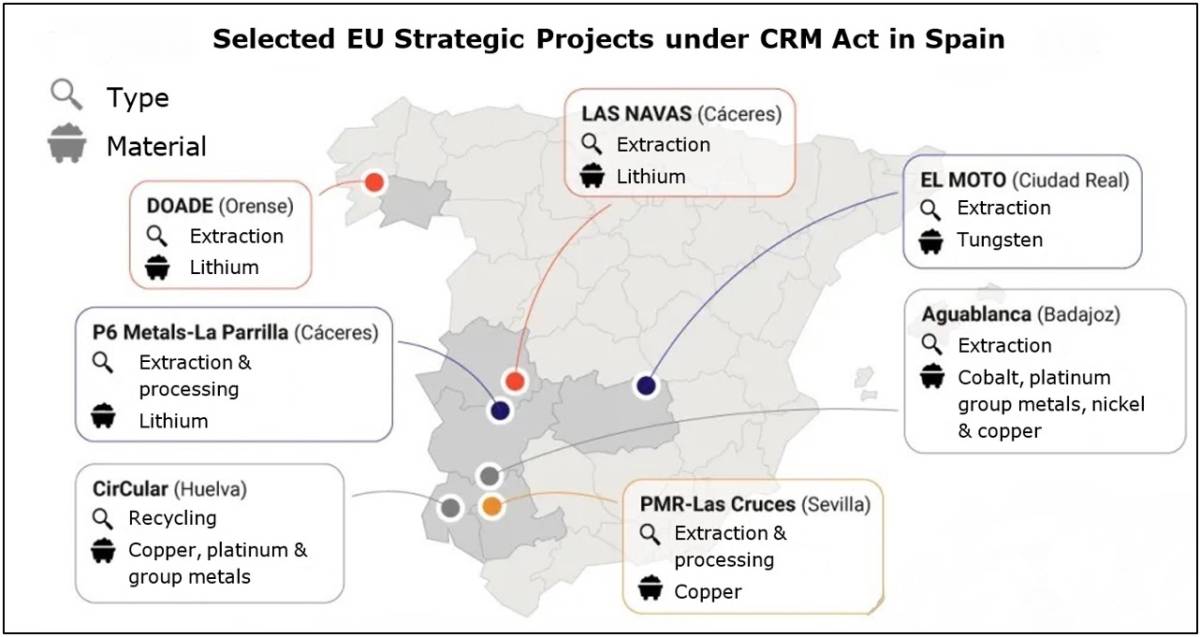

The EU has identified Spain as a key supplier of critical minerals, including copper, fluorspar, feldspar, strontium, tungsten, and tantalum. Copper and tungsten are also classified as strategic raw materials. In early 2025, the European Commission granted Strategic Project status, under the CRMA, to seven mining initiatives in Spain—more than any other EU country alongside France.

These Strategic Projects include lithium extraction in Galicia (Doade) and Extremadura (Las Navas and La Parrilla). The P6 Metals-La Parrilla project will focus on both extraction and processing. The initiative also covers tungsten mining in Castilla-La Mancha (El Moto), home to one of Europe’s largest tungsten deposits. Extremadura (Aguablanca) also hosts one of the few nickel sources in Europe, which will reopen to extract nickel, copper, cobalt, platinum, palladium, and gold.

Meanwhile, Andalusia sees projects extract and refine multiple metals, including copper, zinc, and silver (PMR–Las Cruces), and recycle electronic waste to recover copper, platinum, and other valuable metals (CirCular). Together, these Strategic Projects represent over €4.5 billion in investment and are expected to generate thousands of jobs across Spain’s mining and recycling sectors.

EU Strategic Projects: Support and funding

The European Commission plans to approve additional Strategic Projects every six months, with the second round scheduled to open in late 2025. Advice and support for applications is available online(external link). These Strategic Projects benefit from a streamlined regulatory process, reducing approval times to an average of 27 months, compared to the typical 6 to 8 years. The European Commission also facilitates a single point of contact with public administrations and offer access to EU-level funding opportunities.

Although some financial mechanisms are still under development, initiatives with Strategic Project status have access to a dedicated financing subgroup that advises on funding strategies. This subgroup combines public and private finance sources, including national banks, credit agencies, the European Investment Bank, the European Bank for Reconstruction and Development (EBRD), and private financial institutions.

In July 2024, the European Commission and EBRD launched(external link) a new joint ‘facility’ providing equity investments for the exploration of critical and strategic raw materials, aiming to mobilise around €100 million in investments. By each institution investing €25 million, the facility hopes to leverage a further €50 million in private capital to fund exploration activities that conform to ‘‘high climate, governance, environmental, and social standards’’.

As part of the EU’s new Clean Industrial Deal(external link), the European Commission will establish an EU critical raw materials centre to procure raw materials on behalf of listed companies. By leveraging collective purchasing power, this centre aims to secure better prices and conditions. The scope and implementation timelines of the Clean Industrial Deal are outlined in this MFAT report from July 2025.

Funding for technological innovation in critical mineral extraction, processing, and recycling is available through Horizon Europe. As an Associate Member Country, New Zealand clean-tech firms-particularly those specialising in critical mineral extraction from common or waste materials-are well-positioned to benefit from the €600 million Clean Industrial Deal investment under the Horizon Europe 2026–2027 work programme, which focuses on deployment-ready clean technologies.

The EU’s Strategic Project designation is not limited to projects within EU member states. On 4 June 2025, the European Commission approved(external link) 13 such projects, including one in New Caledonia and three Australian-led ventures in Madagascar, Kazakhstan, and Serbia. The Strategic Projects outside the EU are expected to receive an initial combined investment of €5.5 billion.

Comment

Spain’s diverse range of minerals and mining projects present an opportunity for New Zealand companies seeking to invest in the sector or offer specialised support services. This is particularly relevant in the context of the green and digital transitions, where innovation, sustainability, diversification, and supply chain integration are increasingly in demand.

New Zealand companies bring expertise in sustainable mining practices, environmental technologies, and digital solutions. The presence of Spanish mining service providers already active in New Zealand opens the door for deeper collaboration in areas such as equipment supply, remote sensing, blasting technologies, wildlife and vegetation management, water quality monitoring, and infrastructure development.

The designation of seven EU Strategic Projects in Spain creates strong potential for New Zealand firms to contribute. New Zealand-based initiatives may also be eligible for future EU funding mechanisms as the EU Commission has already approved 13 projects outside of the EU.

With the EU prioritising clean technologies, circularity, and sustainable raw material sourcing—backed by funding instruments such as Horizon Europe, the Clean Industrial Deal, and the newly launched €100 million equity facility—New Zealand companies that provide mining and clean-tech solutions are well positioned to take advantage of these opportunities.

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.

Copyright

Crown copyright ©. Website copyright statement is licensed under the Creative Commons Attribution 4.0 International licence(external link). In essence, you are free to copy, distribute and adapt the work, as long as you attribute the work to the Crown and abide by the other licence terms.