Supply Chains, Sanctions:

On this page

Prepared by the Economic Division in Wellington

Summary

- To ensure New Zealand’s global supply chain connections continue to function during the COVID-19 pandemic, MFAT’s network of Posts and the Trade Recovery Unit are monitoring the operations of New Zealand’s global sea and air freight connectivity. This report provides a snapshot of how global supply chains are functioning offshore, significant international initiatives affecting supply chains, and other issues of interest to New Zealand exporters and importers.

- To provide feedback or information relevant to this report – please contact exports@mfat.net

Report

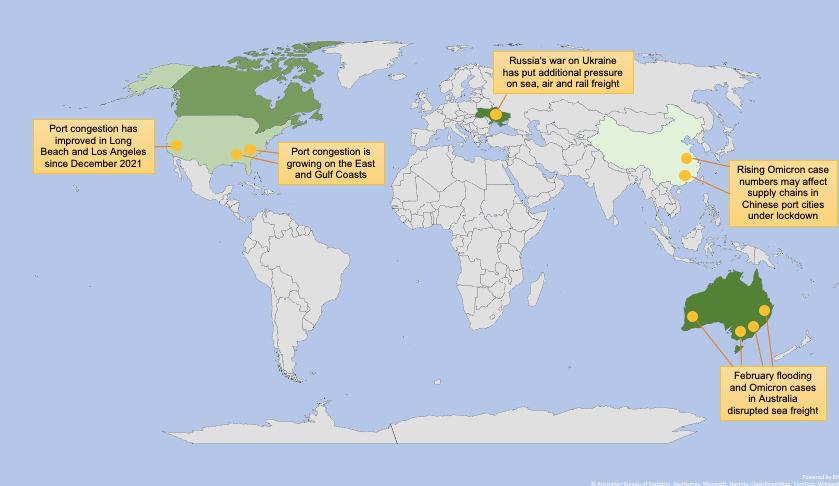

International sea freight remains highly disrupted

- International sea freight faces ongoing delays and congestion, high prices, elevated consumer demand and constrained capacity.

- Shipping delays have worsened during the quarter. According to Flexport’s Ocean Timeliness Indicator(external link), the time taken for containers to travel across the Far East Westbound route (China to Europe) reached a record high of 116 days in March. Times for the Transpacific Eastbound Route (China to the US) also hit a record high in March, peaking at 111 days. Port congestion persists in multiple countries (see below for details on congestion at specific ports in the US, China and Australia).

- Service reliability is at an all-time low for New Zealand exporters. DHL’s local office reports that on-time performance is just above 45% for the top carriers and below 20% for the worst. Fonterra(external link) is finding that 38% of products are delivered in full and on time compared to 80-90% prior to the pandemic.

- Shipping costs are rising for New Zealand businesses. The Customs Brokers and Freight Forwarders Federation notes(external link) that the price of sending a twenty-foot equivalent unit (TEU) to Shanghai, China now costs around US$6400 versus $800 pre-COVID. Likewise, rates for shipping a TEU from New Zealand to Long Beach in the US have grown from $2000 to $10,000.

- Estimates about the timeline for improvement vary. Maersk(external link) and Sea Intelligence(external link) predicted in February that changes might occur towards the end of 2022, while the Economist Intelligence Unit forecast in March that disruptions may start to ease by mid-year.

- New Zealand businesses are taking steps to address sea freight challenges. Kiwifruit exporter Zespri(external link) plans to charter ships to transport 20,000 containers of kiwifruit to North Europe, the Mediterranean, the US and Asia in an effort to avoid delays this season. Similarly, machinery company Hayes International(external link) is buying inventory 12 months in advance to counter growing lead times and price increases.

- Governments are investing in new initiatives to counter global shipping problems. The New Zealand Commerce Commission and the equivalent competition authorities from four other countries (the US, UK, Australia, and Canada) announced(external link) that they plan to share intelligence on anti-competitive behaviour by suppliers and shipping groups. Likewise, the US announced(external link) a joint initiative to promote competition in sea freight. The DoJ will provide the FMC with attorneys and economists, while the FMC will supply maritime industry expertise to the DoJ.

116 days for containers to travel from China to Europe

111 days for containers to travel from China to the US

International air connectivity is improving, but has a long way to go

- Air connectivity is recovering as New Zealand’s border restrictions ease and more passenger flights resume. However, air freight continues to experience strong demand combined with limited capacity.

- The New Zealand Government made two announcements to maintain and support the rebuilding of air connectivity:

- On 10 March, Transport Minister Wood announced(external link) a NZ$250m extension to the Maintaining International Airfreight Connectivity Scheme. This provides certainty that international connections will be sustained over the next year.

- On 16 March, Prime Minister Ardern announced(external link) New Zealand’s reopening for tourism. Citizens from visa-waiver countries can enter New Zealand without having to self-isolate from 1 May, enabling a recovery of passenger volumes and therefore flights.

- Air travel intelligence company OAG records(external link) that global airline capacity increased to 83.4 million seats this month compared to 105 million seats in March 2019. Air New Zealand has announced(external link) the return of 800 furloughed or former staff. It has also revealed(external link) an inaugural flight from Auckland to New York in September. Singapore Airlines(external link) is recruiting staff in New Zealand and is seeing a consistent week-on-week increase in bookings.

- Airfreight prices remain high for New Zealand exporters. The Customs Brokers and Freight Forwards Federation observes(external link) that the cost of sending airfreight cargo to Shanghai has grown from US$3 per kilogram before COVID to $9 now. For Los Angeles, rates have increased from $2.50 to $5.50 per kilogram.

Russia’s invasion of Ukraine has exacerbated global supply chain issues

- Russia’s war on Ukraine, and the resulting economic sanctions and counter-sanctions, have caused additional supply chain disruption.

- International sea freight is experiencing further delays. There is increased demand for container shipping due to sanctions on Russian Railways affecting rail freight between Europe and Asia. Over half of the world’s container shipping capacity has suspended service to Russia, and checks for sanctioned goods are slowing operations at key ports such as Rotterdam.

- Air freight is under extra pressure. According to the International Air Transport Association, cargo flights between Asia and North America usually fly through Russian airspace and account for a quarter of all global freight traffic. Russia has closed its airspace to 36 countries including the US, Canada, UK and the European Union. This could impact airfreight prices for New Zealand exporters.

- Global energy markets are experiencing volatility. On 14 March, the New Zealand Government announced (external link)a cut to petrol excise duties and road user charges by 25 cents per litre for the next three months to alleviate rising fuel costs.

- Commodity prices are fluctuating. While New Zealand is unlikely to experience goods shortages due to low import volumes from Russia and Ukraine, it could be subject to the effects of global price increases. Westpac anticipates(external link) higher food prices and inflationary pressure.

- New Zealand is somewhat insulated from the supply chain impacts of the conflict given our distance from the military action combined with limited bilateral trading relationships with Russia and Ukraine. For further information, see our report on the potential impacts of the Russia-Ukraine conflict on the New Zealand economy(external link).

US$6400 cost of sending a twenty-foot equivalent unit (TEU) to Shanghai, China

US$800 cost for the same container pre-covid

China’s Omicron outbreak brings uncertainty

- COVID-19 cases in key transport hubs may pose risks for global supply chains. After remaining largely free of COVID for months, China is now grappling with rising Omicron case numbers. Supply chain impacts are concentrated in areas where lockdowns have affected manufacturing, domestic logistics and ports, such as Shenzhen and Shanghai (Pudong International Airport is key for our high-value and time-sensitive airfreight exports, and is also home to the world’s largest container port). Rerouting to other airports can be more challenging than for sea freight due to availability of carriers from New Zealand, and slots at alternative Chinese airports.

- The Customs Brokers and Freight Forwarders Federation notes that much of New Zealand’s cargo trans-ships through Chinese ports on its way to and from market. While DHL expects “significant” delays through the Shenzhen ports of Yantian, Shekou and Chiwan, shipping delays are only 1-2 days at most other ports. Customs authorities in Shanghai have announced that they are taking special measures to maintain capacity at the border and ensure clearances at ports can continue to operate.

- Some large New Zealand exporters have been able to adapt as they have a degree of control over their shipping. For instance, a large New Zealand fruit exporter is implementing a contingency plan to use a different port instead of the Port of Shanghai.

- At this stage, there does not seem to be significant and widespread disruption to New Zealand’s trade with China associated with the current outbreak, other than challenges arising from domestic logistics (particularly for sales through e-commerce channels). China’s COVID-19 case numbers remain low by global standards with cases in some of the hardest-hit regions now trending down.

- Short-term supply chain volatility seems likely over the remainder of 2022, particularly if China’s COVID-19 situation evolves into a larger-scale outbreak.

$10,000 rates for shipping a TEU from New Zealand to Long Beach in the US

$2,000 cost for the same container pre-covid

Port congestion in the United States persists

- Congestion at the twin ports of Los Angeles and Long Beach has improved. The Marine Exchange of Southern California reports(external link) that the number of ships waiting for a berth peaked at 109 in early January and is now below 50.

- Gains in California are being offset elsewhere. There are bottlenecks at ports on the East and Gulf coasts as importers try to avoid the West Coast congestion. FreightWaves identifies(external link) that more than 50 ships were queued at the ports of Houston and Charleston in February.

- DHL says that New Zealand exporters continue to face delays of 2-4 weeks when shipping to the US. The Mediterranean Shipping Company(external link) has raised prices by US$3000 for cargo containers heading from New Zealand to American ports.

Trucking prices elevated by protests in Canada

- Anti-vaccine mandate protests along the US-Canadian border in February sparked an increase in trucking prices. According to com(external link), market rates for vans rose by 39% between January 2 and February 5; reefers rose by 33%; and flatbeds rose by almost 15%. Rates remain inflated despite an end to the protests.

Flooding and Omicron pose challenges in Australia

- Sea freight faced strain during February and March from the combined impact of flooding and an Omicron outbreak in Australia. DHL is imposing new congestion tariffs of AU$30 per container due to port congestion in Brisbane, Sydney, Melbourne and Freemantle.

More reports

View full list of market reports.

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link).

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.